I think these FTSE 100 stocks could help me to generate significant returns over the next decade. Here’s why I’m aiming to buy them when I have spare cash to invest in the new year.

Antofagasta

Copper miner Antofagasta (LSE:ANTO) looks quite expensive at current prices. Today, it trades on a forward price-to-earnings (P/E) ratio of 25.4 times, more than twice the Footsie average.

Such a high valuation leaves the door open for a share price correction if newsflow deteriorates. A sudden drop off in Chinese metal imports next year, for instance, is one danger as the economy there struggles.

Yet this doesn’t dampen my enthusiasm. I believe the Chilean copper producer could prove a top buy for the long term as demand for the red metal is tipped to rocket. Industry experts are also tipping a weak pipeline of new supply to persist. So a large market deficit is expected that could push metal prices through the roof.

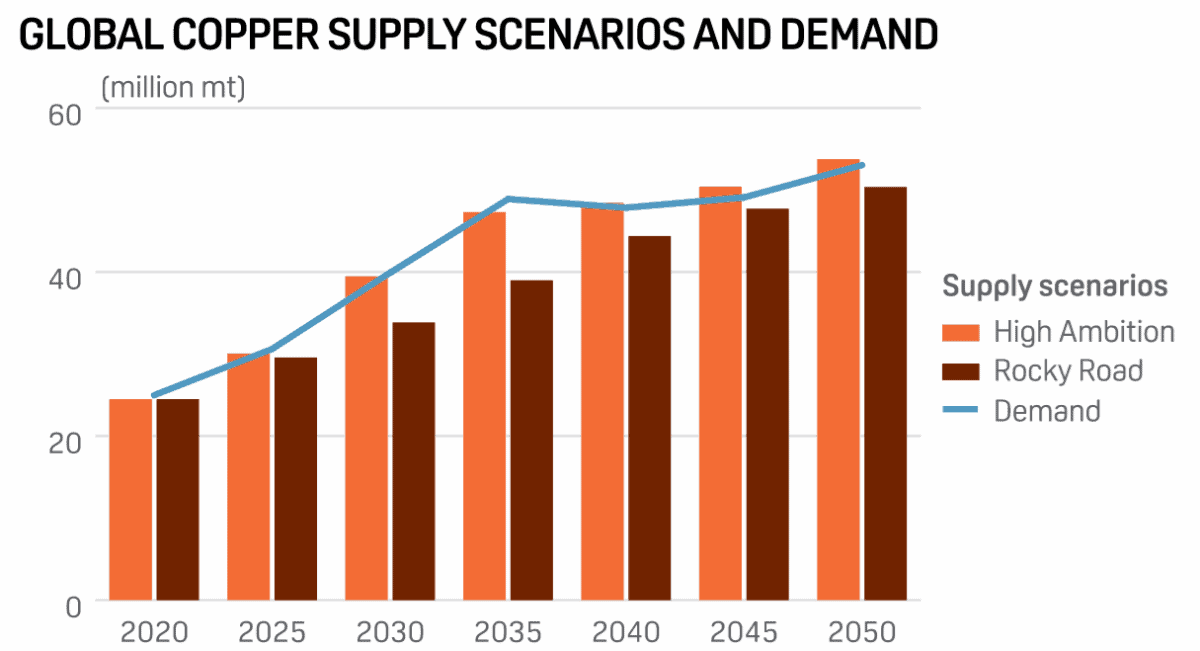

Analysts at S&P Global, for instance, think copper consumption could double by 2035, to 50m tonnes a year, from 25m at present. As the graph above shows, even under a more muted forecast, demand for copper is tipped to rise strongly as electric vehicle (EV) sales rise and renewable energy usage takes off.

Antofagasta should be in a strong position to exploit this opportunity. The firm is expanding its flagship Los Pelambres mine to boost output. And it’s looking to install a second processing concentrator at its Centinela project. It also has a string of exciting exploration projects across Chile and Peru.

With a strong balance sheet — Antofagasta’s net debt to EBITDA ratio stood at just 0.27 times as of June — the firm has plenty of financial firepower with which to pursue its growth strategy.

B&M European Value Retail

The search for value has taken off during the recent cost-of-living crisis. But as the rise of supermarkets Aldi and Lidl most vividly illustrates, the importance of value for money with consumers has been steadily growing since the 2008 financial crisis.

This phenomenon is tipped to endure through the rest of this decade by market experts. And it makes B&M European Value Retail (LSE:BME) a top stock to buy for the long term, at least in my opinion.

The FTSE 100 company intends to continue expanding rapidly to fully capitalise on this opportunity too. Indeed, last month the firm upgraded its store target to a minimum of 1,200 units, up from a prior target of 950. This underlines the rosy outlook for the value shopping segment.

On the downside, I’m concerned about the company’s lack of an online operation. This could see it lose custom to e-retailers like Amazon and omnichannel retailers like Tesco as the popularity of internet retail grows.

But on balance, I still expect profits at the FTSE company to rise solidly over the next decade. And of course, the company could revisit its physical-only model and explore omnichannel at a later time.