The UK housing market has been impacted this year by high mortgage rates and squeezed affordability. Yet after advancing 35% over 12 months, the Taylor Wimpey (LSE:TW.) share price now trades above £1.37, marking a fresh 52-week high for one of Britain’s largest housebuilders.

So, what’s the outlook for Taylor Wimpey shares after the recent rally? Should investors consider buying this FTSE 100 stock today?

Let’s explore.

Share price

It’s important to put recent share price gains into perspective.

Despite enjoying a strong year, the Taylor Wimpey share price is down slightly on where it was five years ago and well below where it was trading at the onset of the pandemic.

Even so, the trajectory looks encouraging. The company expects full-year operating profit will be at the top of its £440m-£470m guidance range, which might bode well for further share price growth in 2024.

Valuation

Currently, Taylor Wimpey’s valuation is below the firm’s long-term average.

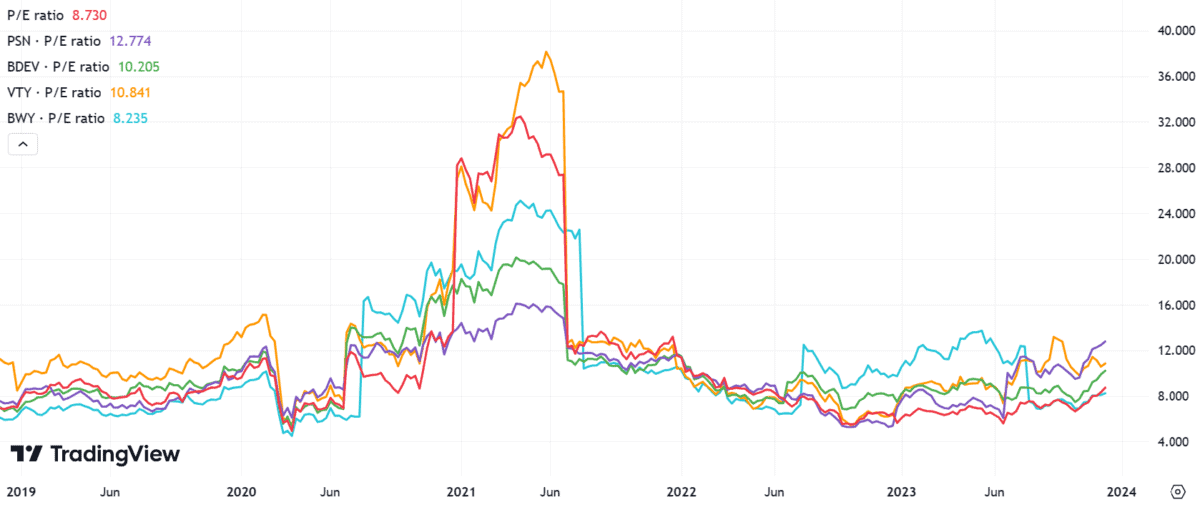

In addition, with a price-to-earnings (P/E) ratio a little above 8.7, Taylor Wimpey shares arguably look better value than many major rival housebuilders.

Persimmon, Barratt Developments, and Vistry Group trade for double-digit multiples today. However, Bellway shares are a little cheaper (at least on this metric), with a P/E ratio of 8.2.

Dividends

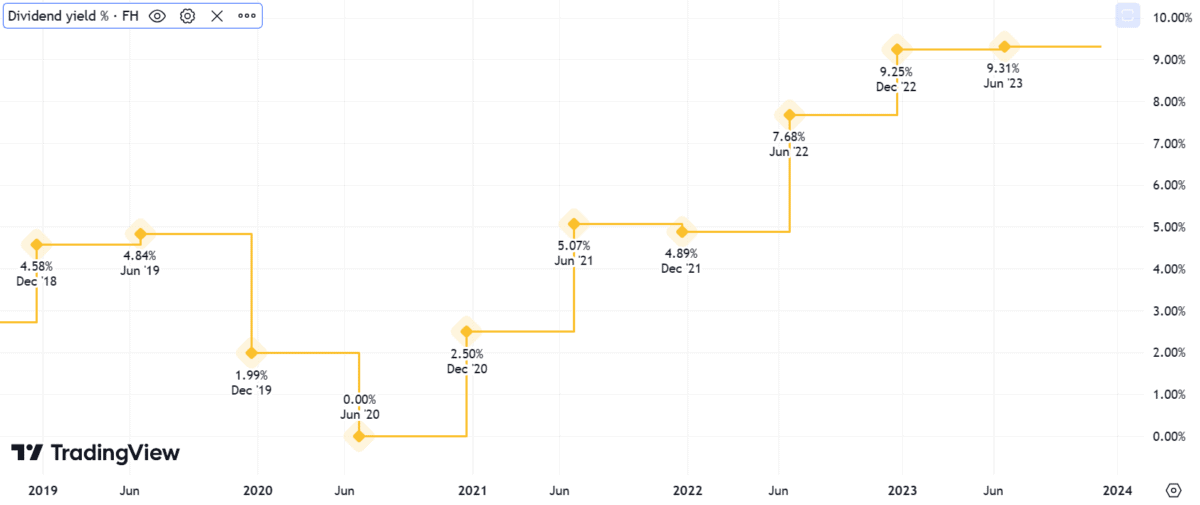

Taylor Wimpey’s dividend yield has risen substantially since the firm suspended payouts in 2020.

The company aims to distribute around “7.5% of net assets to shareholders annually“, or at least £250m, throughout all stages of the housing market cycle.

Although dividends aren’t guaranteed, there are reasons to be optimistic about Taylor Wimpey’s passive income distributions.

