We can earn a second income in many ways. Many of us, when we’re young, look for second jobs to bolster our incomes. Many Britons have also invested in buy-to-let properties in recent years, benefitting from rental income as well as property appreciation.

However, personally, I believe investing in stocks and shares is the most time-efficient and potentially financially rewarding method. It’s also more democratised with very low barriers to entry.

Generating income from investments

Generating income from investing can be easy. However, it’s worth recognising that all stocks return value to their shareholders in different ways.

Some companies won’t pay their shareholders a dividend, but will reinvest in the company or engage in buybacks. Both of these methods can positively influence the share price.

If I’m investing for passive income in the near term, I need to look at dividend stocks.

For example, if I were lucky enough to have £20k in an ISA — equivalent to the maximum annual input — I could invest in a stock paying a 6% dividend yield, and earn £1,200 a year in passive income.

Having said this, it would pay me to spread the risk and invest in a handful of companies paying dividends. The average dividend yield among the 100 largest companies listed in the UK — the FTSE 100 — is around 3.8%, while the largest yield is near 10%.

Compounding

Maybe we’re not happy with just £1,200 a year in passive income. An extra £100 a year could certainly help, but it’s not life-changing for most people.

Instead, we can look to try and grow our initial pot. We can do this using time and compound returns. Compound returns is a strategy that involves reinvesting our returns year after year.

It might not sound game-changing, but it really can be. It means our portfolios can grow exponentially because we’ll be earning interest on our interest as well as our initial capital.

We can also enhance the pace of growth through disciplined regular savings contributions — ideally monthly.

The maths

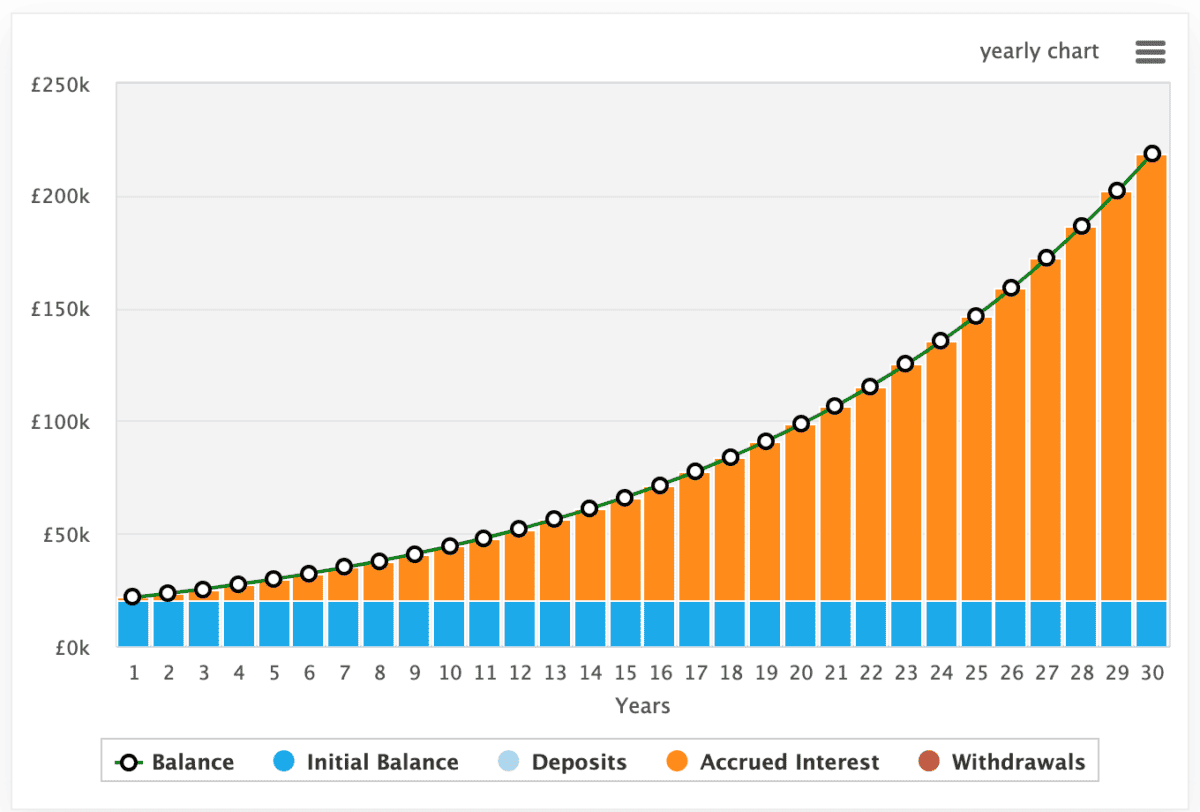

Firstly, here’s how £20k could compound over 30 years when actualising an annualised return of 8%. At the end of the period, the investment is worth £218,700 and is generating £16,700 a year, which could be taken as passive income.

