We’ve seen many stocks head higher recently as investors have warmed up to the possibility of interest rate cuts next year. The FTSE 250 is up around 14.5% in the last two months alone. While that’s nice for share price gains, it does mean lower yields on many FTSE dividend stocks.

However, opportunities are still plentiful. Here are two excellent income stocks I’d buy with spare cash before the New Year starts.

Dividend Aristocrat

First up is BAE Systems (LSE: BA.). The defence stock has nearly doubled in two years, which makes it seem more like a red-hot growth share. But BAE is in fact a solid Dividend Aristocrat.

Unfortunately, the reasons for the stock’s rapid ascent aren’t so celebratory. The shocking invasion of Ukraine and the ongoing geopolitical tensions between the US and China have sent global defence budgets soaring.

As a result, the firm announced a record £66.2bn order backlog at the end of June. Since then, Britain, Japan and Italy have signed an international treaty to develop an advanced fighter jet, with BAE heavily involved.

Admittedly, the forecast 3% dividend yield for 2024 isn’t eye-popping. But I think the massive order backlog, the potential for further share price gains and solid dividend coverage of two times earnings make this a solid buy.

Deutsche Bank analysts agree and have recently increased the stock’s price target to 1,290p. As I write, that’s around 20% higher than the current share price.

Of course, that bullish target may never be met, and the shares could pull back sharply if an unexpected-but-hoped-for peace deal develops in Ukraine.

As far as income is concerned, though, the long-term outlook appears extremely strong.

A rare discount

Next, we have BBGI Global Infrastructure (LSE: BBGI). This is a FTSE 250-listed social infrastructure trust with a nice 5.6% dividend yield. There are a number of things I like about this stock.

For starters, the 56 assets held in the firm’s portfolio are high-quality. They include hospitals, schools, toll roads, bridges and police headquarters.

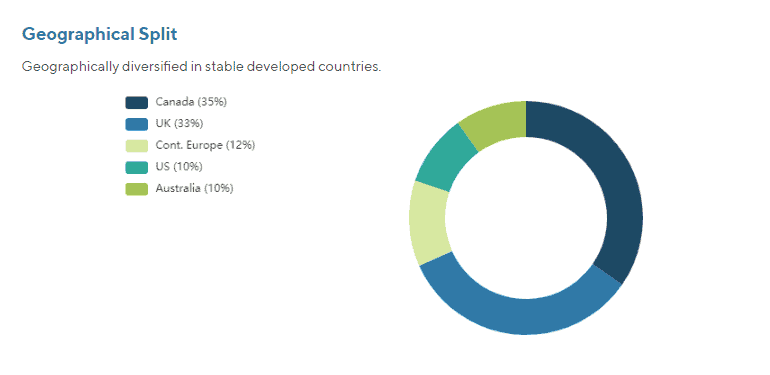

Each generates contractual income streams from government or local authorities. This, along with geographical diversification across three continents, makes the cash flows much more reliable. Indeed, even the pandemic didn’t affect its cash flows or dividends.

Below, we can see this balanced geographical split.

Another attractive feature here is a mechanical inflation adjustment within contracts. That figure is 0.6, which means that if inflation is 1% higher than expected per annum, revenues will correspondingly increase by 0.6%.

Looking ahead, the firm has set dividend targets of 8.4p and 8.57p per share for 2024 and 2025. At today’s share price, that translates into respective yields of 6.3% and 6.5%.

High inflation remains a risk, though. The trust is sensitive to interest rates, and if they’re going to stay higher for longer, as we’re hearing, then the shares could struggle. They’ve already fallen 25% in two years.

That said, the shares are currently available at a discount to net asset value (NAV) of around 12.3%.

Historically speaking, this is rare. It normally trades at a premium due to the stable government-backed revenue. Long term, I think the stock may prove to be a bargain if buying at today’s discount.