For income investors, the reliability of the payout from dividend stocks is obviously paramount. So that means bigger isn’t always better when it comes to dividend yields. Often, a double-digit yield indicates that a dividend cut, or even suspension, might be on the cards.

Of course, a dividend cut isn’t the end of the world. Indeed, it’s to be expected for cyclical stocks in industries such as mining and construction. But it’s far from ideal as the market usually responds to a reduced dividend by marking down the share price too.

Here are three stocks with unspectacular yields, but whose payouts appear incredibly ‘safe’ to me.

FTSE 100 pick

First up is FTSE 100 defence giant BAE Systems (LSE: BA.). Following the dreadful invasion of Ukraine, and the wider geopolitical tensions in the world, demand for its products and services has skyrocketed. The company now boasts a record order backlog of £66.2bn.

This has enabled it to raise guidance for the current financial year. BAE now expects free cash flow of more than £1.8bn, which is £600m more than previously anticipated. It also just hiked the interim dividend by 11% to 11.5p.

In an additional show of financial strength, the firm has announced the £4.35bn acquisition of the aerospace division of Ball Corporation. But this sizeable takeover is the largest by any UK company this year, leaving some to worry about BAE’s debt shooting up.

However, while that adds an element of risk, I’m not concerned about the overall resilience of the dividend. It’s covered 2.1 times by expected earnings.

On a forward-looking basis, the dividend yield stands at a respectable 3.08%.

FTSE 250 stock

My second pick is Warhammer 40,000 creator Games Workshop (LSE: GAW). The miniature wargames company has a rich tradition of rewarding shareholders with rising cash payouts (including special dividends).

The firm funds its growth entirely from operating cash flow and only returns “truly surplus” cash to shareholders. It had a net cash position of £90.2m at the end of May.

Now, the company has recently managed to pass on inflationary costs to its customers. But further price increases are probably out of the question, at least in the short term. So high inflation remains a concern.

Looking forward though, a potentially lucrative licensing deal with Amazon to make Warhammer 40,000 films bodes well for future revenue and earnings growth. The dividend yield is 4%.

Nasdaq share

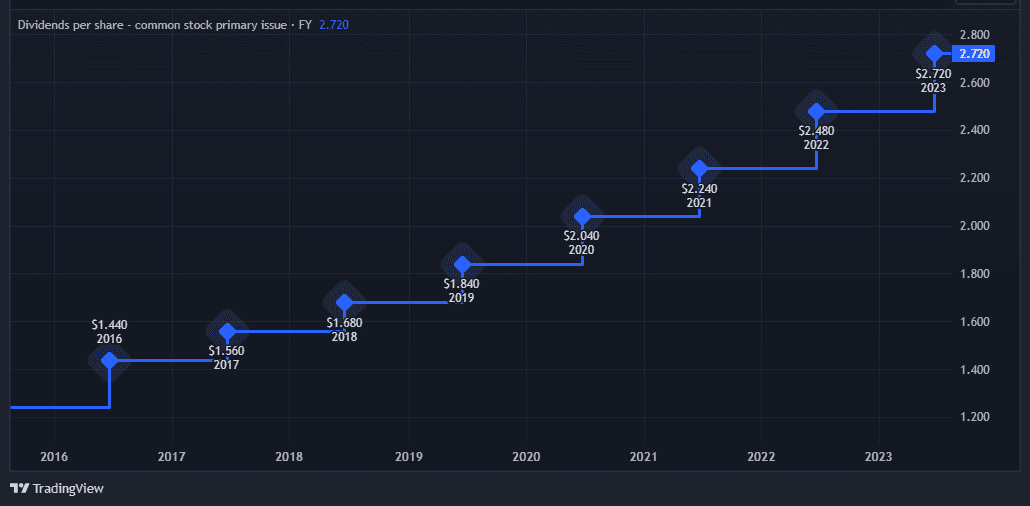

Microsoft (NASDAQ: MSFT) is generally considered a quality growth stock, but it has actually raised its dividend for 13 consecutive years now. In fact, the payout has grown by an average of 10% annually over the past few years.

The technology giant’s business model is powerful because it’s built on highly predictable recurring revenue. Subscription-based products include Microsoft 365 and Xbox Game Pass, as well as LinkedIn and various other services through its Azure cloud platform.

The company has a fortress-like balance sheet, with a net cash position of $64bn at end of June. And it has invested a cumulative $13bn in ChatGPT owner OpenAI to seed further growth.

The dividend yield is low at around 0.9%, which may put off some income investors. But I believe Microsoft will reliably be paying dividends far into the future.