Rising interest rates are a double-edged sword for banks. It’s why the Lloyds Banking Group (LSE:LLOY) share price has dropped 9% since the beginning of 2023.

Higher rates boost the difference between the interest rates banks offer to savers and borrowers. However, Bank of England (BoE) policy tightening can also hit economic growth. In fact, 14 rate hikes since late 2021 have threatened to send the UK economy into a tailspin.

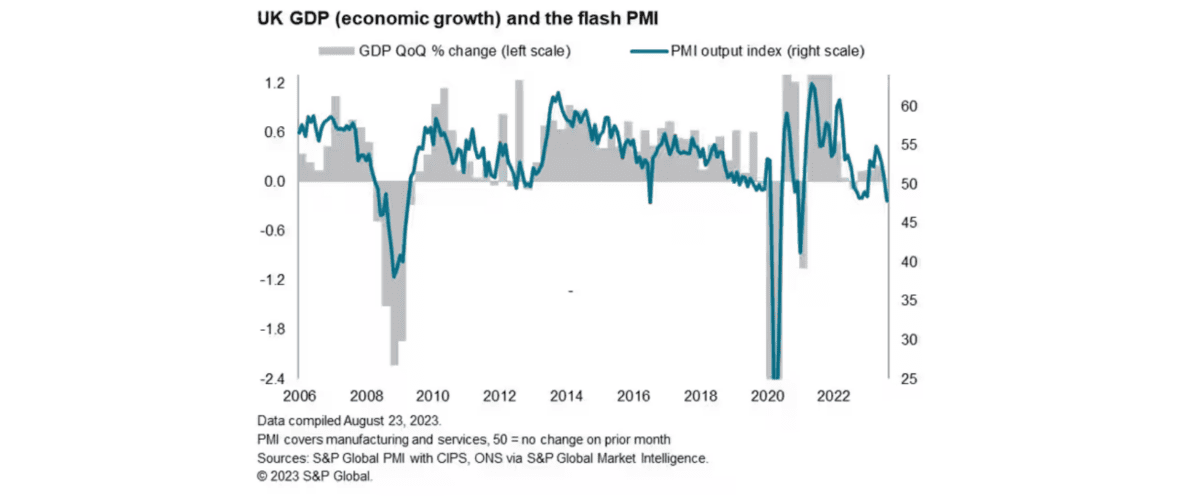

This was evident in latest S&P Global/CIPS UK Purchasing Managers’ Index data this week (shown in the chart above). Following the data, S&P chief business economist Chris Williamson said: “The fight against inflation appears to be carrying a heavy cost in terms of heightened recession risks.”

The index dropped back below the benchmark of 50 that separates expansion from contraction in August. In fact, at 47.8, it was the worst reading since the middle of 2020.

That led to Williamson adding that the numbers “signal a renewed contraction of the UK economy, as an increasingly severe manufacturing downturn is accompanied by a further faltering of the service sector’s spring revival.”

Good news, bad news

So the decision to buy Lloyds shares is — in the near term — a trade-off between the boost higher interest rates provide to the bank’s net interest margins (NIMs), and the carnage they bring in terms of lower revenues and greater loan impairments.

Since the BoE started raising rates things have largely been going well at Britain’s banks. Between January and June, Lloyds’ net income rose 11% year on year to £9.2bn, while profit leapt by almost a quarter to £3.9bn.

However, the bank’s update also revealed a sharp uptick in bad loans. Credit impairments soared 76% from the same 2022 period, to £662m.

The FTSE bank has already set aside a gigantic £2.2bn since the start of 2021 to cover bad loans. This is a worrying figure given that the worst is still to come for Britain’s economy. Signs of a possible housing market implosion are especially concerning for Britain’s largest home loan provider.

Cheap but risky

Many investors argue that this danger is now reflected in Lloyds’ low share price. Today, the firm trades on a forward price-to-earnings (P/E) ratio of 5.5 times.

But this low rating — nor the bank’s large 6.9% dividend yield — are enough to tempt me to invest. As well as those near-term dangers, the company faces extreme challenges to grow long term profits, including:

- Rising competition from digital banks, challenger banks and building societies

- Calls from the Financial Conduct Authority for banks to pay better savings rates

- Pressure to keep branches and ATMs open as the pushback against a cashless society grows

- Brexit-related threats the UK economy and the way the financial services industry operates

On balance, I’d rather buy other cheap FTSE 100 shares for my portfolio following recent market volatility.