Hikma Pharmaceutical (LSE:HIK) is a generics and injectables manufacturer that gained promotion to the FTSE 100 back in September.

However, the Amman-founded company hasn’t performed too well since it joined the blue-chip index. In fact, the generics manufacturer is down 17.8% over three months.

The business

Hikma has three main business segments: Generics, Injectables, and Branded.

- Generics: develops, manufactures, and markets generic pharmaceuticals. This business segment declined in 2022, but has recovered in 2023.

- Injectables: develops, manufactures, and markets generic injectable pharmaceuticals in the US, Europe, and the Middle East and North Africa. This segment delivered $643m in revenue in 2022.

- Branded: develops, manufactures, and markets branded pharmaceuticals in the Middle East and North Africa. The company achieved sales of $1.3bn in this segment in 2022.

Performance

To date, 2023 has been a good year for the business. In H1, the company saw revenue rise 18% to $1.4bn and core profit rise 35% to $401m. This supported EBITDA rising 30% to $451m and a rise in core basic earnings per share to 128.5¢, up 40% year on year.

In a November trading update, Hikma upgraded its full-year guidance in two of its three business segments — not the Injectables division due to supply-chain hiccups.

Headwinds and tailwinds

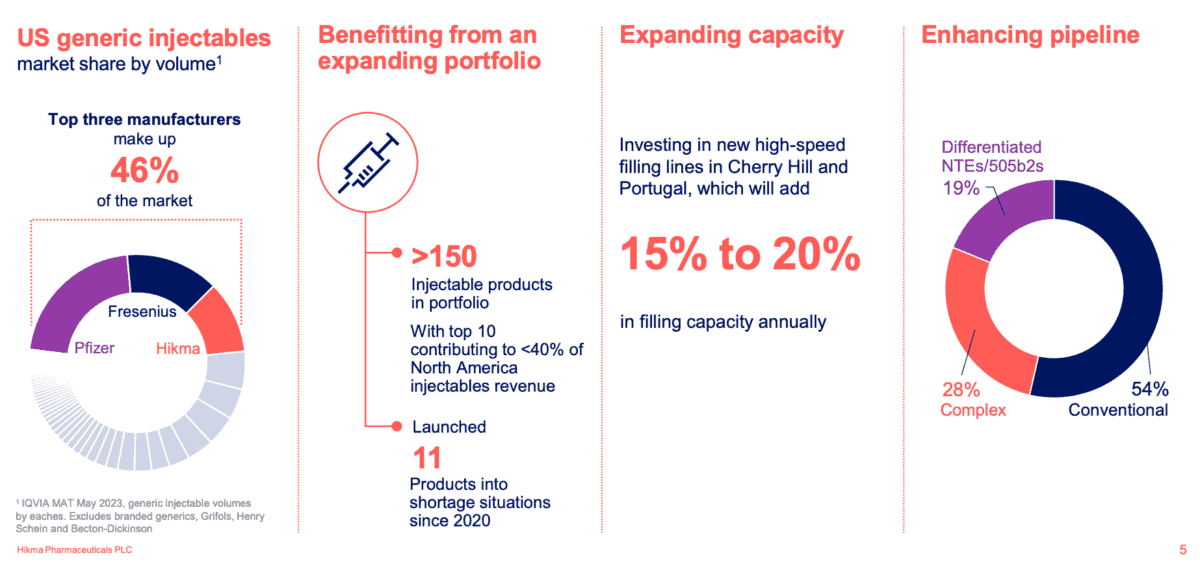

My optimism for Hikma stems from its diversified business model and global presence, particularly in the lucrative US market where it’s one of the top three generics manufacturers.

With three distinct segments, the company avoids over-reliance on one area. Additionally, strategic expansion into the growing pharmaceutical markets of North Africa and the Middle East positions Hikma for potential growth.

However, challenges such as price pressure in the generics market, loss of exclusivity for certain products, and regulatory hurdles pose potential risks to the company’s performance, broadly reflecting those of the wider industry.

2x in 2 years?

With the Hikma share price falling further since early November, the company’s valuation metrics have become more attractive as evidenced by the below price-to-earnings ratios.

| 2023 | 2024 | 2025 | |

| EPS Forecast | $1.42 | $1.89 | $2.01 |

| P/E ratio | 15.2 | 11.4 | 10.8 |

Assuming a 10% annualised growth rate, Hikma appears to be trading at with a PEG ratio around 1.5. That’s not overly expensive. In fact, while one is normally representative of fair value, it’s among the cheapest I’ve come across on the FTSE 100.

I’m certainly expecting to see the Hikma share price recover over the medium term. In 2019, the company registered basic EPS of $2.01 — that’s the last time EPS pushed above $2. This, and the pandemic, was the catalyst for the stock rising above £25 in 2020.

However, I’m not expecting the share price to double in the next two years. That said, it might be possible with new facilities coming online and some analysts forecasting EPS to hit $3 before the end of the decade.

There’s a strong investment hypothesis here based on impressive growth prospects and sector forecasts. That’s why I’m considering it for my portfolio.