FTSE 100 shares are frequently described as cheap by analysts, and have been for a while. That’s often backed up by the price-to-earnings, the price-to-sales ratio, and the price-to-book ratio.

However, we shouldn’t invest because of a company’s performance last year. And we’re not investing just for the next 12 months. It’s about how a company will perform throughout the medium and long term.

PEG ratios

Thus, growth is central to the equation. That’s where the PEG ratio can help us. This metric provides a valuable tool for investors seeking to assess a company’s growth potential in relation to its current valuation.

The PEG ratio, or price/earnings-to-growth ratio, takes into account both the price-to-earnings (P/E) ratio and the expected earnings growth rate.

A PEG ratio of 1 is often considered indicative of fair value, suggesting that the stock’s price is in line with its anticipated growth.

Ratios below 1 may suggest that the stock is undervalued relative to its growth prospects, while ratios some distance above 1 may indicate potential overvaluation.

Nonetheless, this is just a rule of thumb and it’s often prudent to compare companies within the same sector. For example, the PEG ratio is often calculated using annualised growth rates over five years and some industries may see tailwinds further into the long run.

By incorporating expected earnings growth into the assessment, the PEG ratio offers a more comprehensive view than the P/E ratio alone. This is particularly relevant in industries or sectors where high-growth companies might justify higher valuations.

FTSE 100 shares with low PEGs

As noted above, it can pay to compare companies within the same industry. However, the below data provides us with an insight into some of the cheapest stocks on the index. This is just a handful of stocks with PEG ratios that looks pretty attractive.

| PEG Forward | |

| AstraZeneca | 1.5 |

| Burberry | 1.4 |

| Hikma | 1.2 |

| Lloyds | 0.5 |

| Rolls-Royce | 0.5 |

| Smith & Nephew | 1.4 |

This PEG data can be used as the basis to make informed investment decisions. However, the PEG ratio does have one main drawback. That’s the fact it’s reliant on estimated future growth rates. These estimates are subjective and can vary among analysts, introducing a degree of uncertainty into the calculation.

However, the above data broadly reiterates widely-shared sentiment that companies like Lloyds and Rolls-Royce are undervalued. It also provides us with important data about stocks that are less frequently considered, including generics manufacturer Hikma.

AstraZeneca is another interesting company to see on this list. The pharma giant trades around 30 times earnings, but analysts anticipate this R&D-driven business to continue growing an impressive rate throughout the medium term.

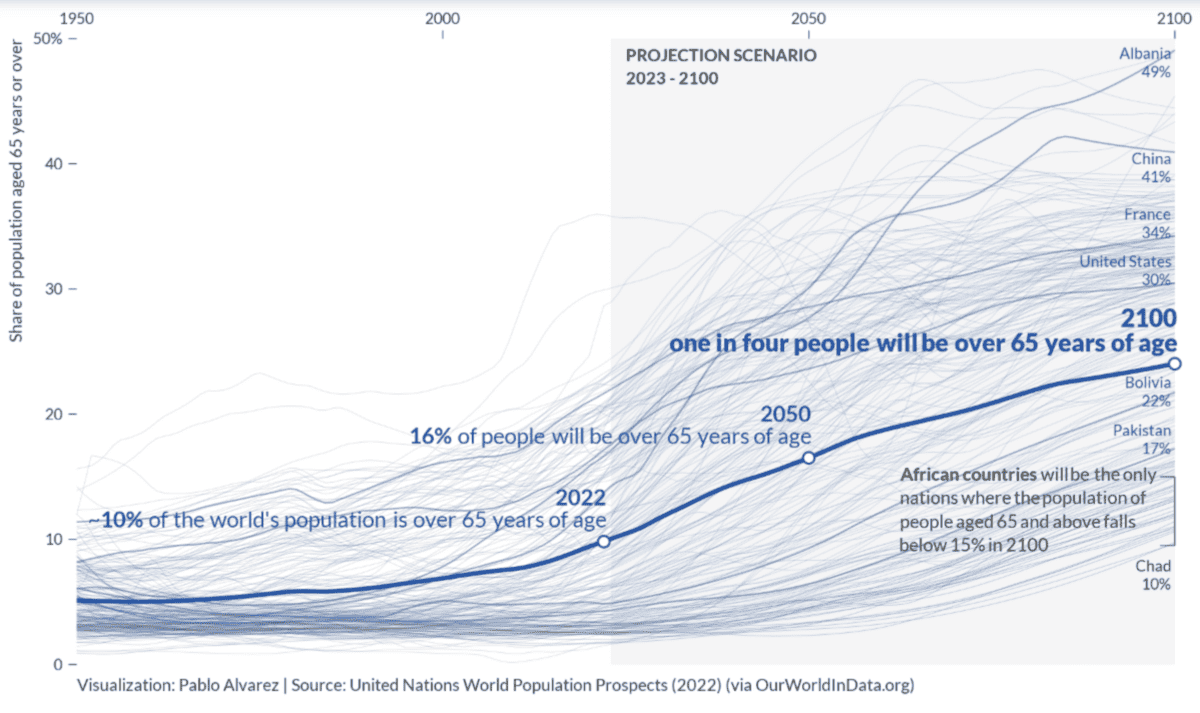

It’s also possible that AstraZeneca, Hikma, and Smith & Nephew will continue growing strongly beyond the medium term. This is because there’s a broad understanding that ageing global populations will cause demand for new drugs, generic products, and medical devices, to surge.

As such, from my notes above, it’s clear that the PEG ratio is good starting point for assessing stocks and making informed investment decisions.