Investing in stocks is one way to generate a second income. Instead of venturing into buy-to-let or seeking additional employment, I find that generating a second income from stock investments can be both time-efficient and financially advantageous.

How it works

While £20k might sound like a lot of money, it’s not enough to generate a life-changing amount of passive income.

In the current market, I could look to safely generate around 6% in dividends annually, and this could be complemented by some share price growth.

For example, if I invest in Lloyds today, I could see 5.8% returns in the form of dividends, and I’d actually hope for something similar in the form of share price growth. The stock appears very discounted at the moment.

However, in terms of dividends, I could only realistically generate £1,200 annually from an initial £20,000. That’s not huge.

Compounding

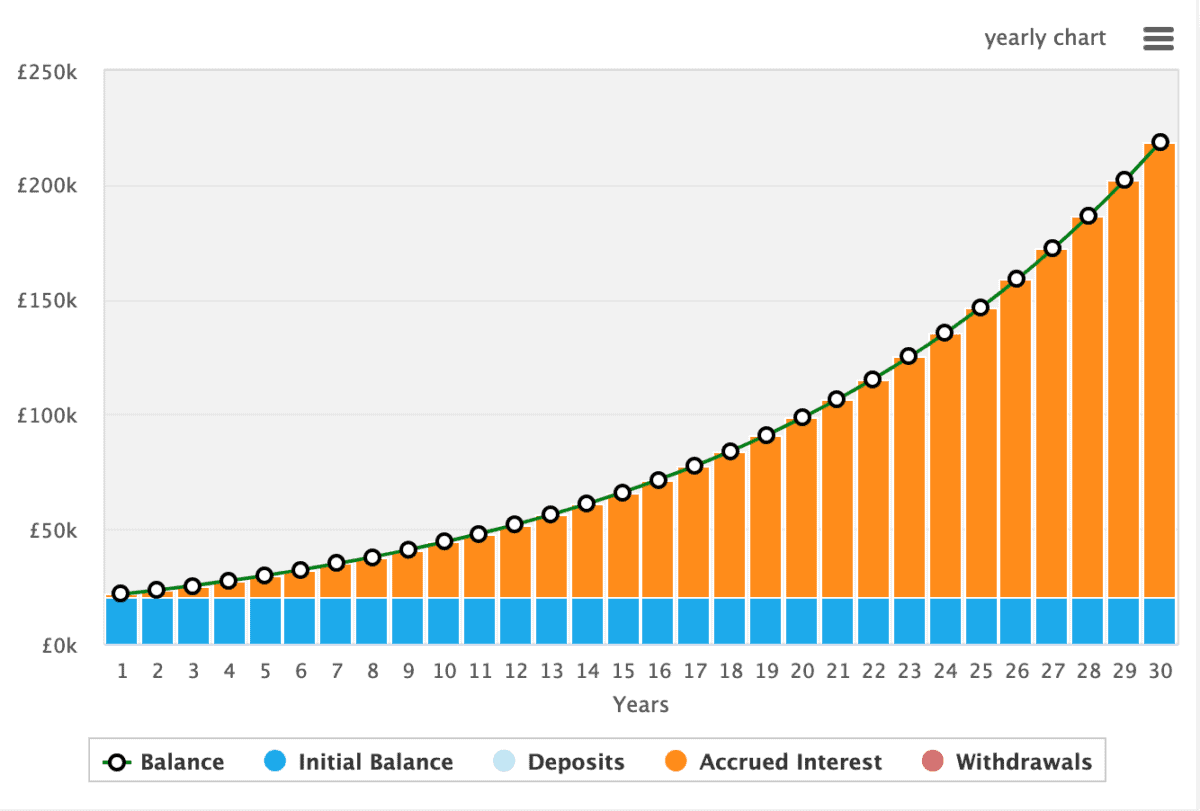

As such, I may want to consider reinvesting my returns every year to benefit from something called compounding. Essentially, this process leads to exponential returns as I’ll start earnings interest on my interest as well as my initial investment.

For example, if I start with £20,000 and assume each year I average an 8% return — this includes share price growth and dividends — after 30 years of reinvestment I’d have £218,000.

After 30 years, my pot would also be big enough to generate £16k a year in passive income. Of course, I could stop earlier and take my dividends. In fact, there are many variables, but this is how it works.

Where I put my money

While this is a time-tested strategy, and the maths adds up, if I pick my stocks poorly, I could lose money. And that’s the last thing I want to do. So where am I putting my money?

Meta: I’m not investing in Meta for its dividend yield, but it’s continued growth prospects and its ability to drive my portfolio forward. Recent optimism stems from the remarkable success of Threads, which has swiftly become the fastest-growing app in history. Since its launch on 5 July, the app has garnered an estimated 125m users. With ongoing expansion, analysts predict that the app has the potential to yield as much as $3bn in revenue by 2024. However, a global recession could be a threat.

Barclays: This isn’t the most exciting stock, but it’s hugely oversold. The bank currently trades with a 58% discount to its tangible net asset value and offers investors a 4.8% dividend yield. There are risks that we may see a slew of defaults in the UK, but these concerns appear to be falling as the Bank of England seems unlikely to keep pumping interest rates.

Hargreaves Lansdown: It offers a 5.3% dividend yield and could be about to surprise the market with its results on 19 September. The investment platform has seen investor activity fall since the pandemic, but it should be getting a huge tailwind in the form of net interest income.