UK shares are currently trading at their biggest discounts to global peers in over a decade. As a result, investors may have an extremely rare opportunity to capitalise on undervalued stocks before the next bull run in the stock market.

Are UK shares on a discount?

According to Goldman Sachs, UK shares are currently trading at a massive discount. Data from the investment bank shows that, on average, British stocks are trading at a 45% discount compared to their US peers. Even after adjusting for differences in sector composition between the two markets, the discount remains an enormous 30%. This is the largest gap since the early 1990s.

Nonetheless, there are several factors to help explain why this is the case. These include Brexit, a strong US dollar, and pervasive investor scepticism regarding the growth prospects for Britain. However, with valuations now at such extreme lows, a substantial amount of negativity appears to already be priced in. This sets up a significant amount of room for UK-based stocks to rise in value once sentiment begins to improve.

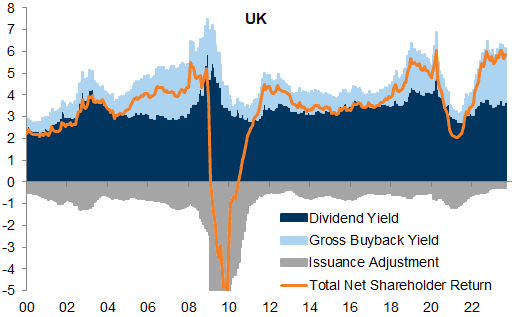

More lucratively, UK companies are famous for their dividends and stock buybacks. Goldman Sachs projects the total shareholder yield from UK shares now sits at around 6% currently. Thus, this presents investors with an opportunity to earn ample passive income while waiting for eventual capital gains.

Early signs of life?

Recent fund flow data reveals early signs of renewed investor interest in UK shares after years of negative sentiment. According to Bank of America, last week UK equity funds experienced the largest inflow in an entire year. While the flows were driven by passive index-tracking funds rather than active stock-picking strategies, it still suggests that the extreme pessimism the UK stock market has suffered may be potentially starting to shift.

More promisingly, surveys show that global fund managers remain heavily underweight in UK shares. This means that there’s still a substantial amount of money remaining on the sidelines. This could change as fund managers begin rotating into the UK market if the economy and geopolitical backdrop show meaningful improvements. More crucially, this could boost the share prices of many FTSE 100 names.

A generational opportunity?

That said, successfully capitalising on this opportunity will require proper timing and patience. By most accounts, a peak in interest rates accompanied by a sustained decline in volatility is likely needed before UK shares can mount a durable breakout into a new bull market.

Additionally, there’s still a threat of a UK recession along with ongoing geopolitical tensions. This could delay or derail the stock market’s recovery. But beyond that, structural issues in the country remain. Issues like weak productivity may continue capping the potential for domestically-oriented UK companies.

Even so, investors still have a rare opportunity today to buy top-quality UK shares at historically low prices. This could potentially set up the prospect of strong multi-year returns.

Therefore, investors with long time horizons and the temperament to pound-cost average could gradually accumulate UK shares at today’s levels and generate handsome rewards over the next decade. Still, patience and discipline will be required in order to realise the potential of this once-in-a-decade opportunity.