The FTSE 100 index of leading shares remains under significant pressure heading into the end of 2023. Market confidence remains weak, and UK shares could continue to sink as:

- Political conflict in the Middle East intensifies

- Concerns over stubbornly-high inflation persist

- Central banks float the prospect of further interest rate rises

- China’s economic recovery splutters

- Supply issues push oil prices northwards

These factors have driven the FTSE 100 2% lower since the start of the year. However, I believe it could be argued that many UK blue-chip shares are now too cheap to miss.

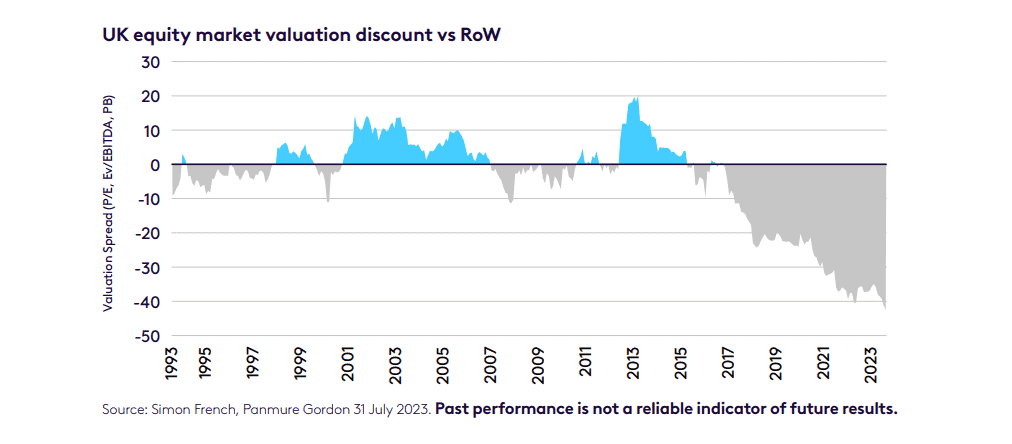

UK stocks trade at a discount

As the graph from Octopus Investments shows, British stocks have been trading at an increasingly-large discount to their international peers. In fact, London-listed companies are changing hands at an enormous 40% discount following this year’s declines.

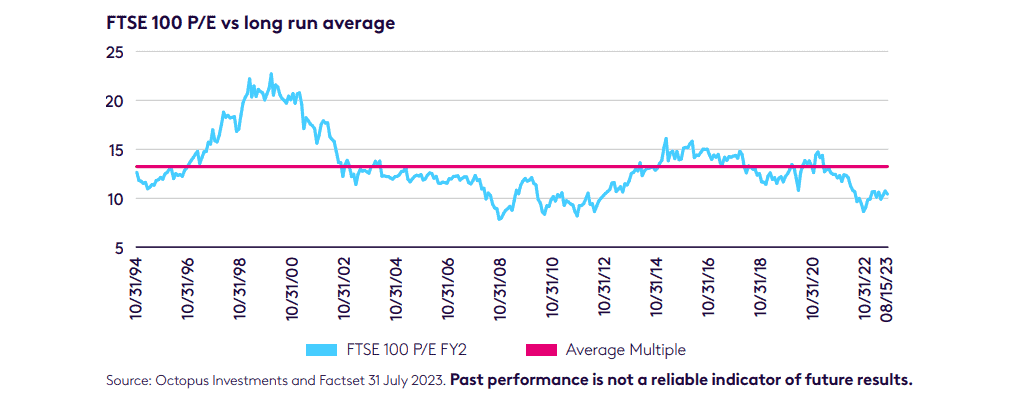

Meanwhile, the average price-to-earnings (P/E) ratio on Footsie shares remains well below historical norms, as can be seen below. Right now, the index’s average multiple sits just above 10 times.

I think today is a great time for long-term investors like me to try and grab some bargains. As I say, stock prices could continue weakening in the short term. But — as history shows us — over a prolonged time horizon share prices tend to rise strongly. While I can’t be certain, I expect UK shares to rebound strongly from current levels.

2 top stocks on my shopping list

Mining giant Glencore is one FTSE-quoted share I’m looking to buy soon. It trades on a forward P/E ratio of 9.3 times and carries a giant 7.7% dividend yield.

The commodities producer and trader is on the back foot as concerns surrounding major consumer China continue to chill investors. Ratings agency S&P even predicted this week that GDP growth there could plummet as low as 2.9% in 2024 if the real estate sector crisis there worsens.

