When hunting down a new growth stock for my portfolio, I often look for low valuations too. Ashtead Group‘s (LSE:AHT) current low price is an opportunity I have my eye on.

My strategy

Growth stocks are key to my investment strategy. Through fundamental analysis, I always look for strong growth trends first.

I own shares in expanding companies, including LVMH, Taiwan Semiconductor Manufacturing Company, and Ferrari. These have all seen stable and consistent returns for me as I’ve added to my positions.

Recently the macroeconomic environment has contributed to depressed share prices, so I’ve seen even higher returns than usual. This is primarily from buying my favourite stocks at lower valuations.

Once the wider economic picture returns to normal, my investment returns could rise considerably, more than if I’d bought them at their usual prices.

Operational analysis

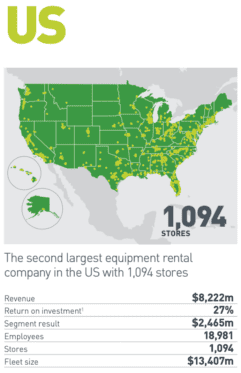

Back with Ashtead, it’s an international equipment rental organisation, primarily operating in the US, UK and Canada under Sunbelt Rentals. The company rents to industrial and construction operations.

I always read annual reports of companies that are potential investments. That way I get a first-hand impression of operational strategies, alongside a detailed explanation of financials.

Ashtead’s 2023 annual report reveals the company is the second-largest equipment rental company in the US, with 1,094 stores.

The annual report lists a market share of 13% in the US, up from 2% two decades ago with an eventual target of 20%. United Rentals takes the top position with a market share of 17%.

To me, one of the areas I need to be cautious about is the amount of direct competition Ashtead has. I’m waiting to see whether the company can reach the highest market share in the US.

In the UK, the story is slightly different. Its operations are in the top slot, with a 13% market share. Second place goes to Speedy with a market share of 8%.

The big weakness

The largest issue I’ve noticed with the company is the amount of debt it carries. It has a debt-to-equity ratio of 1.5, which is worse than 80% of 880 companies in the business services industry.

It’s worth noting that I’m not always too concerned when a company carries a lot of debt. After all, that’s the case with luxury powerhouse LVMH too. And both companies have rigorous expansion strategies, which are evidently effective based on their high revenue growth.

The closing strengths

Ashtead’s shares are currently trading around 25% below their previous highs.

But gross, operating and net margins look remarkably strong to me. The operating margins of the company, which are calculated by dividing operating income (sales minus operational expenses) by revenue, are 31%. That’s in the top 10% of the business services segment.

Ashtead’s average annual revenue growth rate over the past 10 years of 20% further supports it as a shrewd investment.

That said, I’m still considering purchasing the company’s shares as I prefer to take a cautious approach.

I’m not sure yet that Ashtead’s shares are a better purchase than loading up further on LVMH, which is currently down around 25% as well!