BT Group (LSE: BT.A) shares have performed poorly for a good few years now. Since reaching 485p in February 2016, they’ve cratered 77% and now trade for just 111p each. This is only a few pence above a five-year low.

Yet the telecoms giant still has a strong competitive position as a network provider in the UK. So surely there must be some value here, somewhere, mustn’t there? Here’s what the charts say.

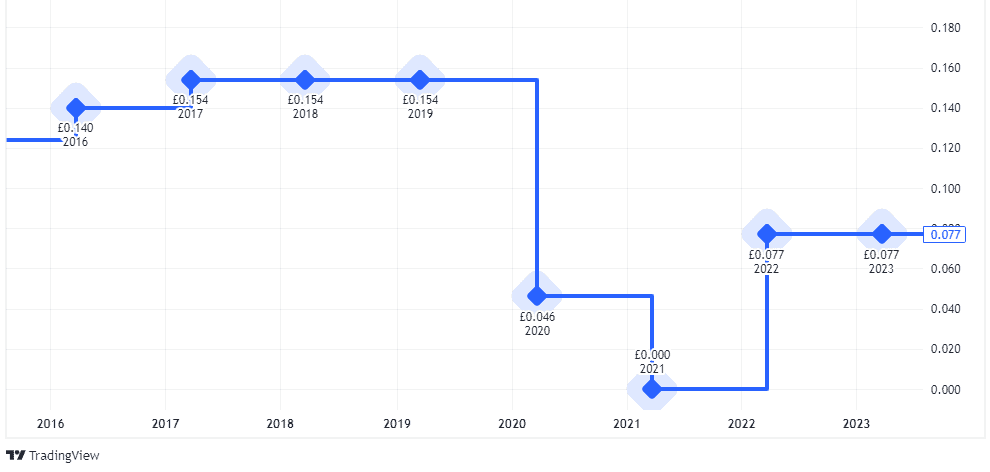

Rebased dividend

BT stock carries a dividend yield of 6.8%. The current yield on the FTSE 100 index is around 3.8%, so the shares look attractive from an income perspective.

The company is expected to pay a dividend of 7.50p per share both this year (FY24) and next year. However, the chart below shows that the annual dividend was previously up at 15.4p before 2020.

The payout was cut in that year, then fully suspended in 2021, before being rebased at half its previous level.

This was done to preserve the company’s credit rating and also reallocate cash towards upgrading its broadband network. It was the first time since its privatisation in 1984 that BT had cancelled its full annual dividend.

Importantly, these lower payouts are now covered 2.4 times by anticipated earnings. In theory, this could provide a margin of safety for income investors.

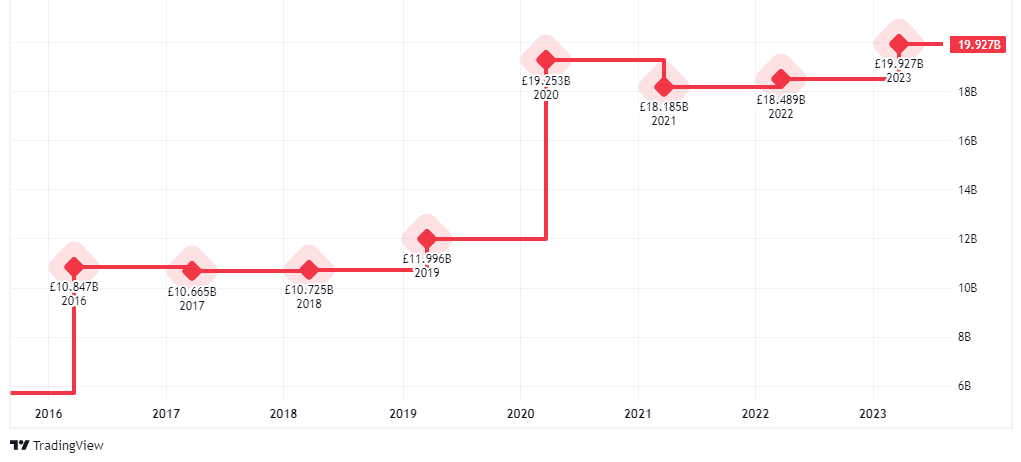

Beware that colossal debt pile

However, we can’t ignore BT’s mountainous net debt, which stood at £18.9bn at the end of March.

In the chart below, we can see that this figure has nearly doubled in five years.

In fact, this net debt is more than BT’s market cap of £11.1bn. Its current enterprise value, which adds the net debt to the value of the equity, therefore stands at £31bn.

Debt is expected to remain high as the firm continues to roll out its full fibre broadband and 5G infrastructure across the UK. There are also hefty pension scheme contributions.

Worryingly, the cost of servicing some of this debt is climbing as interest rates rise. Could the dividend come under further pressure? I think it’s possible.

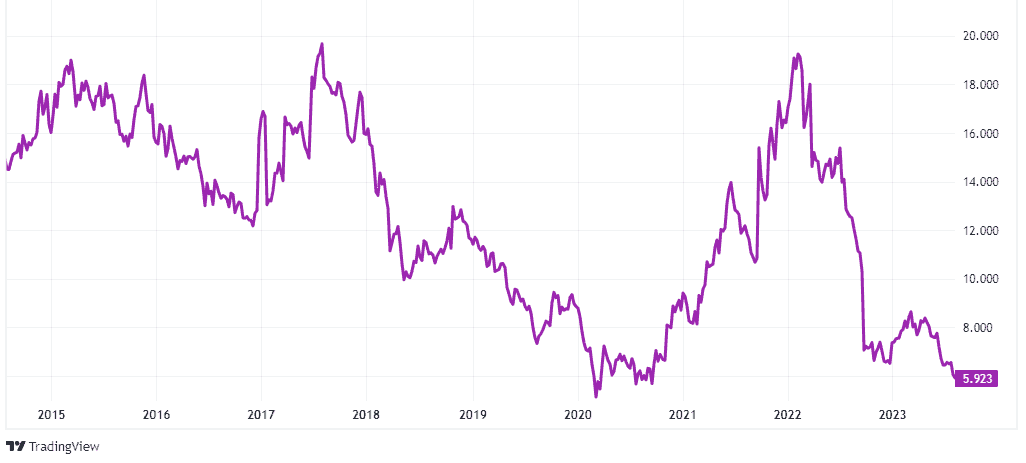

Cheap stock

The falling share price has resulted in a very low price-to-earnings (P/E) ratio of 5.9.

Above, we can see the P/E ratio is near multi-year lows. This could either prove to be a lucrative entry point for investors or a value trap.

Annual revenue is earmarked to stay around the £20bn mark until FY26. Meanwhile, net profit isn’t excepted to increase much, if at all.

Brighter days ahead?

BT is planning to shed as many as 55,000 jobs — more than 40% of its global employee base — by 2030. This cost-cutting should eventually result in rising cash flow.

Also, the company has appointed Allison Kirkby as its new chief executive. She is already on BT’s board and has been the boss of Swedish telecoms giant Telia since 2020.

Interestingly, shares of her current company fell 4% on the news of her departure, which suggests that Telia’s loss could be BT’s gain. Perhaps she can breathe new life into the business when she takes over in January.

With BT stock near five-year lows, any sign of operational progress could spark a turnaround in the share price. However, the company’s debt, slow growth, and uncertain dividend prospects don’t appeal to me.