BP (LSE:BP) shares have remained relatively flat this summer, with a buyback policy making up for an earnings disappointment. In terms of performance, BP has largely been performing in line with other oil supermajors. However, its valuation indicates a significant discount. Let’s explore.

Performance

BP reported a significant earnings miss on August 1. Profit for the quarter came in at £1.8bn, down from $8.2bn in the first quarter. The earnings per share followed suit, experiencing a notable descent from $27.74 to $14.77.

However, this wasn’t hugely surprising. BP was the last of the supermajors to report earnings. ExxonMobil and Shell noted profits falling by 56%, while TotalEnergies said earnings fell by 49%.

Falling earnings across the sector reflected softening demand for hydrocarbons products and narrowing margins across the value chain. During the quarter oil prices fell 10% and natural gas prices by almost 30%.

Of course, this highlights a risk of investing in BP, as well as its peers. And if the environment deteriorates, and energy prices fall, the stocks could tumble.

Dividends and buybacks

In its recent earnings report, BP announced a plan to repurchase $1.5bn worth of shares before the Q3 results announcement later this year. This amounts to about 1.4% of the shares that were available at the time of the announcement. Notably, BP has reduced the number of its shares by 8.4% over the past 10 years, a pivotal aspect of its investment strategy.

BP’s dividend yield stands at 4.12%, which is higher than the average for the index. This dividend is also quite dependable. The company has only cut it twice in the last 15 years. The first time was after the Deepwater Horizon oil spill, when BP had to pay fines. The second time was during the pandemic. Additionally, its coverage ratio is 4.24 times, indicating that, based on previous earnings at least, the dividend seems sustainable.

Valuation

BP has historically had the lowest gross profit margin of the supermajors, standing at 30.7% at the end of Q1. This may not be the case for long, however. BP highlighted in its Q2 report that the acquisition of TravelCenters of America – a deal that will add a network of 288 sites located on US highways – should almost double its global convenience gross margin.

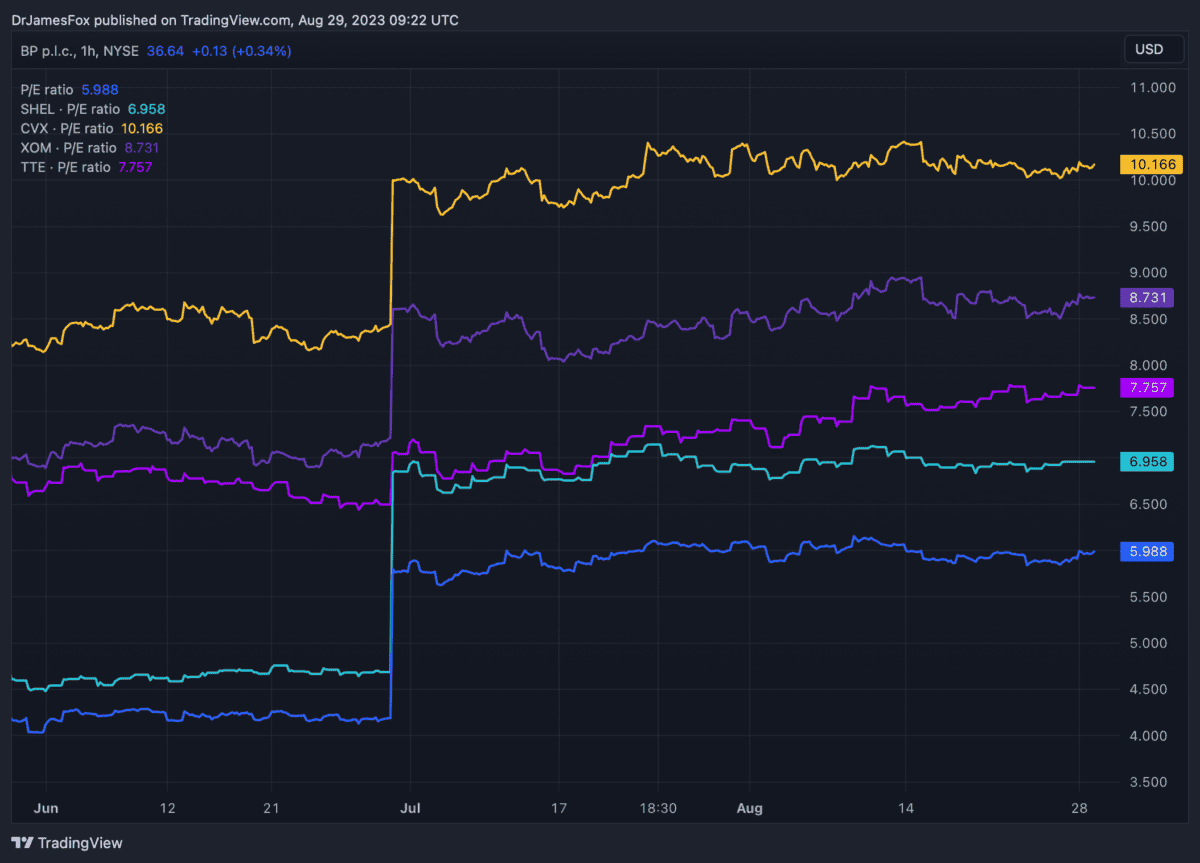

However, more importantly, when we look at valuation metrics, BP retains a significant discount. At present, BP’s P/E stands at 5.9, with a forward P/E of 6.5 based on projected earnings for the year.

As we can see in the chart below, this represents a significant discount versus peers. It’s also a discount versus BP’s five-year average P/E of 8.3.

We can see that Shell is the closest company by valuation, and this highlights the discount afforded to UK stocks. But we also know that debt is another reason for the relatively low valuation.

BP’s debt-to-equity ratio is around 0.59 – Exxon 0.2, Chevron 0.14, and Shell 0.44. In turn this is a drag on profitably. However, it’s evident that this does not fully account for the discount. As such, BP appears undervalued.