The balance sheet looks robust with the business anticipating a net cash position of £500m-£650m by year end. Plus, asset strength from its particularly large landbank underpins the mammoth dividend.

Risks

Nonetheless, the macroeconomic environment remains challenging.

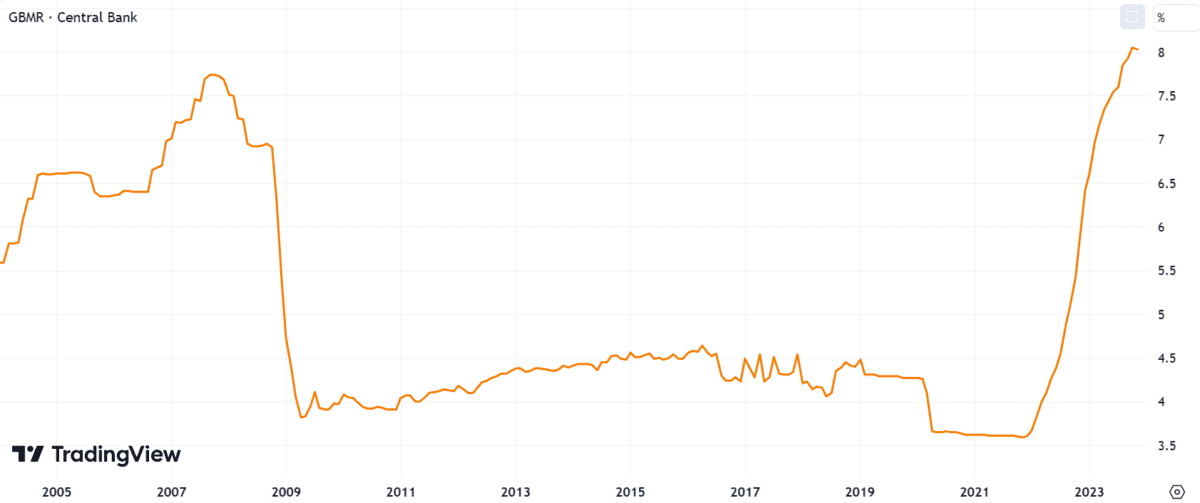

Standard variable rate mortgages are above 8%. This has suppressed housing market activity, creating uncertainty for UK housebuilder shares.

Granted, fixed rate deals are lower. There are also promising signs that borrowing costs may have peaked. Some bold analysts predict mortgages could become much cheaper next year.

However, core inflation remains stubbornly high at 5.7%. The Bank of England has cautioned rate cuts may not materialise in 2024, and further hikes can’t be ruled out.

Potential investors should follow Governor Andrew Bailey’s future comments closely, given how rate-sensitive the Taylor Wimpey share price is.

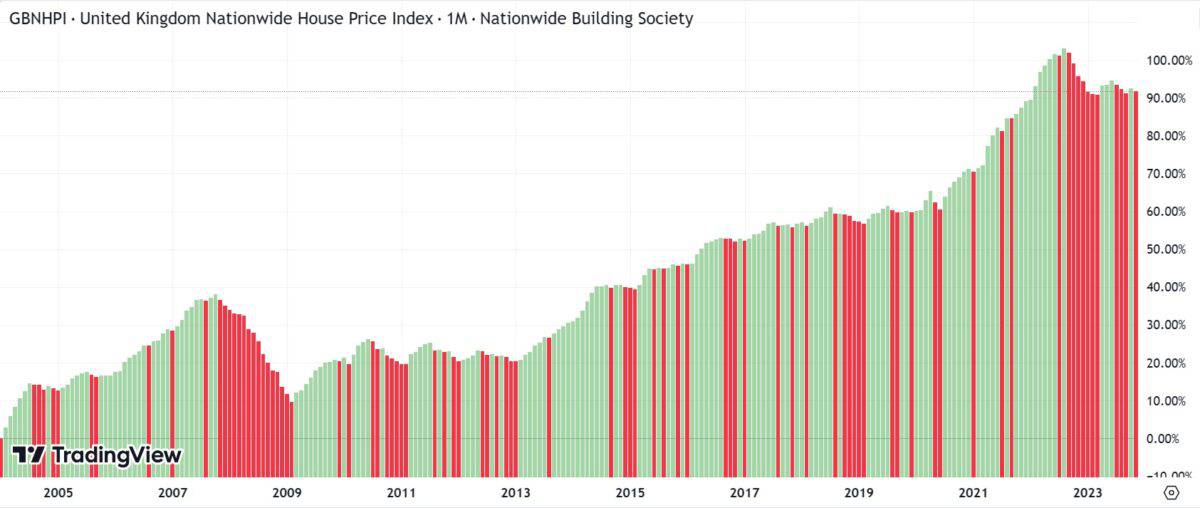

In essence, if monetary policy remains tight, house prices could fall further next year. This would likely hurt the group’s profitability. Looking back to the 2008 financial crisis, which nearly precipitated the company’s collapse, shows how devastating such declines can be.

A stock to buy?

Taylor Wimpey faces notable macroeconomic risks. The UK housing market outlook remains highly uncertain, especially in the near term.

Nonetheless, I believe the housebuilder’s better placed than many competitors to capitalise on the significant growth opportunities arising from Britain’s chronic housing shortage once lending conditions improve.

I’m a long-term shareholder and continue to hold my position, not least for the chunky dividend payouts. Since I’m comfortable with my present exposure to the sector, I’m not adding more shares for now. Nonetheless, I think Taylor Wimpey merits further research from investors as a potential buy today.