Like its AI peers, Alphabet (NASDAQ:GOOGL)(NASDAQ:GOOG) stock has seen a handsome gain this year, rising over 30%. Nonetheless, the shares have been stagnant since May as the AI narrative takes a breather. Should investors consider buying the stock today?

UBS downgrade

Alphabet stock’s flat performance of late can be attributed to the recent downgrades it has received from UBS and Bernstein. The two investment banks downgraded their ratings for the Google owner stock from ‘buy’ to ‘hold’ a couple of weeks ago.

Analysts from the two brokers cited risks associated with cannibalisation. They fear that the rollout of Google’s chatbot, Bard, and integrating it with Google’s main revenue driver through Search could end up jeopardising the company’s top line.

This is because AI-generated responses will most likely push advertisements down the page. And given that advertising revenue accounts for more than 80% of the conglomerate’s top line, fewer advertisements mean less revenue. This wouldn’t bode well for Alphabet stock.

After all, investors would have seen the effects of cannibalisation via Shorts on YouTube since its introduction. YouTube’s short-form content has been taking views away from its longer videos, which generate higher revenues. As such, YouTube’s revenue has dwindled in recent times.

Medical intervention

Even so, it would be foolish to sell Alphabet stock purely on the basis of cannibalisation alone. That’s because management has shown over the past couple of months that they’re capable of handling such issues alongside macroeconomic headwinds, all while expanding the tech giant’s offerings.

The slide in YouTube revenue seems to have reached a nadir, and Google Cloud is finally profitable. Therefore, investors should have every confidence that the board can overcome its potential cannibalisation issues surrounding Search over time as well.

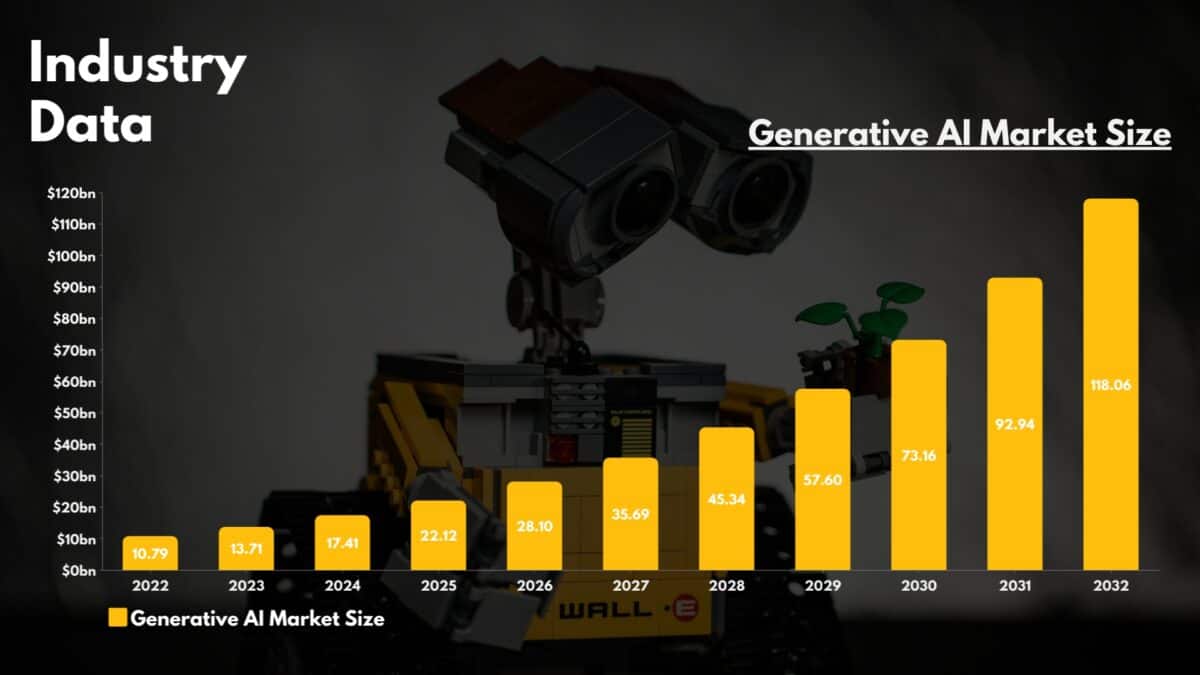

And despite the recent negative sentiment towards Alphabet stock, investors should note that analysts’ ratings tend to only take short-term projections into account. UBS’ and Bernstein’s ratings haven’t fully considered the full potential of the generative AI market, which could grow to $118bn in the next decade.

What’s more, Alphabet is host to one of, if not, the most sophisticated AI businesses in the world — DeepMind. Hence, there’s still plenty of ammo in the war chest for the firm to use as generative AI continues to grow exponentially over the coming years.

Should I buy Alphabet stock?

It’s for the above reasons that analysts remain relatively bullish on Alphabet stock. In fact, among the 49 qualified analysts covering the stock, 41 of them rate the shares a ‘buy’. None of them has a ‘sell’ rating, and it’s no surprise either.

Taking a look at the group’s valuation, its shares are trading at reasonable multiples. Its forward P/E ratio of 21 remains low by historical standards, and will seem like a bargain if generative AI continues to grow at a rapid pace.

More importantly, Alphabet has one of the best balance sheets. With a debt-to-equity ratio of just 4.5%, it has enough firepower to navigate through a potential recession while using excess capital to instigate further share buybacks. This should enhance shareholder value and boost the Alphabet stock price.

Pair all of that with the extremely exciting and evolving state of AI, and investors may want to consider the current slump in Alphabet stock as a buying opportunity.