I’ve been taking advantage of the recent deterioration in the price of Lloyds (LSE:LLOY) shares to top up my holdings. The blue-chip bank is currently trading around 43p, down from highs around 54p earlier in the year.

Trading at a discount

Prior to the pandemic, Lloyds shares were frequently hovering around the 60p mark. The stock has not reached that high in the years since. And I find this particularly interesting.

After all, at the time, the UK had already voted for Brexit — a risk factor that kept the stock depressed for a while — and interest rates were near zero to stimulate growth.

Lloyds was also less profitable than it is today. The bank delivered £4.2bn in profit before tax in 2019 versus £6.9bn last year. So, why are Lloyds shares trading at a discount versus their pre-pandemic levels?

Default risks

Lloyds shares, like other banks, were pushing upwards until February when the SVB fiasco sent financial stocks into reverse.

While SVB was something of a warning for the industry, interest rates have since pushed higher, extending far beyond the Goldilocks zone.

The relationship between interest rates and bank profitability isn’t a simple one. On one side, there’s a tailwind as net interest margins have increased with rising interest rates.

On the other hand, as interest rates have extended beyond 3%, there’s been increasing concern about the capacity of individuals and businesses to make their growing repayments.

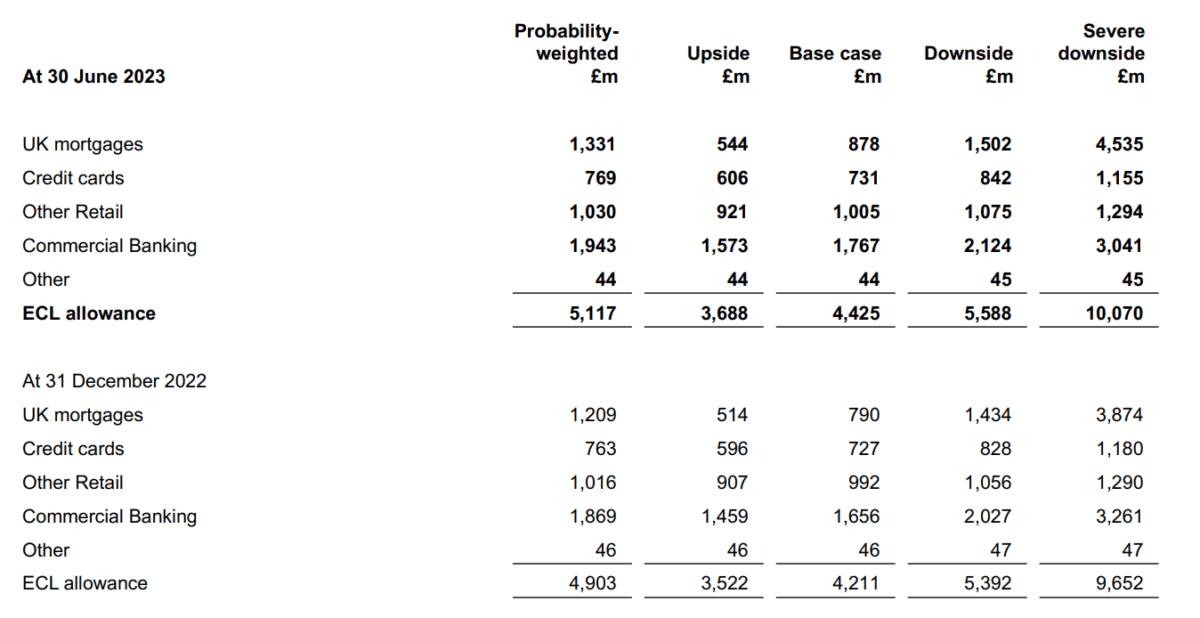

Under the bank’s worst-case forecast, expected credit losses could reach £10.1bn. To put that into context, under the base-case scenario, the bank foresees expected credit losses of £4.2bn.

Is it really that bad?

Since Lloyds published the above forecasts in its half-year results in late-July, there have been some broad sentiment changes.

With UK economic growth supposedly stronger than we had expected, and more signs that interest rates have peaked, it’s possible that the worst-case scenario has been avoided.

Moreover, investors may find some peace in the recent UK banks stress stress. Under the stress scenario, its Common Equity Tier 1 (a measure of liquidity) would fall to 11.6%. Lloyds was the second-best performer of all UK banks.

The recent struggles of Metro Bank may have contributed to some further concerns about the health of the UK banking sector. However, after a new deal, announced on Sunday, an SVB-esque fiasco has been avoided.

Heading to 60p

Trading at 5.5 times earnings, Lloyds isn’t expensive. In fact, it trades at a significant discount to peers including HSBC, Standard Chartered, and other non-UK focused institutions. If we were to apply a price-to-earnings ratio comparable with its international peers (8 times), the stock would be trading around 65p.

Likewise, we can see that Lloyds trades with a price-to-book ratio of 0.58 times, inferring a 42% discount versus its tangible net asset value. Risk, in my opinion, is too heavily factored into the share price.

By comparison, US institutions trade with a P/B around one. As such, if we applied a P/B of one, we’d expect to see the Lloyds share price at 75p.

So, barring any severe economic slowdowns or mass defaults, I expect to see the Lloyds share price creep towards 60p.