Lloyds (LSE:LLOY) shares have rarely been cheaper. The stock dipped below 30p during the early stages of the pandemic, but under normal conditions, Lloyds rarely falls below 40p.

Moreover, it’s worth highlighting that Lloyds shares changed hands for more than double the current share price 10 years ago. And before the financial crash, the lender’s share price reached £5.

So this raises the question, could buying Lloyds shares today be like buying Rolls-Royce shares a year ago? The latter’s shares are up 161.7% over 12 months.

Valuation

Rolls-Royce shares were described as “woefully mispriced” in 2022. So what about Lloyds’ valuation?

Lloyds shares certainly aren’t expensive, trading at 4.8 times earnings over the past 12 months, and 5.8 times forward earnings. This represents a considerable discount versus the sector.

| P/E (TTM) | P/E Forward | P/B | |

| Lloyds | 4.8 | 5.8 | 0.59 |

| Financial industry average | 9.5 | 9.6 | 1 |

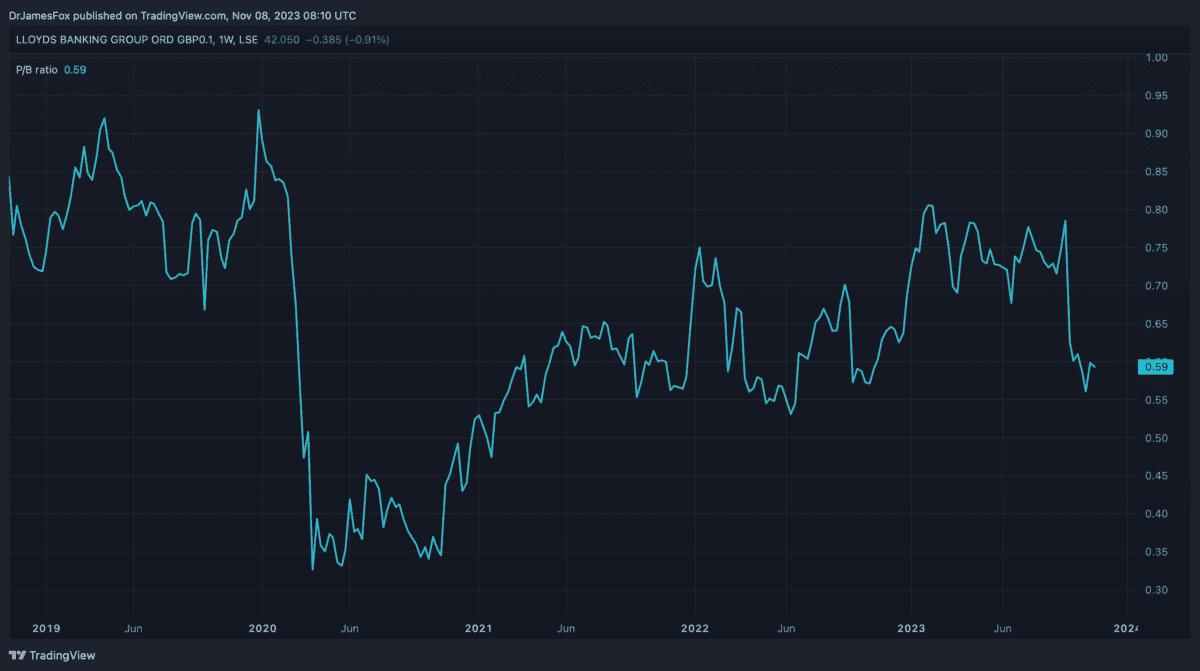

One of the most important metrics to look at is the price-to-book (P/B) ratio. This compares a company’s stock price to its book value per share, indicating whether the stock is undervalued or overvalued, based on its accounting value.

The above chart highlights that Lloyds’s P/B is significantly below one, inferring a discount to its net asset value.

These metrics suggest the stock’s fair value could be higher. Analysts following Lloyds certainly think so. The average price target is 61p, around 50% higher than the current share price.

Tailwinds and headwinds

Contrary to popular opinion, the shares will likely benefit from falling interest rates over the medium term. In fact, the bond market has priced in 75 basis points of cuts in 2024. There are several reasons for this:

- As interest rates fall, capital is often reallocated from debt and cash to shares. This provides momentum to stocks like Lloyds.

- Interest rates have extended too high for banks. Above 5%, investors are worried that borrowers will default on their loans, leading to widespread defaults. Falling interest rates will lessen this risk.

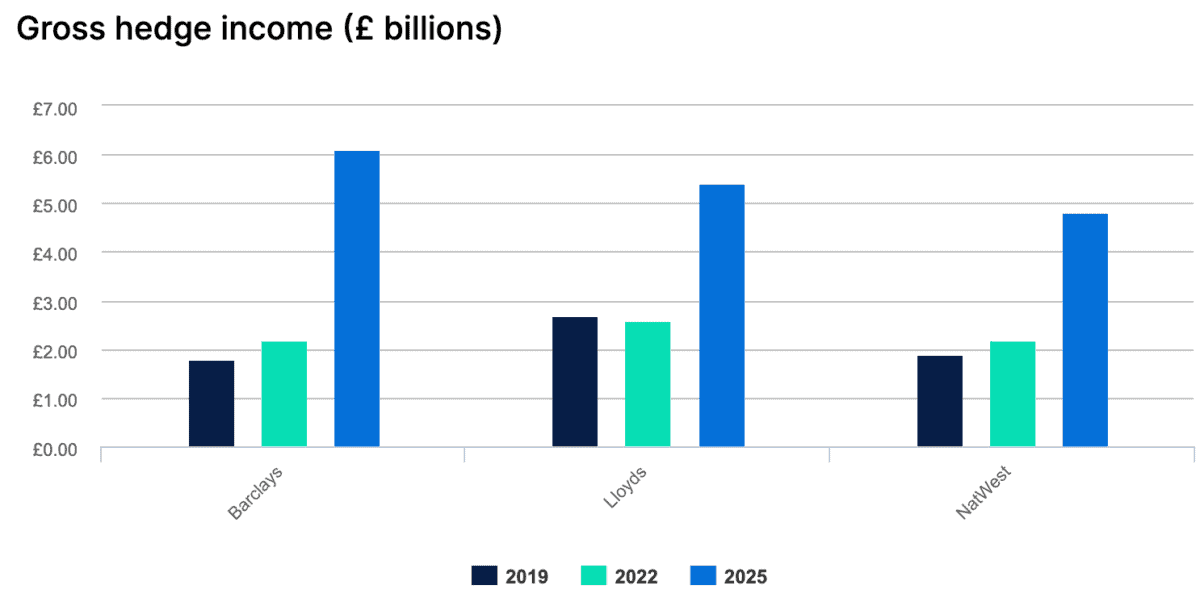

- Banks can benefit from hedging strategies when interest rates fall. They can do this by buying fixed-income assets like bonds with high yields. These will continue paying the fixed yields even as interest rates fall.

Of course, no investment comes without its risks. Lloyds has no investment arm and is therefore more exposed to the positive or negative conditions of the lending market.

In the case of a severe economic downturn, some of Lloyds’ investors worst-case scenarios may be realised. Rising unemployment amid high interest rates would certainly be unfavourable for Lloyds.

Having said that, the forecast isn’t for a severe recession, so it’s not the most likely outcome. Moreover, the average Lloyds mortgage customer has an income of £75,000. This provides the lender with a cushion against any prevailing negative economic climate.

I’m not expecting Lloyds shares to grow 161% over the next 12 months. However, with interest rates falling, and assuming a severe recession is avoided, I believe the stock could surge.