The BT (LSE:BT.A) share price has fallen 50% over five years, and despite a failed rally this year, trades near a five-year low. It’s among the worst-performing stocks on the FTSE 100.

So will this £12bn company ever recover? Let’s explore.

Financial concerns

BT faces significant financial challenges. Net debt currently amounts to £19.9bn, surpassing its market capitalisation of £12 billion. And this is a concern, especially as interest rates rise, making debt servicing more costly.

Additionally, the company is grappling with a substantial pension deficit, necessitating considerable top-up payments, which came in at around £1bn in cash outflows last year.

These payments are projected to fall to around £600m annually from 2024 to 2030, but remain significant. In turn, this leaves the company with a very slender near-term cash surplus.

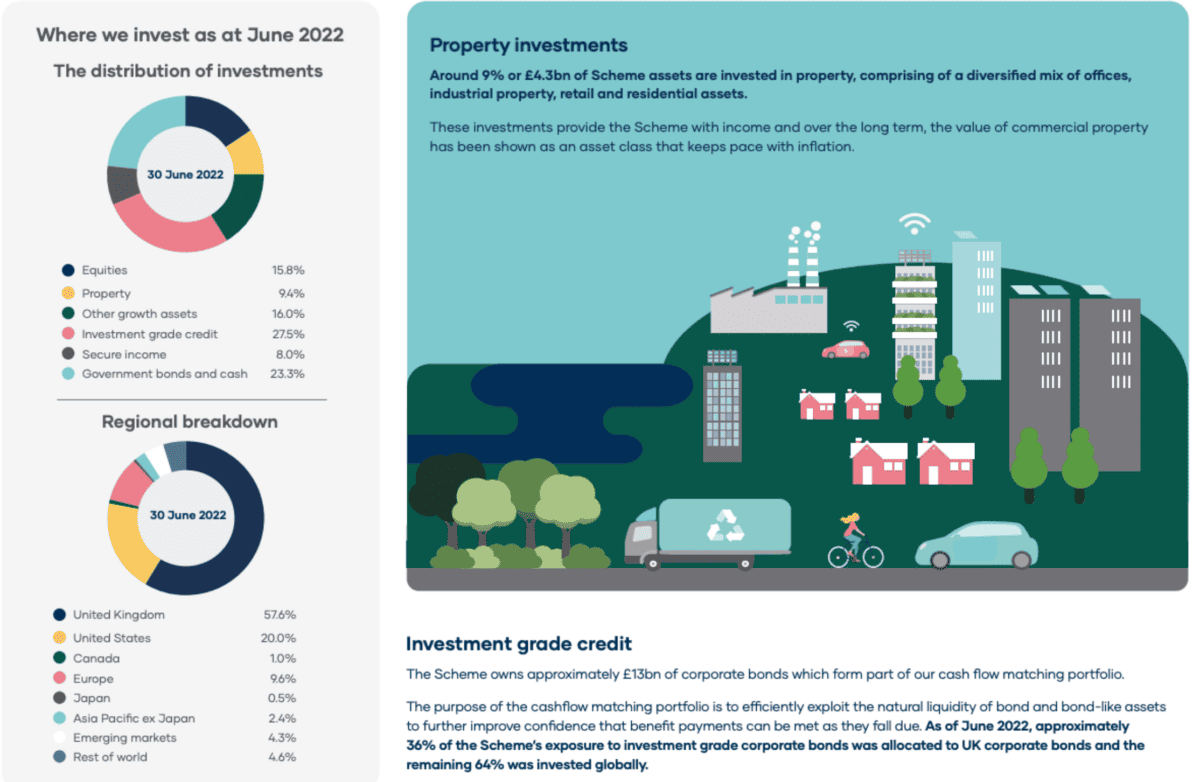

While the large proportion of the pension scheme’s assets are in investment-grade credit, like gilts, a not insignificant amount is in equities and property. In fact, around 9% of the scheme was invested in property, including commercial real estate, as of June 2022.

Given the poor performance of this area in recent years, some analysts are wondering whether BT’s top-up payments will have to rise further.

At the same time, the company maintains its investments in expanding its fibre-to-the-premises (FTTP) broadband and 5G network across the UK. Consequently, it seems unlikely debt reduction will take place in the near future. That’s unless BT opts for a capital-raising strategy, such as selling or spinning off its Openreach networks business.

Economic concerns

UK economic growth lagging its peers, inflation remains elevated, and living standards are under pressure. So it’s hard to see things improving for BT.

While several BT offerings won’t suffer if prices rise, the demand environment is unlikely to be great for items like subscription TV. BT is an equal owner in the TNT Sports network, formerly BT Sports.

Worth the risk?

BT appears cheaper than many of its peers when we look at the price-to-earnings ratio (6 times) and the EV-to-EBITDA ratio (4.9 times). While that might look appealing, it’s likely other companies have stronger growth forecasts. After all, much of BT’s cash flow is being redirected towards its pension scheme.

Moreover, BT is a company that, to some investors, is lacking direction. It recently made a significant leadership change by appointing Allison Kirkby, an existing board member, as its new chief executive. She is set to take the reins from Philip Jansen, with her official start date expected to be around the end of January 2024.

This transition in leadership comes at a critical juncture for the company. It’s navigating through various challenges and opportunities in the telecommunications and media industries.

So despite the relative valuation looking attractive, I’d rather put my money elsewhere. BT may be trading near fair value.