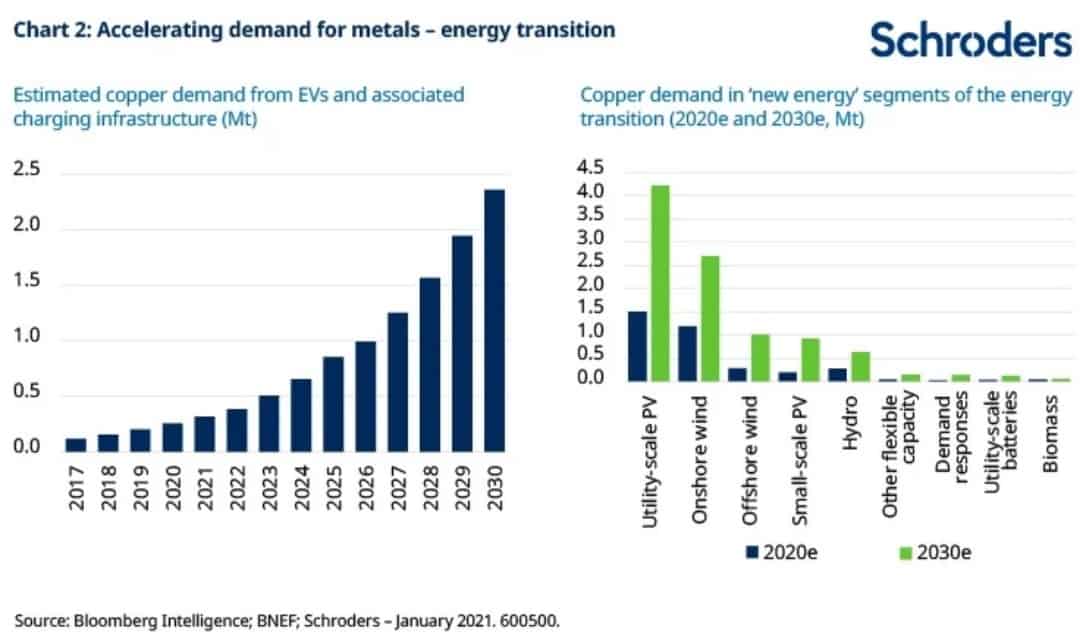

But Glencore is a stock I expect to thrive over the longer term as metals demand soars. The graph below, for instance, shows how demand for copper alone is expected to soar as the green energy and electric vehicle revolutions roll on. This could drive profits at mega miners like this through the roof.

I’m also considering opening a position in SSE. The energy producer trades on a prospective P/E ratio of 10.2 times and carries a FTSE 100-matching 3.8% dividend yield.

I think this is a bargain given the company’s excellent defensive qualities. Unlike most other UK shares, earnings here should remain stable, regardless of the broader economic landscape.

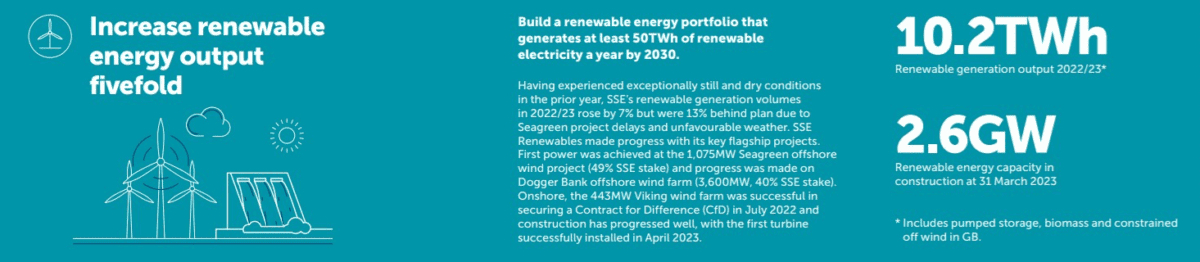

I think SSE could be a stock for me to capitalise on the rising role of renewable energy. The company is ramping up wind power capacity this decade to meet growing demand for clean power too, as this graphic below shows.

While further project delays could sap potential earnings growth, I’m still expecting profits and dividends here to rise strongly in the coming years.

There are plenty of bargains right now across the FTSE 100. And I think these stocks could be great for me as well as potential first buys for a starter portfolio.