Tesla (NASDAQ: TSLA) stock has continued to please investors throughout 2023. Although it’s still far off its 2021 highs, it has returned a whopping 143% year-to-date.

Broaden this horizon to five years, and the shares have soared over 1,400%. This means that if I’d invested £1,000 in 2018, I’d be sitting on over £14,000 today.

Given its impressive history, could Tesla shares be a smart addition to my portfolio this October? Or is the world’s leading EV manufacturer’s stock still vastly overvalued? Let’s investigate.

Justifying Tesla’s valuation

Tesla has long been the darling of the EV industry, but its persistently high price-to-earnings (P/E) ratio has always led investors to question if the stock might be overvalued.

The shares currently trade on a P/E ratio of 74. For context, the Nasdaq average is 18, and most good-value stocks trade below 10.

To highlight how crazy this ratio is, let’s take Ford and General Motors. They trade on P/E ratios of 11 and four, respectively. These are much more established players, each with over a century of history behind it.

That said, the real value of a stock isn’t based on a ratio, it’s based on what investors are willing to pay for it. Tesla shares have been as high as $410 (around $1,230 before the three-to-one stock split in August 2022). This signifies that investors are in fact willing to pay a huge premium. It wouldn’t surprise me if the stock popped again in the future.

Delivering consistent results

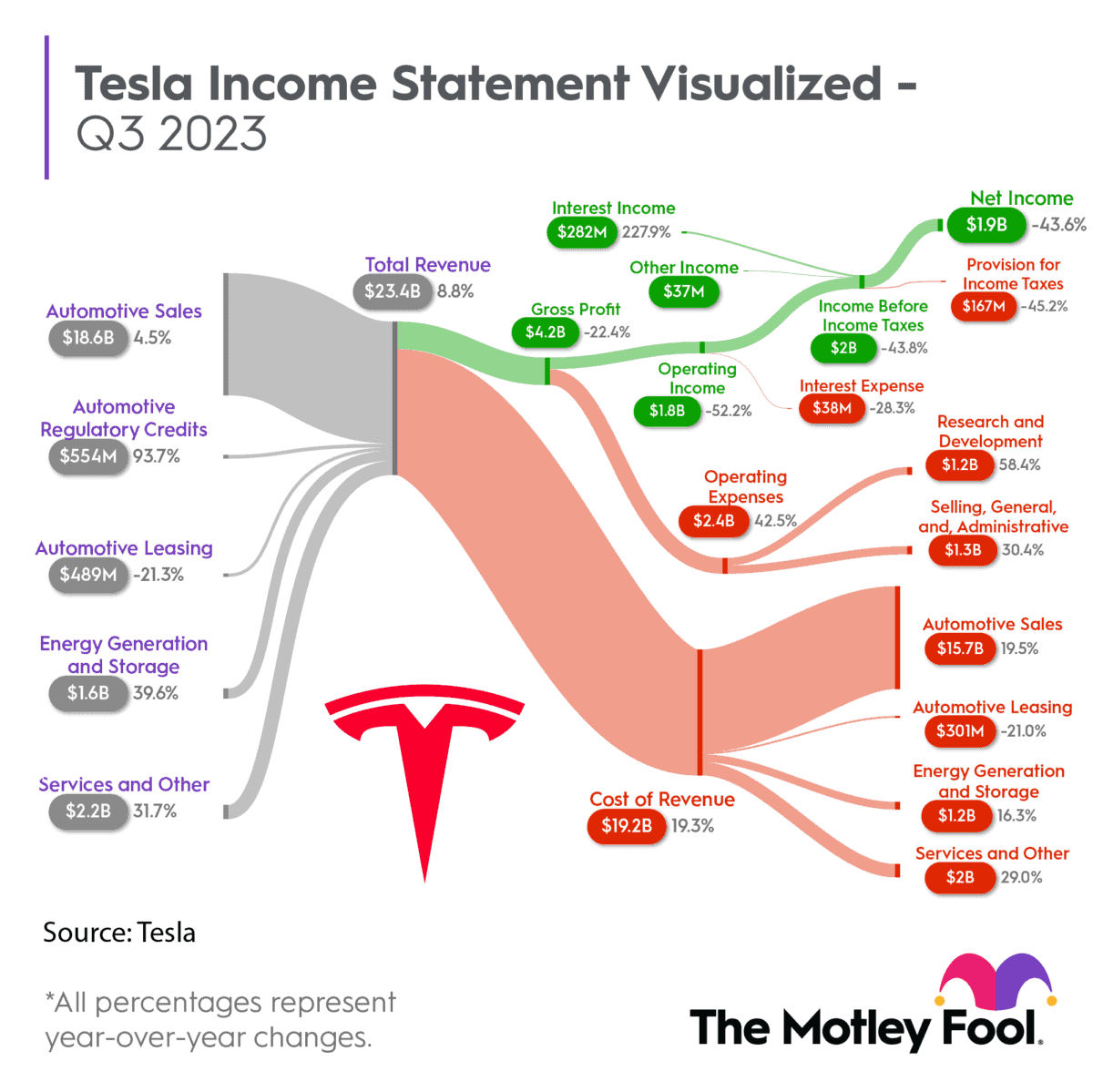

After turning profitable in 2020, Tesla has consistently delivered solid results. In its 2023 half-year results, the company delivered $39bn in automotive revenues, up over $10bn from the same period in 2022. Net income came in slightly lower than in 2022, however, this doesn’t worry me given the current tricky economic climate.

Tesla releases its third-quarter results next week. I’m eager to see how the company has performed and how investors react to the news.

Tough times ahead?

It’s no secret that inflation is one of the key macroeconomic trends shaping markets at the moment.

High inflation and rising interest rates can spell trouble for companies like Tesla, as it has substantial capital investments and high research and development costs.

Inflation erodes purchasing power, making it more expensive for businesses to acquire resources and materials essential for production. For a capital-intensive company like Tesla, this could significantly impact profit margins.

Additionally, when interest rates rise, borrowing becomes more expensive, increasing the cost of financing for expansion and innovation. The EV manufacturer’s ambitious plans for growth and technological advancements might face hurdles in the current high-interest-rate environment.

The verdict

Although Tesla shares have performed well this year, the stock is just too volatile for my liking. While investors have paid more for the shares in the past, this is no indication that these levels will be reached in the future.

I’ll be waiting for the company’s Q3 results before taking another look. Until I’ve had a chance to go through them and reassess, I won’t be investing any time in October.