Housebuilders like Taylor Wimpey (LSE:TW) have an excellent reputation as reliable and generous dividend shares. It’s why I bought this particular FTSE 100 share for my own portfolio in 2017.

But while the builder continued to offer above-average dividend yields, I haven’t been tempted to add more of its shares to my Stocks and Shares ISA. For the record, its dividend yield for 2023 and 2024 sits at an impressive 8.2%.

However, could recent good news suggest that trading conditions might be about to improve? And should I buy more Taylor Wimpey shares following these developments?

Good news, part 1

Property prices have steadily eroded as interest rates have steadily increased and the UK economy has spluttered. But fresh data from the Halifax has fed speculation that the market may finally be stabilising.

While average home prices were down 3.2% year on year in October, those prices were up 1.1% from September. This broke a streak of six straight monthly reversals.

Good news, part 2

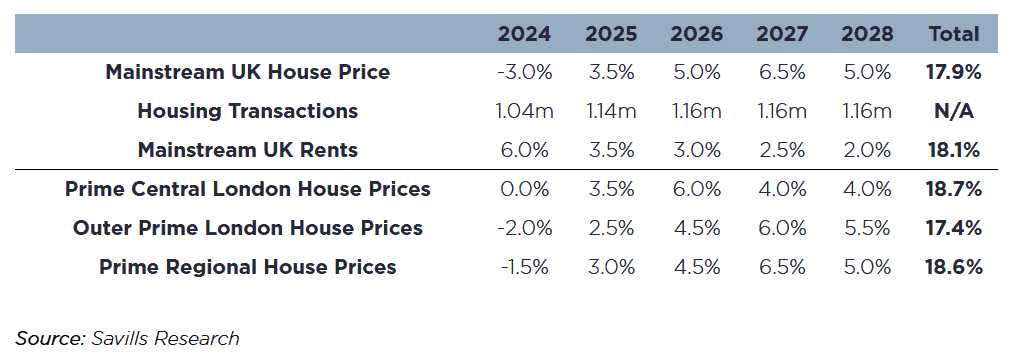

In other encouraging news this week, Savills predicted that the current downturn will “bottom out” around the middle of 2024. This will happen as mortgage rates ease in expectation of interest rate cuts later in the year, the estate agency said.

It added that “although affordability is only likely to improve gradually, it should buoy buyer confidence and allow the first shoots of recovery to appear“.

However…

While these reports contained some good news, there were also some details that suggest the housebuilders will continue to struggle.

Halifax also said that “buyer demand… remains weak overall“, with prices rising in October due to supply constraints as prospective sellers keep their properties off the market.

The building society also said it doesn’t expect home prices to continue growing until 2025. Meanwhile, Savills thinks average prices will fall a hefty 3% next year.

I’m concerned that the housing market could perform even worse over the next couple of years too, given the ongoing danger of sticky inflation that means interest rates may remain higher for longer. A pronounced downturn in the UK economy would also weigh heavily on home sales.

Should I buy Taylor Wimpey shares?

Taylor Wimpey’s dividend forecasts already look fragile. And any worsening of the market as suggested above would make them appear even more flimsy.

At the moment, annual dividends of 9.4p per share are predicted through to next year, in line with last year’s reward. But these projections are outstripped by anticipated earnings of 9.2p and 9.1p for 2023 and 2024 respectively.

On the plus side, Taylor Wimpey has a strong balance sheet that could help it meet these forecasts. Net cash actually edged slightly higher to £654.9m as of June.

But a blend of consistently-weak demand and rising build costs could put its balance sheet under growing strain and test its ability (and its appetite) to keep paying big dividends.

The long-term outlook for UK housebuilders remains robust. As that table by Savills shows, home values appear on course to rise strongly once current market trouble subsides. But right now, I’d rather buy other UK shares to make passive income over the next couple of years.