I’ve been adding to my holding in Agronomics (LSE: ANIC) all year long. And I intend to keep buying this penny stock throughout 2024.

However, I plan to invest opportunistically, picking up shares when there’s selling pressure. Fortunately, this shouldn’t be a problem as this market cap minnow does tend to yo-yo quite a bit.

Here’s why I’m bullish heading into the New Year.

Buffeted by interest rate speculation

There’s been a lot of share price volatility recently, even by Agronomics’ standards.

The stock surged 20% to 11p in November when it looked like interest rates might start coming down next year. Then it fell back down to 9p when that suddenly looked less likely.

Of course, this makes sense. Agronomics is a venture capital firm and start-ups need capital to get off the ground. Yet we’re no longer in the era of near-zero interest rates when cheap capital was abundant.

Therefore, the risk of companies in general going under is higher, which explains why shares of Agronomics have lost half their value since late 2021.

What is cellular agriculture?

Today, the firm has over 20 early-stage companies in its portfolio. The aim is to nurture a couple of big winners in the emerging industry of cellular agriculture, with the hope that these will more than offset the inevitable failures.

For those unfamiliar, cellular agriculture is the production of animal-based products (meat, milk, eggs and more) from stem cell cultures rather than directly from animals.

Importantly, this meat is real and not plant-based.

Beyond improved animal welfare, there are many benefits to this method of food production. These include:

- Land Use: Significantly less land and water needed compared to traditional farming

- Emissions: Lower greenhouse gas emissions compared to livestock farming

- Health: Lab-grown meat is unlikely to require many antibiotics, reducing the risk of antibiotic resistance in both animals and humans

- Food Security: No reliance on weather conditions or seasons, leaving nations less vulnerable to food supply chain shocks (conflict in grain-producing Ukraine, for example)

Cellular agriculture lies at the intersection of some of the biggest trends of this century.

Promising portfolio progress

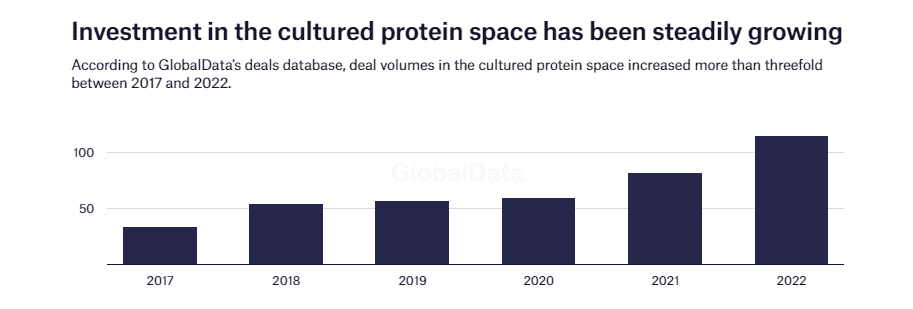

Despite the challenging macro backdrop, many of the firm’s top holdings have had no problem raising capital recently. Indeed, money continues to pour into the space.

BlueNalu, for example, raised $33.5m in funding in October. This firm is a global leader in cell-cultured seafood (fish that hasn’t been fished, basically).

Its first product is a lab-grown portion of bluefin tuna, which it plans to commercialise in several Asia Pacific nations.

Agronomics now holds a 5.12% stake in BlueNalu. If this start-up goes public or is acquired, I’d expect some tasty gains for Agronomics shareholders.

The future

Now, there’s no certainty when — or even if — these cell-based products will go mainstream. After all, we live in the internet age when even the science behind vaccines regularly gets questioned. So I’d expect some scepticism about meat grown entirely outside of an animal’s body.

Yet some of these products have already been approved by regulators. And analysts at Barclays see the alternative meat market growing tenfold between 2021 and 2031.

This penny stock offers everyday investors like myself a way to get in very early on this emerging mega-trend.