The London Stock Exchange is packed with brilliant bargains following market volatility in 2023. So I’ve been searching the FTSE 100 and FTSE 250 for stocks that could boost my passive income.

These UK shares offer dividend yields well above the Footsie forward average of 3.8% for next year. If City forecasts prove correct, I’d make a second income of £1,310 if I invested £20,000 evenly across both.

Here’s why I think they could be excellent sources of dividend income for years to come.

Target Healthcare REIT

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

News of dividend reductions tends to send a chill down the spine of investors. Earlier this year Target Healthcare REIT (LSE:THRL) shocked the market when it announced plans to rebase its annual dividend to 5.6p per share.

But revisions to a payout policy aren’t always a bad thing. In the case of FTSE 250-quoted Target, it gives the company — which owns and operates 97 care home facilities — a better chance to grow its portfolio.

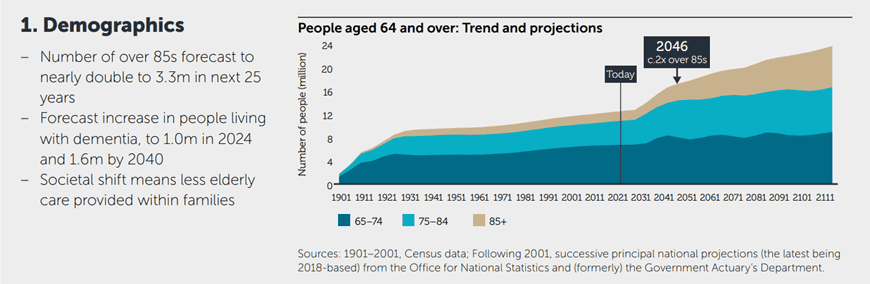

I think this real estate investment trust (or REIT) is a great way to capitalise on Britain’s soaring elderly population. As life expectancies increase and the number of people needing social care rises, the care home sector is tipped to grow strongly, as the chart below shows.

I also like the peace of mind that it provides me as an investor. Its tenants are tied down on extra-long-term contracts (its average unexpired lease term stands at 26.5 years). Its properties are also let out to 32 different clients, cutting the risk of rent collection problems.

Under REIT regulations, Target has to pay at least 90% of annual rental income out in the form of dividends. This explains why the company carries a healthy 7.4% dividend yield for this financial year (to June 2024).

Nursing staff shortages could hamper the firm’s performance. But on balance I still expect earnings (and therefore dividends) here to grow strongly.

WPP

The global advertising sector is plagued with uncertainty going into 2024. Agencies like WPP (LSE:WPP) may continue to struggle if tough economic conditions persist and companies cut back on spending.

However, I’m still expecting this FTSE 100 company to pay the huge dividends City analysts are currently expecting. Firstly, predicted payouts for next year are covered 2.4 times over by anticipated earnings. This provides a wide margin of safety.

WPP also has a strong balance sheet it can fall back on to help it meet dividend forecasts if needed. Its net debt to EBITDA sat within target at 1.68 times as of June.

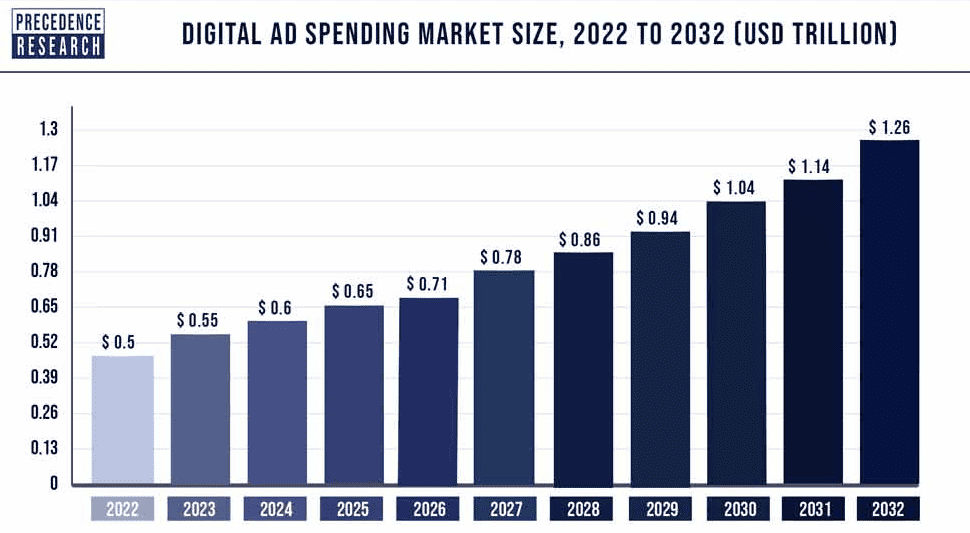

I think this 5.7%-yielding share could be a great way to generate long-term passive income. The company is spending huge sums on digital advertising, a sector that’s tipped to explode over the next decade as the technological revolution rolls on. This is illustrated in the chart above.

I’m also confident in WPP because of its broad geographic footprint. This gives it excellent exposure to fast-growing emerging economies which it’s likely to keep building through further acquisitions.