Scancell (LSE: SCLP) shares are having a great run at the moment. Over the last month, they’ve risen around 70%.

So, what’s beyond this big share price rise? And should I buy the penny stock for my own portfolio?

What does Scancell do?

First, a little bit of information on this under-the-radar company.

Scancell is a clinical-stage biopharmaceutical company that’s focused on developing novel medicines to treat significant unmet needs in cancer and infectious disease treatment.

Listed on London’s Stock Exchange’s Alternative Investment Market (AIM), it currently has a market cap of around £137m, meaning it’s a very small company.

Why is the share price soaring?

As for why the share price has jumped recently, it’s all down to excitement around the company’s ImmunoBody® cancer vaccine, SCIB1, which is being developed for the treatment of patients with metastatic melanoma.

In September, the company released the results from the first stage of its Phase 2 SCOPE trial with the vaccine and they were very good, with an 82% response rate from 11 patients.

The trial has now successfully transitioned into the second stage, which will involve an additional 27 patients. The company believes that there is a 90%+ probability that the second phase will also be successful.

If the data is validated in the second-stage trial, it will give Scancell the confidence to initiate a randomised phase 2/3 adapted registration programme in patients with unresectable melanoma (melanoma that cannot be completely removed) – a potential $1.5bn per year market.

Should I invest?

There’s no doubt that Scancell’s cancer vaccine sounds promising. If it gets to market, investors here could see huge returns.

But the thing about these kinds of clinical-stage biopharmaceutical companies, from an investment point of view, is that they are very risky.

Ultimately, their projects tend to be very hit or miss. As a result, they often turn out to be poor long-term investments.

I actually remember discussing Scancell with a friend all the way back in 2012. At the time, the shares were on fire (they were a ‘12-bagger’ in 2012) due to enthusiasm over the same vaccine – SCIB1.

But with the company generating minimal revenues and no earnings since then, its share price has just gone backwards.

Personally, I think a better approach to small-cap investing is to focus on companies that are already profitable and growing their revenues and earnings at a fast pace.

A good example of such a company is software firm Cerillion.

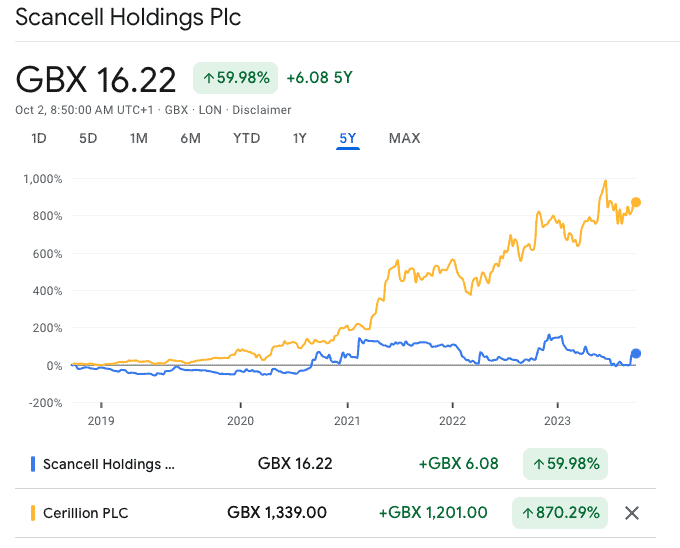

It has been a fantastic investment in recent years (outperforming Scancell by a significant margin) due to the fact its earnings have been steadily climbing.

Source: Google Finance

Of course, not every small-cap company with growing revenues and earnings will turn out to be a good investment. There are plenty of variables that can impact investment returns including market conditions and valuations.

But with a bit of research, it’s possible to find high-quality small-cap companies that have the potential to be winning long-term investments.

You can find plenty of information on these kinds of companies right here at The Motley Fool.