Oil and gas stocks have been some of the best performing in my Stocks and Shares ISA over the past few years. But as the world begins to transition away from hydrocarbons in favour of more renewable sources of energy, how do I square this fact with continuing to keep the likes of BP and Shell in my portfolio?

Peak oil

Last month’s release of “World Energy Outlook 2023” from the International Energy Agency (IEA) has again brought into sharp focus the long-term viability of the oil industry.

Grabbing the limelight in that report is the prediction that demand for all types of fossil fuels will peak by 2030. But behind every bold headline is an examination of the detail. The report does run to 355 pages.

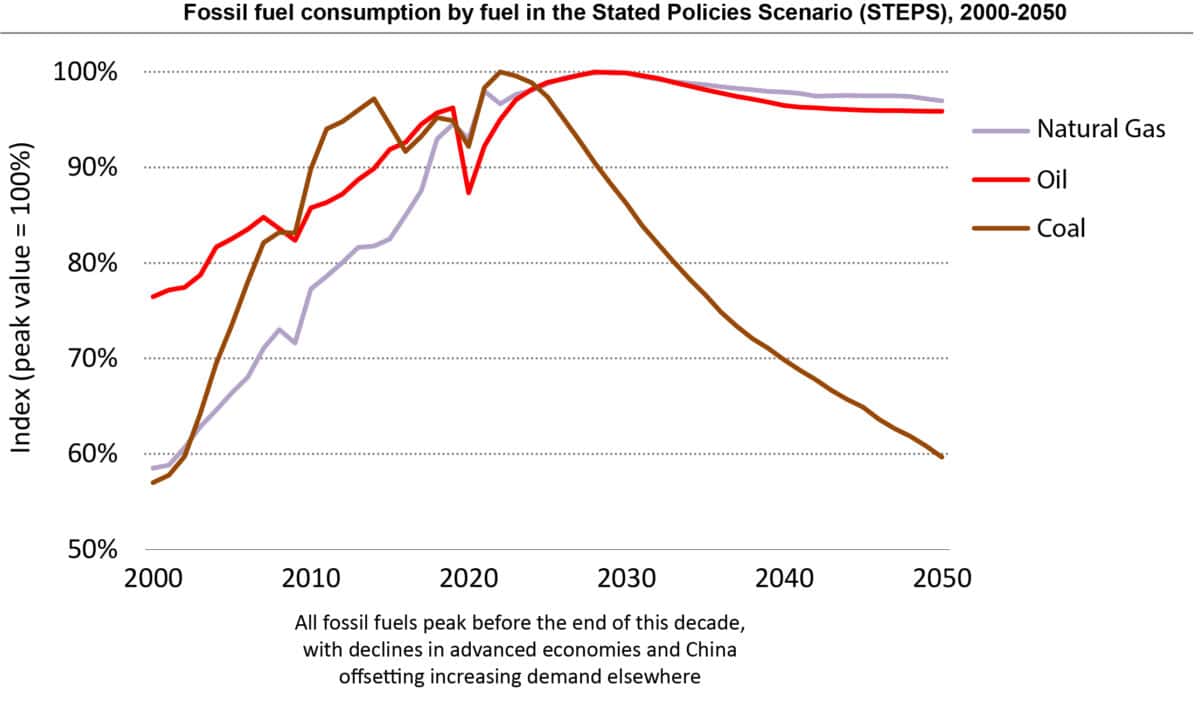

The IEA models future demand for hydrocarbons using a number of different scenarios. The default one is called Stated Policies Scenario (STEPS).

The STEPS scenario is designed to provide a sense of the prevailing direction of energy system progression, based on an examination of the current policy landscape. The following figure shows the demand for hydrocarbons under this scenario.

Source: International Energy Agency

What strikes me is how demand for oil and natural gas barely declines between 2030 and 2050. Indeed, the IEA states: “continued investment in fossil fuels is essential in all of our scenarios”.

Anti-ESG agenda

Although I remain bullish on the prospects for the oil industry, that doesn’t mean that I sit in the anti-ESG camp.

The anti-ESG agenda has been growing in popularity as of late. Some argue that ESG investing is just a fad that will eventually fizzle out. Nigel Green, CEO of deVere Group, argues that investors who take such a backward-looking view “could negatively affect their prospects for growing and safeguarding their wealth”. I agree.

Policy makers and the global citizenry have all voted and the train has left the station. Over the next few decades, the world is going to increasingly rely on renewables and electrification as the means to reduce carbon emissions and address the climate change emergency.

As an investor, this fact presents me with unparalleled opportunities.

My ESG strategy

One issue for me is that many of the low-carbon technologies today are just beginning. With hundreds of start-ups in the space, vying for capital, the odds are against me picking a multi-bagger. That is why I stick to established players like National Grid.

For many investors, ESG is about investing in renewable and clean sources of energy. This is too narrow an approach, in my view.

One of the ironies of the push for low carbon technologies is that it requires metals in huge quantities to make it a reality. For example, it’s estimated that the UK alone will need to install five times the amount of electricity transmission infrastructure in the next seven years than has been built in the last 30.

The problem is that the supply of critical metals such as copper and silver needed to build the grid infrastructure, for EVs, batteries, and solar panels just isn’t there. That makes investing in the likes of Glencore, Anglo American, and Fresnillo, no-brainers to me.