I’ve been keeping a close eye on Exscientia (NASDAQ:EXAI) — a growth stock specialising in AI-driven drug discovery and development.

It’s at the forefront of revolutionising the pharmaceutical industry by leveraging AI and machine learning to accelerate the drug discovery process.

What it does

Its primary focus is on discovering small molecule drugs, essential in treating various diseases and conditions.

Exscientia’s AI-driven platform combines vast datasets, computational power, and sophisticated algorithms to design and optimise potential drug candidates quickly and efficiently.

This approach enables the identification of novel drug candidates with a higher likelihood of success, reducing the time and cost traditionally associated with drug discovery.

Exscientia has gained significant recognition and partnerships within the pharmaceutical industry, which is always a good sign.

To date, it has collaborated with prominent pharmaceutical companies like Merck, Bayer, Sanofi, and Bristol Myers Squibb to advance drug discovery projects.

These partnerships highlight the industry’s growing interest in harnessing AI and machine learning to streamline drug development processes and bring new therapies to patients more rapidly.

Worth its premium

Exscientia’s valuation, trading at approximately 22 times sales, may appear high. However, it’s essential to consider the compelling factors behind this valuation.

The key driver is the remarkable potential of AI-driven drug discovery, a field that’s garnering increasing attention and investment.

As noted, the complexities and costs associated with traditional drug discovery, AI offers a faster and more efficient way to identify promising drug candidates. Traditionally, around 90% of drug candidates fail in clinical trials.

Moreover, the AI drug discovery market’s projected growth to reach $909bn by 2030. This underscores the immense potential of this field. As technology continues to advance and the demand for innovative healthcare solutions rises, Exscientia could be in pole position to dominate.

Changing fortunes

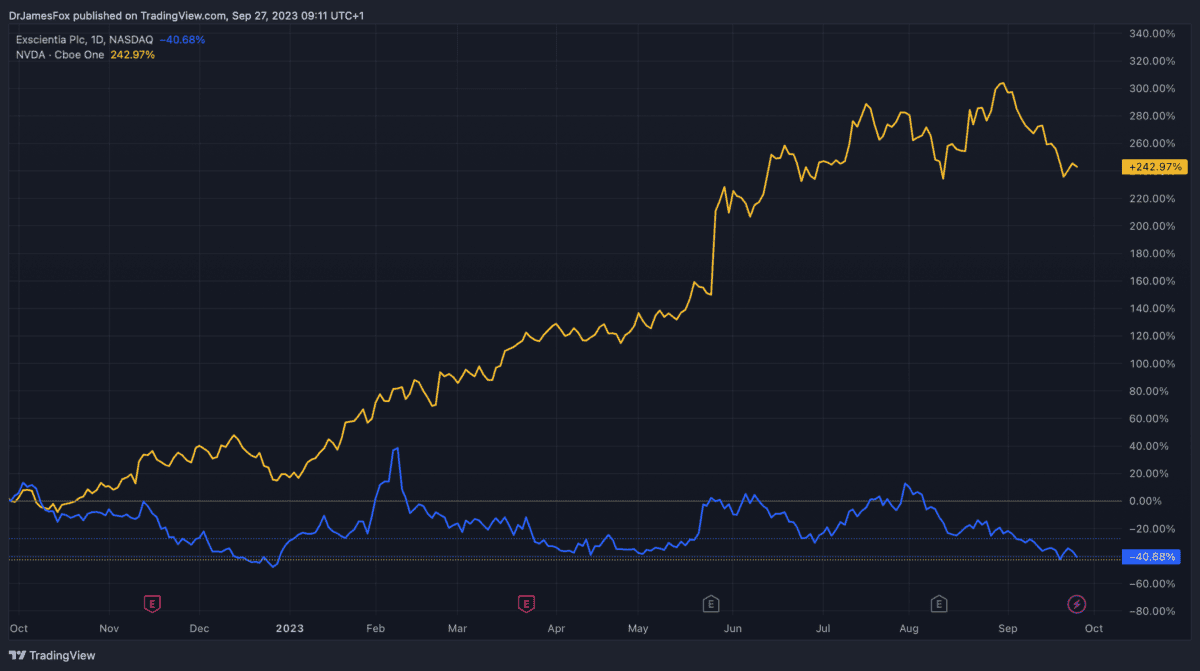

While Nvidia shares have surged this year, Exscientia shares have tanked. So are Exscientia shares primed to turnaround?

While investing in biopharma stock without a marketable product is always speculative, there are positive indicators here. The partnership with Merck will deliver $20m in cash upfront and up to $674m if all three programmes are success. That’s greater than Exscientia’s market cap.

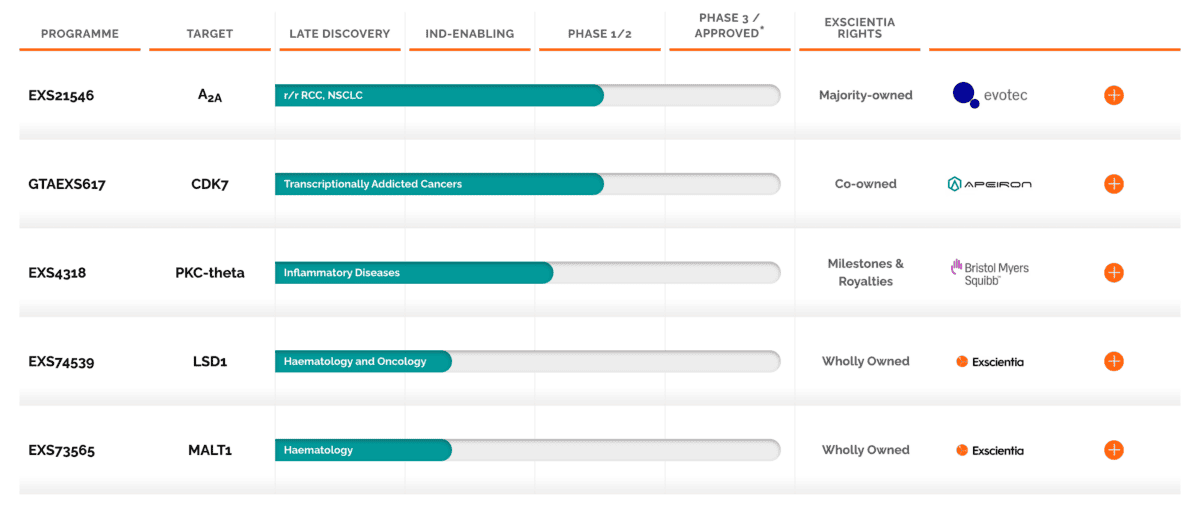

Equally, there have been several positives in pipeline development.

However, with the prevailing investor sentiment souring, it may require a big announcement to turn the share price around. After all, it’s not like the company is going to have a saleable product in the near term.

Despite sizeable R&D expenses and an increasing headcount, the financial position appears sound. Nonetheless, investors should keep an eye on the burn rate after net operating cash outflows increased to $53.7m in Q1.

The company had $553.3m in cash at the end of the last quarter. This suggests an enterprise value of only $70m. I think this hugely discounts the value of its pipeline so my outlook on Exscientia is positive. It’s clear that the industry has a lot of interest in the firm’s operations — always a good sign.

Moreover, Exscientia continues to innovate, and appears to have the cash on hand to sustain it medium term.

It would be a speculative investment for me, but should its AI prove a winner in drug development, it could surge. Nonetheless, I’m wary there could be more downward movement in the share price before any uptick.