With most FTSE companies done reporting their interim and quarterly results, a number of stocks have declined in value. While this doesn’t bode well for the short term, long-term investors could see an opportunity to bag a bargain. So, here are three dirt-cheap shares to look at buying in September.

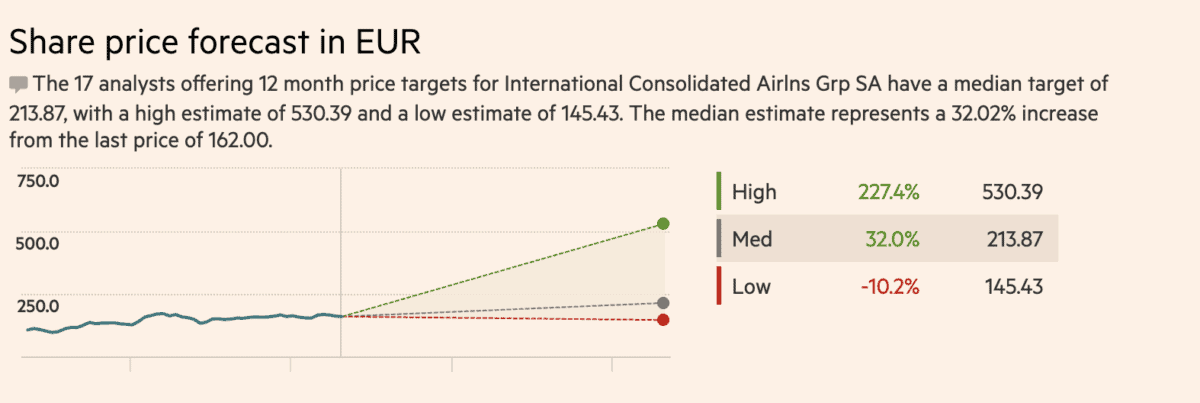

1. Lloyds

Lloyds (LSE:LLOY) shares sank after its latest results missed estimates slightly. Nonetheless, this was expected given the bank’s prior warning about lower income in Q2. While headline figures disappointed, the board actually upgraded its full-year guidance. The lender now sees net interest margin for the year coming in above 3.10%, from the initial 3.05% guidance, with a return on tangible equity (RoTE) of over 14%.

Provided the bank meets its estimates, Lloyds shares are trading at an extremely cheap forward price-to-earnings (P/E) ratio of 5.7.

Pessimists will point to contracting margins and slowing loan growth, but Lloyds is well-prepared for higher rates. Its affluent customer base is also largely insulated, and structural hedges should boost income by an additional £1.8bn in H2.

With the Lloyds share price trading well below its book value, the stock looks rather cheap. That said, investors ought to be wary that any surprises to inflationary data could push the stock down further.

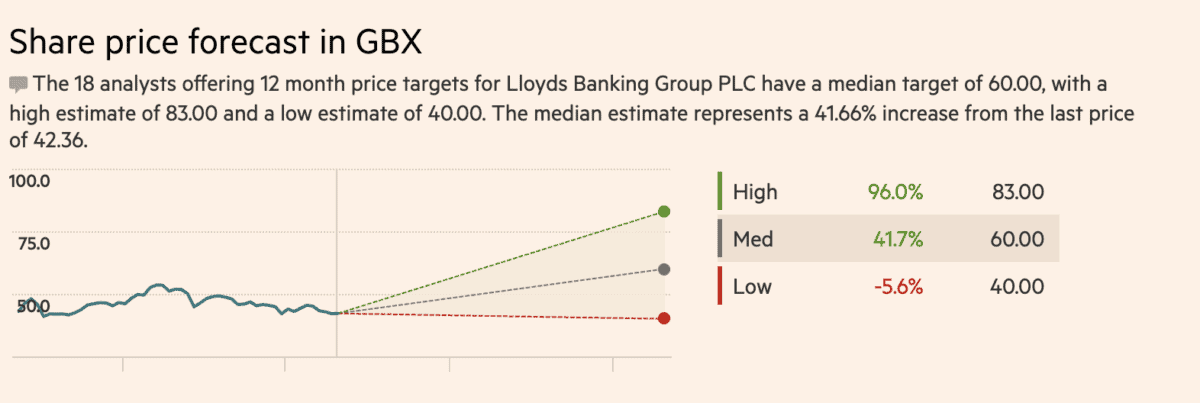

2. Barclays

Barclays (LSE:BARC) shares are also another cheap option. The stock retreated after the Blue Eagle Bank downgraded its UK net interest margin outlook to 3.15% from 3.20%. However, it’s worth noting that the downgrade is more reflective of deposits shifting towards lower-margin accounts, rather than any asset quality concerns. And although impairment charges rose in Q2, it remains comfortably below estimates.

While the economic environment is undoubtedly challenging, Barclays should benefit when rates settle into the 2%-3% “Goldilocks” zone. This is when rates aren’t too high to trigger higher defaults, but not too low that the firm doesn’t make any income.

But with Barclays shares trading at just five times earnings, it’s arguably cheap. In fact, several analysts have gone as far as to argue that Barclays shares are oversold. With a recovery in investment banking and lower costs on the horizon, the stock could shoot up in the medium to long term.

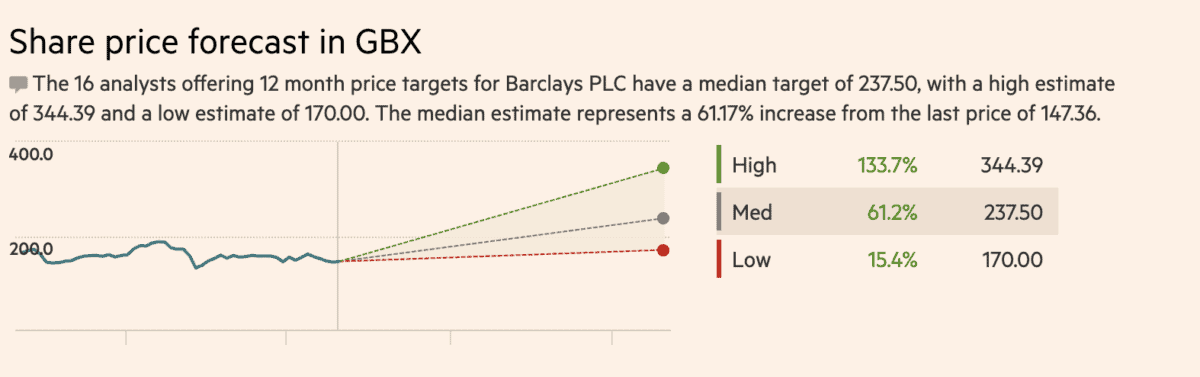

3. IAG

The IAG (LSE:IAG) share price remains depressed, down 75% over five years. But with a price-to-earnings (P/E) ratio of 4.6, the shares are looking extremely cheap for what looks to be a FTSE 100 growth stock. Operating profit beat expectations by a whopping 40% and leisure travel demand continues to roar back.

Improving cost guidance and additional aircraft deliveries also paint an upbeat picture. This should see British Airways continue to ramp up its capacity. Having said that, it’s also the only one among its constituents to still lag behind its 2019 capacity. This could continue being a drag on profits.

Nevertheless, the consortium’s debt position continues to improve. Net debt to adjusted EBITDA is now only at 1.5 times, which is certainly encouraging. While risks do remain, the fact that IAG shares trade at just 5.4 times its forward earnings shows that it’s far cheaper than many of its FTSE peers. Thus, IAG stock could offer substantial growth for investors’ portfolios as the aviation recovery continues to rise in altitude.