In its Thursday update, Persimmon (LSE:PSN) announced its confidence in aligning with projected full-year profit expectations. This is despite challenges like elevated mortgage rates, the cessation of the Help-to-Buy program, and considerable market volatility.

During the half-year assessment, the homebuilder highlighted substantial resilience in its top-line growth, excluding bulk sales. It referred to its growth as “robust“. This was reinforced by the improvement in private average selling prices, which was complemented by effective cost-saving measures.

With this, the share price ticked upwards slightly. The stock is now trading at £11.60, down 37% year on year. So, with this broadly positive outlook, is this a buying opportunity?

Valuation

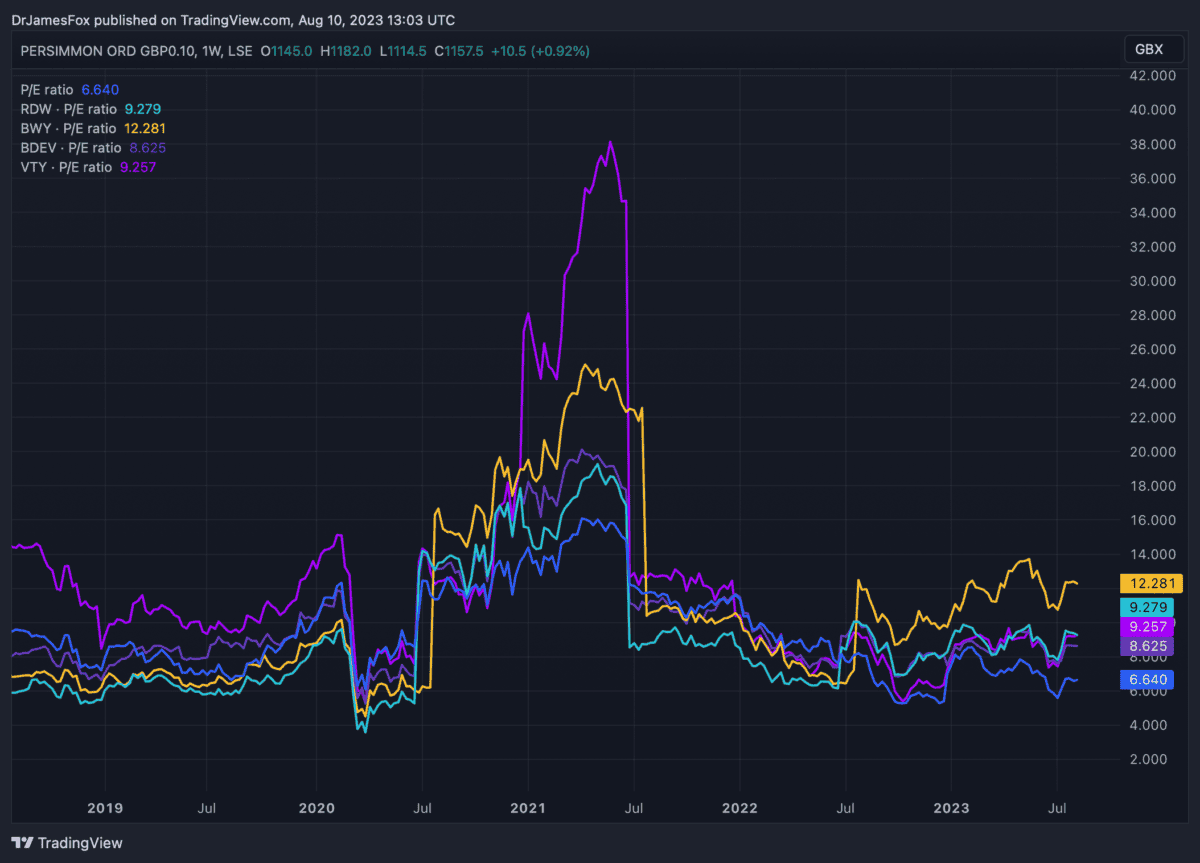

UK housebuilders currently trade at remarkably low multiples. This is a consequence of the exceptional performance during the 2021/22 period, which witnessed a substantial surge in house prices across the nation. This surge led to improved volumes and margins within the sector.

Yet, spanning the past 18 months, the industry has faced headwinds in the form of inflation and monetary tightening. This has led to a noticeable deceleration and subsequent decline in share prices.

Persimmon shares trade at around 4.5 times earnings on an adjusted basis, and 6.7 times on statutory. This reflects a discount versus industry peers, including Vistry, Barratt Development, and Redrow.

