On Friday morning (4 August), Amazon (NASDAQ:AMZN) shares soared 8.5% in the German market, mirroring the steep surge in extended US trading on Thursday.

That came after the company’s impressive sales growth and profits surpassed Wall Street’s expectations, attributed to quicker and more cost-effective customer deliveries.

Additionally, the Seattle-based corporation said the recent challenges in cloud-computing are beginning to dissipate, further contributing to Amazon’s remarkable performance.

Share price trend

Amazon’s shares — along with those of other technology companies — have experienced a remarkable surge since the beginning of the year. However, if I had invested £1,000 in Amazon one year ago, my investment would now be worth less at approximately £950.

This decline in value was primarily due to a slump in the stock towards the end of 2022. Despite a recent surge, extended on Friday, the value of the shares is still almost on par with the value from a year ago.

It’s important to note that the shares aren’t denominated in pounds. So investors would have needed to purchase the stock either in US dollars or euros.

Over the course of the year, the pound has appreciated by about 3% against the dollar. This means that even with the recent surge in Amazon’s stock, the value of the shares would be worth less today in pound terms compared to a year ago.

Moreover, Amazon doesn’t pay dividends to its shareholders. Instead, it has historically focused on reinvesting its profits back into the business. This should fuel its expansion efforts and growth initiatives.

Still room for growth

Thursday’s results smashed expectations.

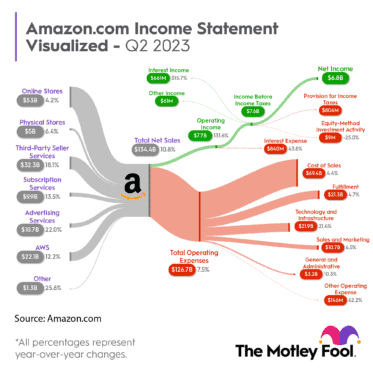

- Net sales came in at $134.38bn, above consensus of $127bn to $133bn.

- Diluted earnings per share stood at $0.65, surpassing the estimated $0.35.

- Amazon Web Services (AWS) achieved Net Sales of $22.14bn, representing a small beat versus the estimated $21.71bn.

- The operating margin was reported at 5.7%, significantly higher than the estimated 3.46%.

Additionally, the company has provided a strong outlook for the next quarter. Net sales are projected to be in the range of $138bn to $143bn, far above estimated figure of $138.3bn.

Despite the growing popularity of online shopping, approximately 80% of retail sales worldwide still occur in physical stores. This statistic alone highlights the significant potential market that Amazon, the dominant force in global online sales, can target. Reflecting this growth opportunity, however, it trades at a huge premium versus the wider discretionary spending segment.

One of Amazon’s key strengths is its continuous investment in cutting-edge technologies like artificial intelligence and machine learning. These investments are likely to further enhance its competitive advantage in the online retail space, as well as its web services division.

Amazon faces competition from various players, including retail giants like Walmart. However, it remains a formidable force on a global scale. Few companies have managed to match Amazon’s reach, scale, and innovative capabilities in the e-commerce industry.

The untapped market is huge and Amazon’s relentless pursuit of innovation is clear. So the company is well-positioned to continue its growth and maintain its position as a leader in the online retail space. However, it’s essential for it to continually leverage its competitive advantage, using technology while expanding the firm’s online presence around the world.