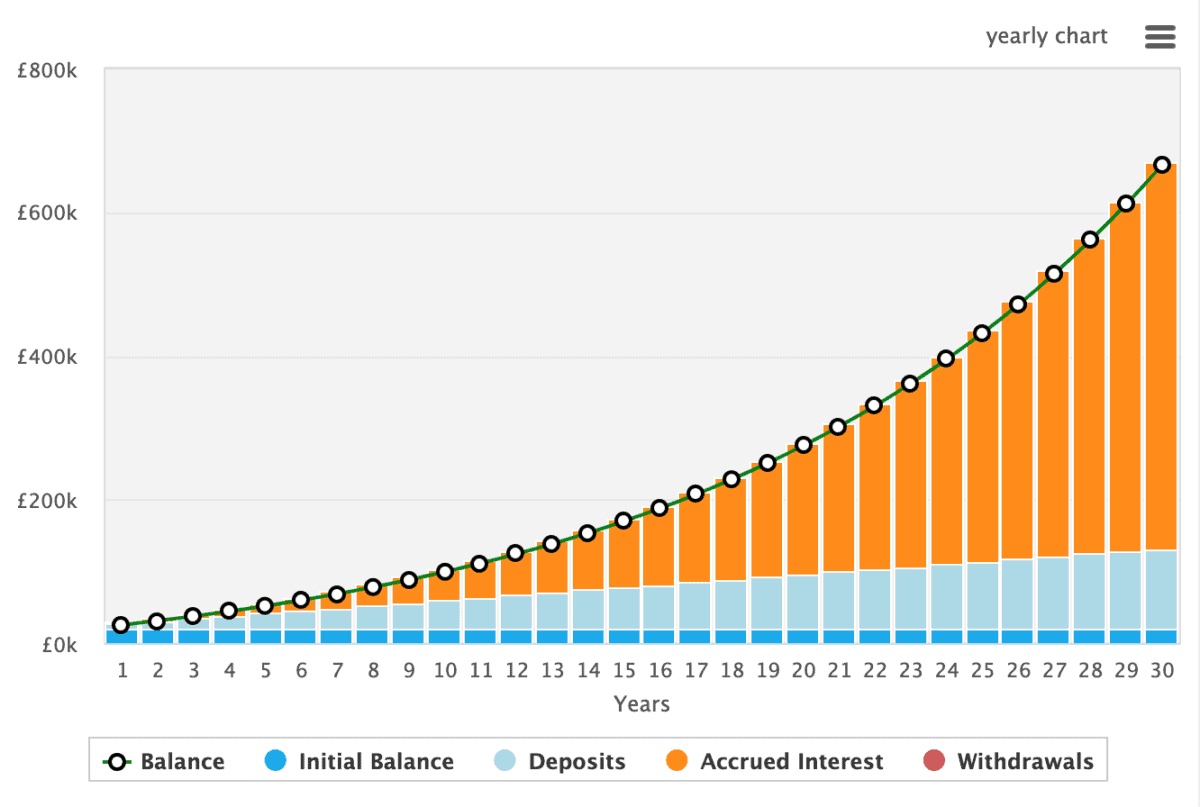

This highlights the impact of compound returns, but the equation changes completely when we include a monthly contribution. In the below graph, I’ve assumed a monthly contribution of £300.

At the end of the period, the investment would be worth £665,700 and would be generating returns worth £50k a year. This highlights how impactful monthly savings can be.

Now for the not so fun part. While 8% is very achievable, and seasoned investors can look for low double-digit annual returns, it must be noted that if I choose the stocks poorly, I could lose money. Thus, research is incredibly important.

Finally, it’d pay me to use the Stocks & Shares ISA. That’s because it allows me to earn dividends and benefit from capital gains without paying tax.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.