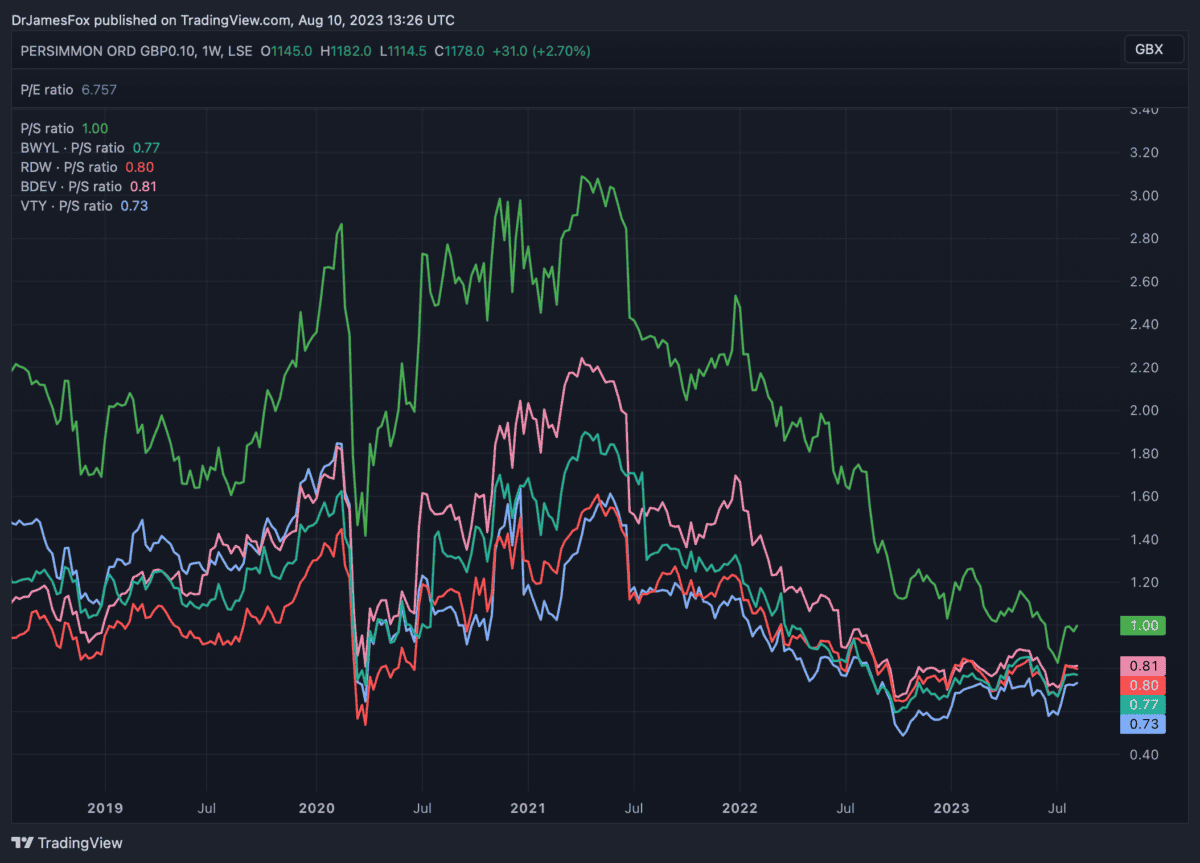

However, on the price-to-sales ratio, Persimmon appears more expensive. This suggests that Persimmon is more efficient at generating profits from revenue. In turn, we can observe that Persimmon may be achieving better margins than its peers.

Persimmon has traditionally been known to trade at a premium compared to some of its peers in the UK housebuilding industry due to its higher profit margins.

One of the factors contributing to Persimmon’s historically higher valuation is its business model, particularly its approach to land sales.

The FTSE 100 stock has been known for strategically managing its land bank and optimising land sales, which has positively impacted its profit margins and overall financial performance.

Considerations

As emphasised by CEO Dean Finch on Thursday morning, the long-term demand for housing is likely robust. This need has become increasingly apparent over time, as the pace of housing supply struggles to match the consistently growing demand.

Various factors contribute to this upward trajectory in demand, including notable increases in life expectancy rates and a marked rise in the number of single-person households. The result is a distinctly pronounced scarcity in housing availability.

It’s simple, but positive appraisal on the outlook moving forward. Despite the current unfavourable backdrop for home buyers, and the impact of cost inflation on homebuilders, it seems likely that the industry will experience a significant uptick in time.

This makes Persimmon, a company well-positioned to deal with economic challenges, partially by virtue of its size, an attractive long-term investment. The stock, however, may not see upward pressure for some time. When considering the monetary value of time, some investors may see better prospects elsewhere.