All dividend stocks have the potential to give investors a nasty surprise. That’s because payouts are never truly guaranteed and they can (and do) occasionally get cut.

However, I believe some Dividend Aristocrats are more likely than others to keep churning out passive income. Here are two I’d buy today if I didn’t already hold them.

150 years of income and growth

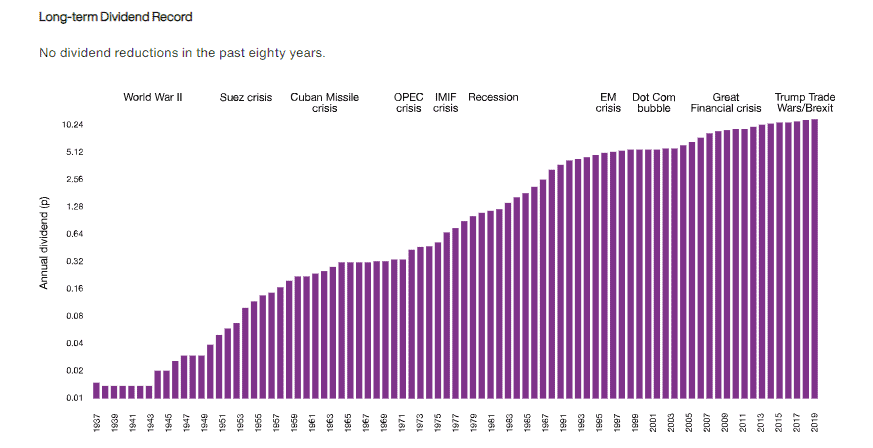

First we have Scottish American Investment Company (LSE: SAIN). This is a FTSE 250 investment trust that celebrated its 150th anniversary this year. Incredibly, it hasn’t cut its dividend since 1938!

The trust operates a diverse global portfolio of stocks (and some bonds). Its aim is to find resilient companies that can grow their earnings and dividends healthily over the very long term.

That means it isn’t so much focused on high dividend yields. Indeed, the stock only carries a 2.9% yield itself.

However, this philosophy has served it incredibly well, allowing the managers to identify the likes of Microsoft, PepsiCo and Watsco years ago.

The trust has also long highlighted the potential of top holding Novo Nordisk‘s weight-loss medication to turbocharge the company’s earnings and dividend.

This has been proved correct, as Novo Nordisk revealed in its most recent quarter that sales of its Wegovy weight-loss drug had risen more than 700% year on year.

One risk is that these stocks have increased so much that they’re now quite pricey. Novo Nordisk shares, for example, currently trade on a P/E ratio of 42. Any pullback could put pressure on the trust’s own share price.

However, in terms of the dividend, I reckon it’s safe. Investment trusts are allowed to retain as much as 15% of their revenue, which means they can use cash reserves to maintain consistent payouts even during challenging times.

Monster yield

If a starting dividend yield of 2.9% doesn’t sound that exciting, then I’ll mention insurance and pensions firm Legal & General (LSE: LGEN). This FTSE 100 stock is sporting an enormous 8.8% yield.

Normally I’d be a bit wary of any dividend yield approaching double-digits. It can sometimes be a warning sign that the yield is unsustainable.

However, in this case, I just think the stock is incredibly undervalued.

Why do I say this?

Well, despite a challenging backdrop, the firm is still on track to achieve its target of generating between £8bn and £9bn in capital by 2024. And its balance sheet remains strong, with a Solvency II ratio of 230% in the first-half of 2023, up from 212% in H1 2022.

A solvency ratio indicates whether a company’s cash flow is sufficient to meet its long-term liabilities. So it’s a way of measuring an insurance firm’s financial health. And L&G’s appears to be tip-top.

Of course, this high yield has so far failed to attract large numbers of bargain hunters. Therefore, there’s a risk that the shares might continue to be ignored for a while longer.

However, as with the previous stock, I’m reassured by L&G’s terrific long-term dividend record. In 2000, the payout was 4.32p per share. Last year, it was 19.37p per share.

For 2024, the stock is on a forecast dividend yield of 9.6%. If sustained, that’s enough to treble the value of an investment inside 12 years.