I’m searching for the best FTSE 100 dividend stocks to buy for my portfolio today. And HSBC Holdings (LSE:HSBA) has appeared on my radar thanks to its enormous 5.76% forward-looking dividend yield.

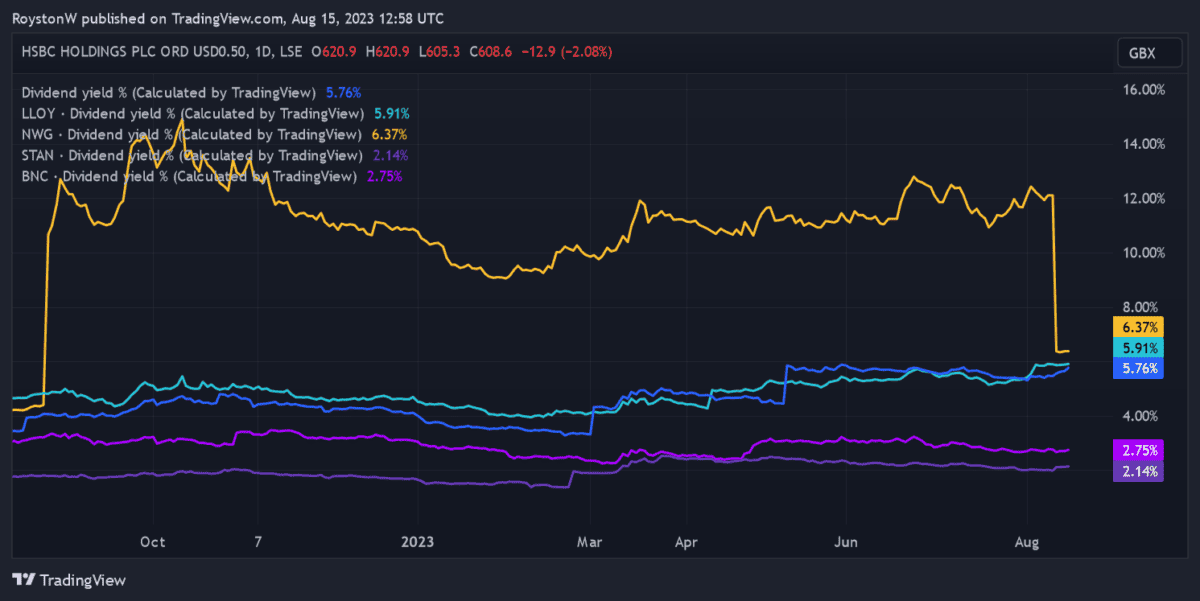

On the plus side, its dividend yield for this year is comfortably above a forward average of 3.7% for FTSE-listed shares. However, the yield on HSBC shares also trails those of some of Britain’s other major banks.

So what should I do to boost my passive income?

No to Lloyds and NatWest

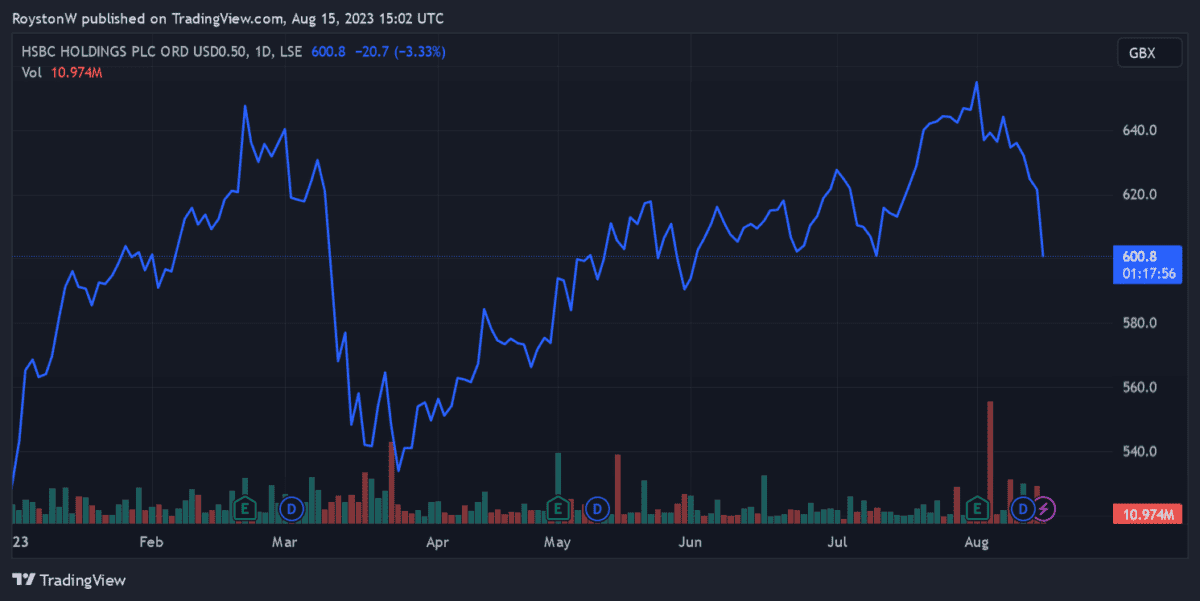

As the chart shows, HSBC’s dividend yield for 2023 has steadily increased during the course of the year. This comes despite the bank’s share price increasing 15% since 1 January, and suggests that City brokers have bumped up their dividend forecasts since the start of the year.

That said, the yield here still sits below that of some other FTSE 100 banks. It’s a good 0.6% lower than the forward yield over at NatWest Group. It’s also beaten by the yield at Lloyds Banking Group.

This doesn’t mean I’d prefer to buy these other banks for dividend income, though. And it’s not because I don’t believe these businesses will pay the dividends forecasters are expecting.

The Lloyds and NatWest share prices have sunk in 2023 due to the worsening economic outlook in the UK. There’s a good chance that they will continue plummeting too, even though extra interest rate rises are likely that will boost the banks’ net interest margins (NIMs).

Both firms have reported weak loan growth and soaring impairments in the first half of the year. The danger is that these problems could be here to stay.

Some economists believe that major structural problems like low productivity, new trade barriers and regional wealth indifferences will hamper the UK economy for much of the decade. The problem is that, unlike HSBC, neither has significant exposure to overseas markets to offset problems at home and drive earnings.

Yes to HSBC

In fact HSBC generates the lion’s share of its profits from fast-growing Asian territories. And it plans to pump billions of dollars into China, Hong Kong and Singapore to boost its market position, a strategy I’m confident should deliver excellent long-term earnings and dividend growth.

For this reason, I’d rather compare HSBC with other banks that have significant emerging markets exposure when deciding whether to buy.

Fellow FTSE 100 share Standard Chartered is one that has large Asian and African footprints. Banco Santander, meanwhile, has sprawling operations across Latin America and Eastern Europe.

As the chart shows, the dividend yield at HSBC for 2023 is more than twice the size of those of StanChart and Santander. This reflects the company’s decision to set a payout ratio of 50% for the next two years.

The bank looks in great shape to meet current dividend forecasts. Dividend cover for this year sits at a healthy two times. It also has a strong balance it can lean on (its CET1 capital ratio rose to 14.7% as of June).

Troubles in China’s property market will be worth keeping an eye on. But I believe that right now HSBC remains one of the most attractive FTSE 100 dividend stocks to buy today. I’ll be looking to add it to my own portfolio when I next have spare cash to invest.