The last stock market crash in the UK started on 12 March 2020. This was due to a combination of factors, including the escalating Covid pandemic and fears of a global recession.

Fears of a looming stock market crash have been well publicised this year. With recession forecasts and geopolitical tensions high, there’s plenty of negative sentiment.

However, I don’t think we’ll see a stock market crash. Plus, many of these concerns are already factored into share prices.

Why wait?

Stock market crashes are infrequent and challenging to predict. The occurrence of a stock market crash in the UK, or any other financial market, is influenced by various factors, including economic conditions, geopolitical events, market sentiment, and external shocks.

The reality is that we’ve been in situations like this before, with negative economic forecasts and geopolitical tensions. The most likely scenario is for a mild recession in Europe and the US, and this has been more than factored in.

And by waiting, I could miss out on some of the attractive valuations we’re seeing on the FTSE 100 and FTSE 250 today. British stocks have been on sale for some time. Only a few, like Rolls-Royce and BAE Systems have beaten off the negative sentiment to push higher.

The laggard

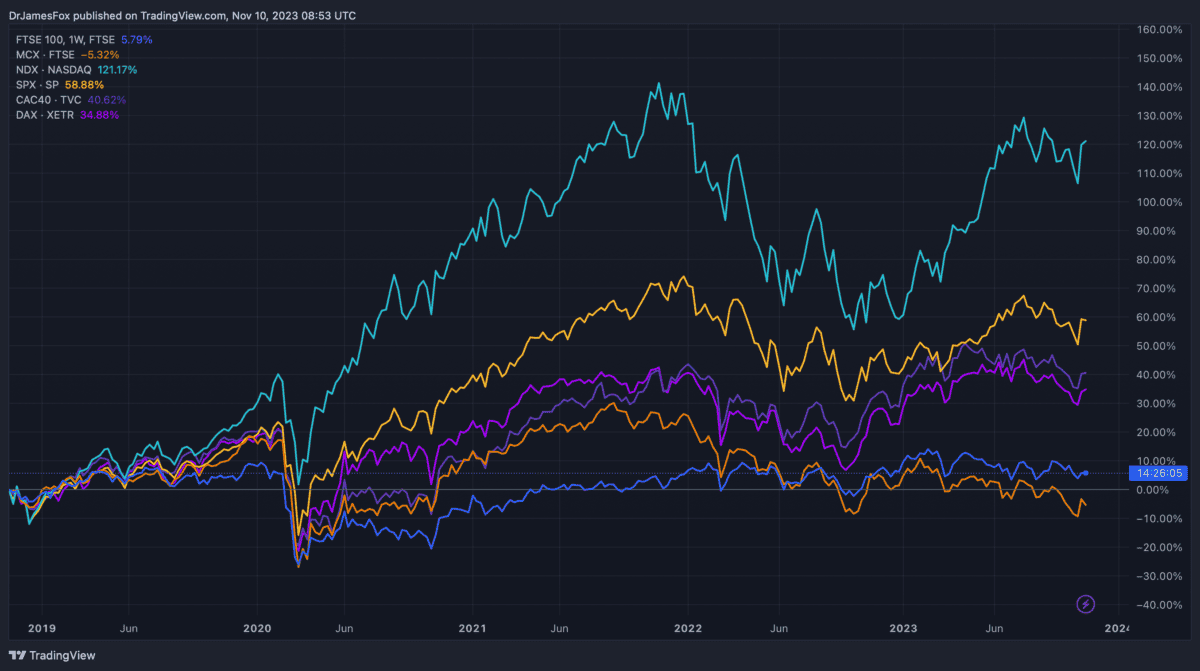

The below chart shows that UK-listed stocks have underperformed their global counterparts over the past five years. Valuations are constrained and sentiment is poor. And it becomes a self-fulfilling prophecy, as investors become less incentivised to invest in an underperforming index.

The chart shows that the FTSE 100 is up just 5.7% while the FTSE 250 is down 5.3% over five years. During that same period, the NASDAQ has more than doubled in value.

Stocks on sale

There’s nothing intrinsically wrong with UK-listed stocks as a whole, even if we hold negative views on the future of the British economy. The FTSE 100 is an index full of multinational companies with 70% of index revenue coming from outside the UK.

I must, of course, recognise that no investment is risk free even if the valuations are attractive. Sometimes when you think a stock can’t fall any further, they do.

It may take some time before confidence returns, but I see this as an opportunity to top up on undervalued UK-listed stocks. So, here are some of the companies I’ve been buying or am looking to buy.

| P/E | Five-year average P/E | Discount versus average share price target | Performance 12 months | |

| Barclays | 4.45 | 12.8 | 36.2% | -11.2% |

| Crest Nicholson | 5.1 | 9.4 | 20.1% | -17.9% |

| Hargreaves Lansdown | 10.5 | 24.2 | 28.3% | -12.8% |

| IAG | 4.1 | n.a. | 30.3% | 18.3% |

| Legal & General | 5.8 | 9.2 | 18% | -5.7% |

| Smith & Nephew | 14.7 | 32.4 | 21.3% | -3.1% |

Of course, this isn’t to say that I don’t have stocks listed on other indicies. However, as Warren Buffett has highlighted throughout his career, we should be fearful when others are greedy and greedy when others are fearful.

The current state of the FTSE 100 and FTSE 250 gives me the opportunity to pick up objectively cheap stocks, and hold them until their value is actualised.