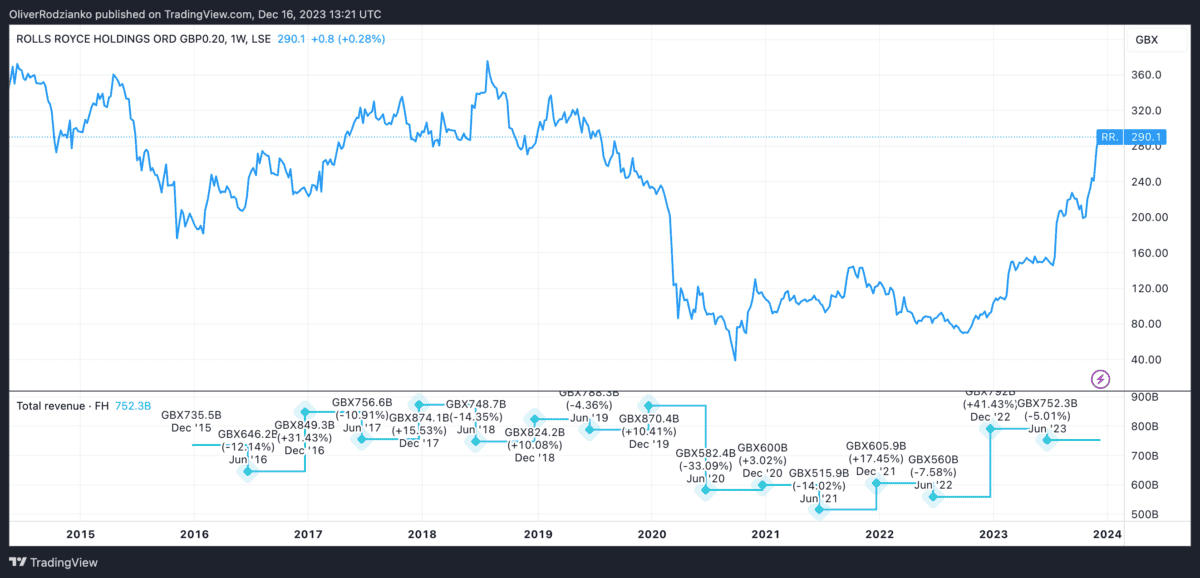

The Rolls-Royce (LSE:RR) share price has increased by nearly 200% since October 2022. Partly, this is due to rising revenues recently, which is depicted in the chart below:

Source: TradingView

However, I wanted to get a clearer understanding of what the management plans to do to maintain such strong share price performance moving forward.

Keen followers of Rolls-Royce will know there’s a new CEO commanding the ranks. Let’s see what Tufan Erginbilgiç has in store for shareholders.

Future plans

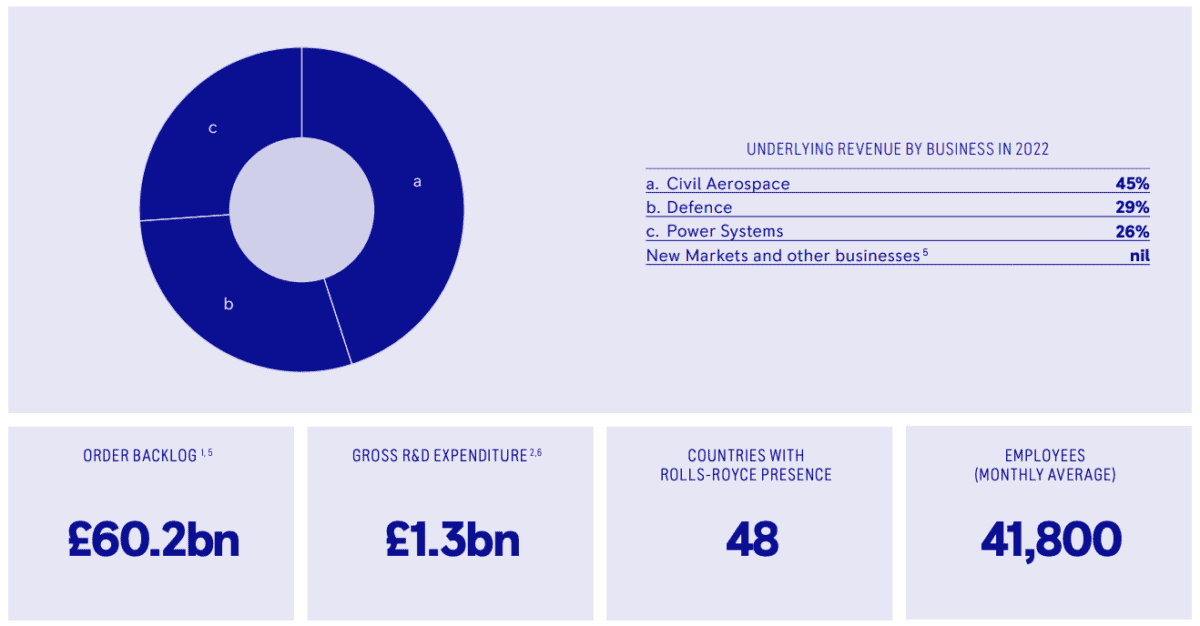

Here’s an overview of the business as presented in its 2022 annual report:

The company has some specific future plans that are worth mentioning.

First, Rolls-Royce is developing a nuclear reactor to place on the moon, funded by the Space Agency with £2.9m.

Second, the organisation is re-entering the narrowbody aircraft engine market. Its UltraFan technology will focus on sustainability and fuel efficiency.

I think it’s important to note that there are significant risks with both of these projects being successful.

Both have significant regulatory and technical hurdles to surpass, for example.

More specifically, the lunar reactor will face funding and safety risks, and the UltraFan, market competition and demand factors.

The Erginbilgiç way

A former BP executive, the new CEO of Rolls-Royce, as of 2023, is taking the bull by the horns.

He has a financial focus and is looking to improve previous financial instabilities. He’s also announced layoffs of 2,000-2,5000 employees in an effort to boost efficiency.

As a result, the company boasted a fivefold increase in operating profit in the first half of 2023.

When I read about these measures, I’m eerily reminded of Musk’s takeover of Twitter. Don’t get me wrong, the two situations couldn’t be more different in many ways.

Yet, the drive for efficiency and a lean management style has perhaps become popular.

A closer look at the financials

I’ve analysed Rolls-Royce before. One thing I noticed is that the share price shooting up so high so quickly isn’t justified by the financials to me.

For example, although revenues have increased since 2021 after the pandemic hit the company quite hard, it has a lot of debt on its books.

As of 2019, during the pandemic, debt hit £5.7bn and rose as high as £7.8bn in 2021. To put that into perspective, the company held only £3.5bn of debt in 2017.

This presents some concern for me as a potential investor.

The forward price-to-earnings ratio of the company is also 26. That considers the current stock price divided by the predicted earnings per share. It ranks in the bottom 25% of 56 companies in aerospace and defence on this metric.

Not for me

This is a company that doesn’t look too attractive right now, in my opinion.

I think shareholders are bumping up the share price on premature expectations.

This one’s on my watchlist because I love to study what’s happening here, but I won’t be adding it to my portfolio soon.