Morgan Advanced Materials (LSE:MGAM) is an often overlooked FTSE 250 stock. However, it’s made headlines this year for the wrong reasons. That was after a cyber attack meant millions worth of damage and margin falls during the first half.

Despite this, the stock looks like great value. Currently, the stock trades at 7.5 times earnings, and 10 times forward earnings. This is a big discount versus the international industrials sector.

So let’s take a closer look at FTSE 250 stock.

What it does

Morgan Advanced Materials is a maker of specialist products that use carbon, advanced ceramics and composites. Its products find applications in various industries, including aerospace, defence, energy, healthcare, electronics, and industrial sectors. Those products are designed for demanding environments and provide critical functionalities in a series of future-proof industries.

A slower year, but better medium term

MGAM revised its guidance for 2023 down following the cyber attack. The company now expects revenue to be between £1.65bn and £1.75bn, from £1.75bn-£1.85bn previously. Profit before tax is also expected to range £120m-£130m, down from £130m-£140m previously.

“As previously announced, the cyber event we experienced at the start of the year has impacted sales, profitability and cash in the short term,” chief executive officer Pete Raby said in the H1 report.

Adjusted earnings per share fell 37.7% to 9.9p during the first half. But the FY guidance reflects revenue growth of 2-4%.

The compressed margins during the period aren’t expected to be sustained, with Barclays forecasting EBITDA margin to “to mid-teens and a new peak“.

Additionally, it’s worth noting that prominent clients of Morgan Advanced Materials, such as Airbus, Siemens energy, and Rolls-Royce, are currently benefiting from favourable market trends. This further contributes to the firm’s potential for an improved financial performance.

My belief is further supported by the firm’s position in end-user markets with high potential and price insensivity.

Valuation

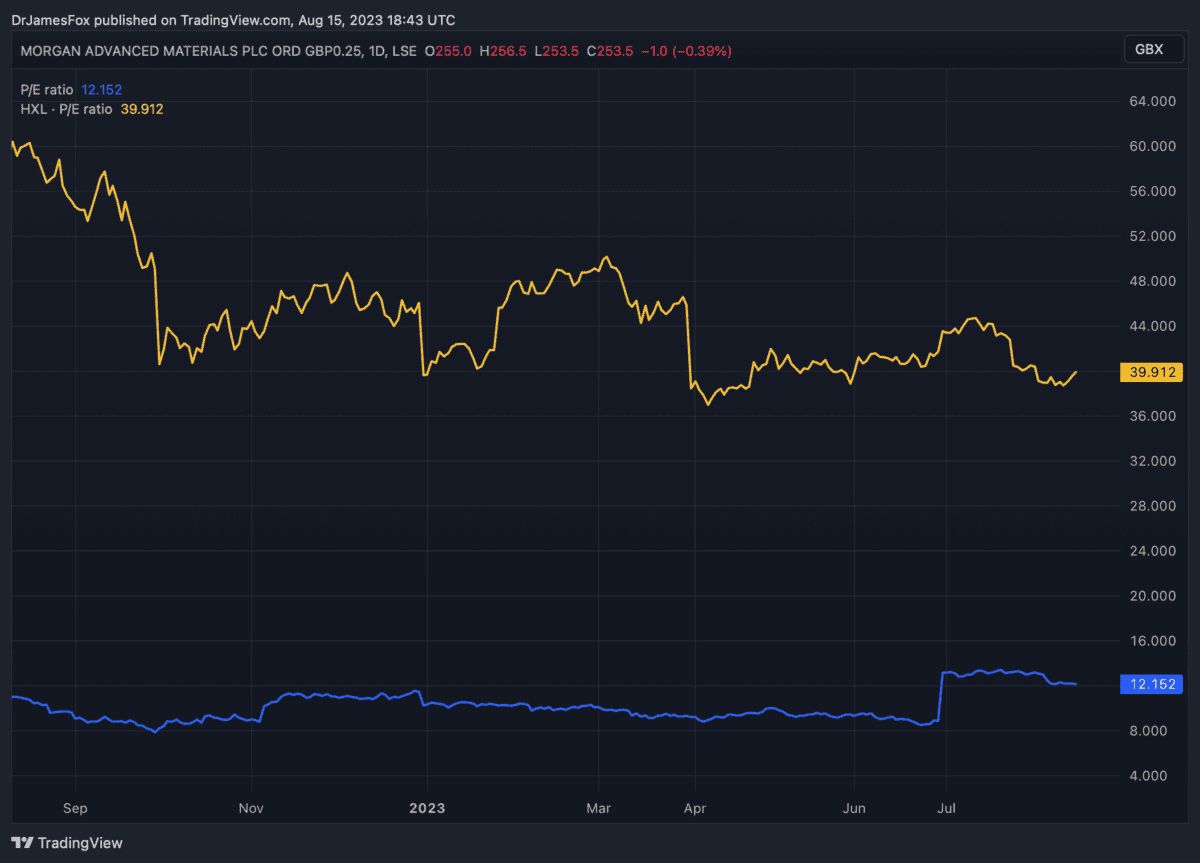

As noted, Morgan Advanced Materials trades at 7.5 times earnings. This puts it at a significant discount to the FTSE 250 and its sector. Industrials have an average price-to-earnings (P/E) of 20.2, meaning Morgan Advanced Materials has a 38.6% discount. Here’s how the FTSE 250 stock compares to US firm Hexcel Corporation on TTM non-adjusted P/E.

The chart shows us it trades at a sizeable discount to its US advanced materials peer. We can also see this discount when using the EV-to-EBITDA ratio.

So what’s the upside?

Of course, like any investment opportunities, there are limits. Investors will be concerned to see net debt doubling, up by 100.5% to £257.7m over the first half. This in part is due to speed up investment in IT infrastructure after the cyber attack.

However, this is particularly enticing investment opportunity — I’ve added it to my own portfolio. Notably, Barclays has established price target of 365p — a 35% upside. However, it’s worth recognising that various analysts see the potential for even more upside.

This outlook stems from the company’s entrenched presence in burgeoning markets and its role in delivering specialised products tailored to industry-specific demands.

I think this compelling positioning and its ability to capitalise on evolving market dynamics makes the investment very attractive.