These dividend shares both offer yields far ahead of the 3.8% FTSE 100 average. Here’s why I’d buy them today.

Boxing clever

Investor appetite for Tritax Eurobox (LSE:EBOX) shares has spiked as expectations of interest rate cuts have risen. Many commentators now believe that rate reductions from the European Central Bank could come as soon as Q1.

This would give net asset values (NAVs) at Europe-focused property stocks like this a big boost. It may also bolster demand for the real estate investment trust’s (REIT) properties.

On the downside, economic conditions in Continental Europe remain extremely challenging. Latest Ifo Institute data showed business sentiment in Germany weakened further in December, raising fears of a regional recession still further.

Yet a huge supply/demand imbalance in the warehouse and logistics property market could still support solid trading at the investment trust. City analysts agree — they expect annual earnings to edge 3% higher this financial year (to September 2024).

Rents are still heading higher as the supply of new properties continues to lag demand growth. Weighted average prime rental growth in Europe stood at a healthy 10.8% during Q3, according to real estate services company Jones Lang LaSalle.

This was down from 15.6% in 2022 but still way above the 5.9% five-year average. A vacancy rate of just 4.3% in Q3 further underlines the size of the supply crunch in Europe.

Demand for large scale logistics assets is underpinned by strong structural drivers as customers look to fulfil their e-commerce sales, secure economies of scale and efficiencies and add resilience to their supply chains.

Tritax Eurobox

This robust backdrop means that dividends at Tritax Eurobox are tipped to remain at 5 euro cents per share. This translates to a healthy 7.1% forward yield.

REITs like this are required to pay at least 90% of annual rental profits out in the form of dividends. This bodes well for shareholder payouts beyond the short-term, too: as demand rapidly increases so should shareholder payouts.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Another European heavyweight

I’m also considering adding shares of abrdn European Logistics Income (LSE:ASLI) to capitalise on this part of the property sector.

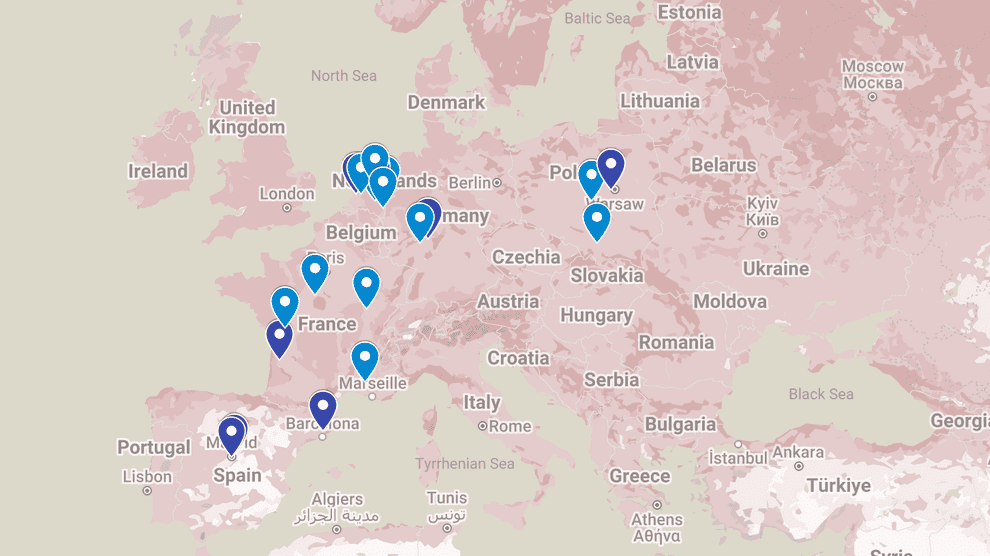

Like Tritax Eurobox, its operational footprint stretches far and wide. Its presence in multiple countries reduces risk and provides exposure to fast-growing Eastern European territories.

In fact, both companies own assets in some of the same countries including Germany, Poland, Belgium and The Nethelands. abrdn European Logistics’ geographic coverage can be seen below.

This investment trust could be an even-better selection for passive income than Tritax Eurobox. This is because of its superior dividend yield of 8.2% for 2024.

Companies like this aren’t just vulnerable during tough economic periods. Changes to property planning rules can significantly impact their construction goals. Earnings can also be impacted by other building-related issues like cost overruns and project delays.

But on balance, I still think both stocks are top buys for passive income in 2024 as well as over the long term.