I’m searching for the best value stocks to buy next month. Are these UK and US shares too cheap to miss?

Up and down

Aerospace giant RTX Corporation (NYSE:RTX) is a US stock I have my eye on today. City analysts expect earnings here to rise 41% in 2023. This leaves the company trading on a price-to-earnings growth (PEG) ratio of just 0.4.

A reminder that any reading below 1 indicates a share is potentially undervalued.

RTX — which last month changed its name from Raytheon Technologies — has been giving investors plenty to chew over lately. It recently upgraded full-year sales expectations following a strong second-quarter result. But its share price has tanked following news that free cash flow will come in $500m lower than forecast, at $4.3bn.

This is due to problems with its Pratt & Whitney plane engines. A powder metal issue means that it may have to inspect as many as 1,200 engines earlier than expected, putting huge pressure on cash flows.

Reward and risk

Plane engines are complex pieces of hardware with many thousands of parts. So dangers like this are a constant threat to profits. Yet the long-term picture remains extremely bright for the company.

Defence budgets — which struck record peaks of $2.24bn in 2022, according to the Stockholm International Peace Research Institute — look set to keep rising as tension over the geopolitical landscape rises.

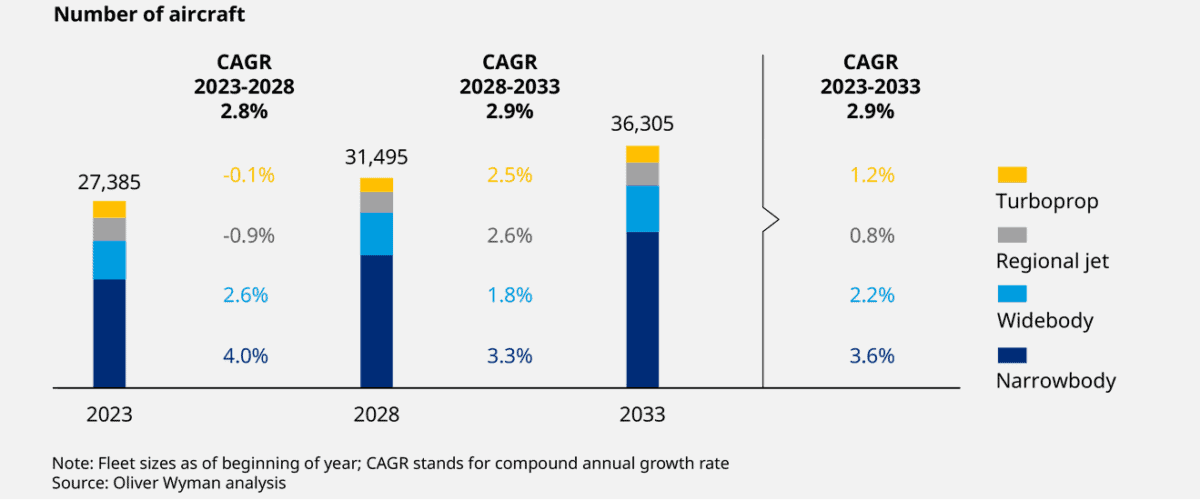

Commercial demand for its Pratt & Whitney engines should also surge as plane-building activity steps higher. As the chart below shows, consulting firm Oliver Wyman expects the civil aviation fleet to rise 33% over the next decade.

That said, I’m not prepared to buy RTX shares for my portfolio just yet. The company’s net debt is approaching $30bn, a worrying level for me given uncertainty over the extent of those engine problems and the potential impact this could have on cash flows this year and beyond.

I won’t buy the US stock before I see an update on the issues at Pratt & Whitney. But I’ll be keeping an eye on what happens with a view to buying some cheap shares.

A better buy

I’d rather use any cash I have to pick up some shares in Chemring Group (LSE:CHG). Right now it trades on a forward price-to-earnings (P/E) ratio of just 15.2 times. This is well below a defence sector average of 21.6 times.

Like RTX, the business is in a strong position to capitalise on rising weapons spending. It’s the world’s leading provider of countermeasure technology (with a market share above 50%). It also makes sensors, explosives, and is an expert in electronic warfare and cyber security.

In fact business is already booming. The FTSE 250 firm enjoyed £338.2m worth of orders between October and April, up 81% year on year. Consequently its order book sits at its highest level for 10 years, at £749.5m.

The chance of product failure can spell huge trouble for companies like this. But encouragingly, Chemring has an excellent track record of product delivery and performance. I think it could be a great addition to my shares portfolio next month.