Like many of its other AI peers, the Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) share price has risen admirably this year. If AI-related advancements pave the way to improved productivity and profitability, Alphabet stock could be much higher in a year’s time.

Competitive edge

The stock has seen impressive gains this year, rising over 50% as the tech giant’s advancements in AI have played a major role in propelling it higher.

Additionally, the company has recently made several further key AI announcements related to its Google Cloud and Workspace platforms. The firm unveiled new offerings like Duet AI in Workspace. This provides AI assistance for tasks like summarising documents and improving video meeting quality.

Alphabet is also pricing Duet AI at $30 per user per month. This undercuts Microsoft‘s competing product, Microsoft 365 Copilot. This should give the Mountain View-based group even more leverage as the competition between the two tech giants continues. Hence, it’s no surprise that Alphabet has outperformed Microsoft shares this year. After all, Duet AI’s capabilities are expected to increase the adoption of Google’s cloud services, which has reached an impressive $32bn revenue run rate.

Artificial gains or here to stay?

With its big run-up this year, the important question now is whether the stock can maintain its stellar momentum. I think the answer lies in between these two extremes as there are reasons for both optimism and caution.

On the positive side, Alphabet appears well-positioned to capitalise on the booming demand for both enterprise and generative AI. The new AI products build on Google’s existing strengths in areas like natural language processing. As companies across sectors ramp up investments in AI, Alphabet’s Google Cloud platform stands ready to provide the infrastructure and tools they need.

Nonetheless, there are challenges that could slow the ascent of the stock as well. For one, competitors like Microsoft and Amazon won’t cede ground easily in the cloud services market. Microsoft is aggressively integrating AI into offerings like Teams, while Amazon’s AWS boasts a strong client base. As such, taking market share from these rivals will be difficult.

Even so, with its technology leadership and extensive resources, Alphabet’s shares seem poised to maintain strong growth. But expecting the stock to continue rising 50% annually seems unrealistic. Therefore, moderating gains to the order of 10-20% per year appears more likely from here on out.

Can it continue growing?

For long-term investors, Alphabet remains appealing, especially when the shares experience a pullback. The conglomerate dominates the online advertising and search industry after all. It’s also a cash cow that provides fuel for investing in emerging areas like cloud and AI.

For those reasons, Alphabet’s push into enterprise AI comes at an opportune time, allowing it to expand its cloud business dramatically. If it maintains momentum, Alphabet’s growth story could still have plenty of room to run.

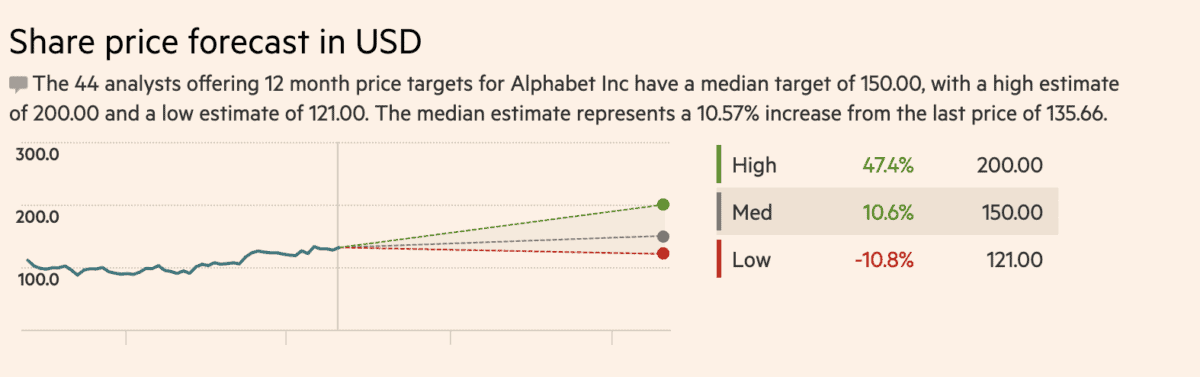

With the shares trading at a forward price-to-earnings (P/E) ratio of 22.2, the stock trades at a value below its historical average P/E of 30.3. And despite its rapid rise this year, the shares still have room to grow. In fact, analysts see the stock reaching $150 per share in a year’s time.