Lloyds (LSE:LLOY) shares today trade at a fraction of where they were before the 2008 financial crash. The stock is down around 90% from its peaks.

However, over the past two years, shares in the banking giant are pretty much flat. So if I had invested £10,000 in Lloyds shares two years ago, today I’d still have around £10,000, plus dividends.

Thankfully, given the above-average dividend yield, and increases in payments over the two years, I would have received around £800. So we’re looking at an annualised yield of 4%. That’s not great, but the FTSE 100 index has performed poorly too.

Bad debt crisis?

The decline in the Lloyds share price has been driven by concerns regarding the bank’s potential exposure to a significant rise in impairment costs caused by higher interest rates, which could lead to a wave of loan defaults.

Under the bank’s worst-case scenario, Lloyds is projecting expected credit losses (ECL) to reach a substantial £10.1bn. This amount represents around 35% of Lloyds’ current market capitalisation.

As of 30 June, the severe downside scenario appeared to be twice as impactful as the probability-weighted scenario, which was considered the most likely at the time.

During this period, Lloyds emphasised that even a slight change in interest rates could significantly impact ECL. A mere 10 basis point increase was estimated to result in a £226m ECL rise, while a 10 basis point decrease could potentially lead to a £366m increase in ECL.

These factors have added to the market’s concerns and contributed to the decline in the Lloyds share price.

Worst case avoided

However, it appears likely that the worst-case scenario has now been avoided, especially with the Bank of England halting its monetary tightening cycle. For now, this appears to have released some downward pressure on the bank, with the share price pushing up 6% over one month. Nonetheless, with Monetary Policy Committee electing to keep interest rates at 5.25%, some risks remain.

The Goldilocks zone

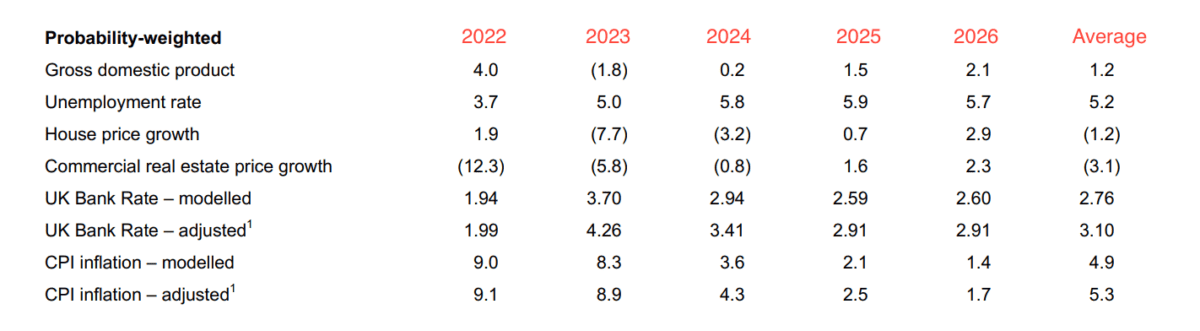

I’ve been saying this for a while, but I foresee very attractive conditions for banks in the medium term. Taking the bank’s probability-weighted forecast below, we can see that interest rates will likely moderate while economic growth is expected to stabilise.

Interest rates ranging from 2-3% are often considered a favourable ‘Goldilocks zone’ for banks. In this range, impairment charges are expected to decline, while net interest income remains robust. Banks, being cyclical stocks, typically thrive in a healthy economic environment.

This environment allows banks to navigate with lower risks of loan defaults, resulting in reduced impairment charges. Simultaneously, they can continue to benefit from elevated net interest income, which contributes to their overall financial strength.

Additionally, banks tend to perform more optimally during periods of economic prosperity, as a thriving economy often leads to increased lending activity and improved financial results for these financial institutions.

Moreover, valuation remains central to my investment thesis. Lloyds trades at just 5.8 times earnings and 0.72 times book value.