Having started the year on the front foot, the FTSE 100 has slumped lately. But as the second half of the year begins, optimism could flood back into the market. With that in mind, here are three cheap FTSE stocks to buy in July before it’s too late!

1. easyJet

easyJet (LON:EZJ) shares started the year strong, rising 55%. However, the stock has flatlined since late January. That’s because investors are on the fence as to whether the company’s ever-improving guidance will come to fruition.

Nonetheless, the stagnant easyJet share price also presents a potential buying opportunity. The stock has every reason to climb further, and could do so when the FTSE 250 stalwart reports its Q3 results later this month.

CEO Johan Lundgren has been upgrading the budget airline’s profit outlook over the past two quarters. What’s more, the firm’s multiple revenue streams continue to show robust growth. And with fuel prices continuing to slide, easyJet could even surpass analysts’ profit estimates for its full year.

Given that easyJet shares are currently trading at discounted valuation multiples, with a P/S ratio of 0.5 and forward P/E ratio of 10.2, July could be the time to load up on the stock before they take off.

2. Marks and Spencer

Marks and Spencer (LSE:MKS) is another top FTSE stock to buy in July. The shares may be up over 100% from its October lows, but considering the upside potential for the retailer, they may still be worth buying as a long-term investment.

On the back of a solid set of full-year numbers, the growth story for M&S is just getting started. Food, clothing & home, as well as international sales, all saw massive growth. And with the group now expected to overtake Waitrose’s market share by 2027, a cheap P/E ratio of 10.3 is going to seem like a bargain.

The FTSE 250 constituent is also anticipated to resume paying dividends when it announces its interim results in November. Analysts are currently pricing in a dividend of 5p per share. But given the recent numbers from NEXT and ASOS, earnings could surprise to the upside and push dividends higher.

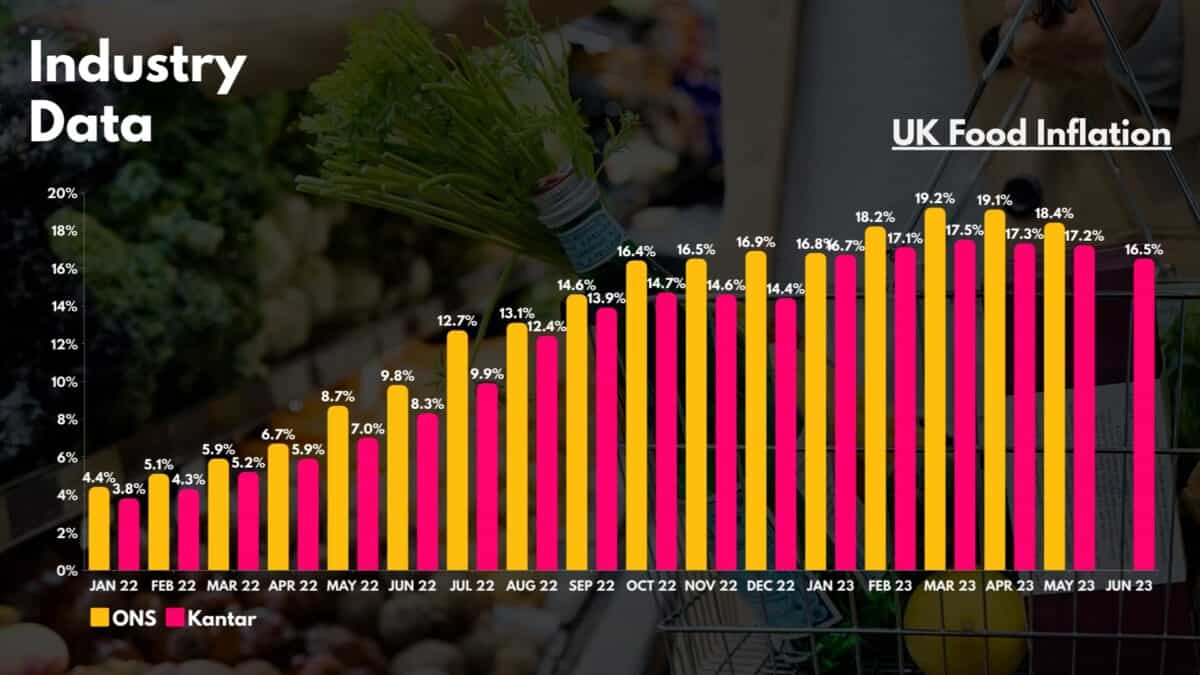

More importantly, food inflation seems to have peaked and is on its way down. Considering that M&S has locked in the prices of 200 products while wholesale food prices continue to decline, the grocer will stand to gain from the widening spread, allowing it to improve its margins.

3. Carnival

Rated as one of the worst stocks to buy at one point, Carnival (LSE:CCL) shares are now quickly becoming one of the FTSE’s biggest attractions. The stock is up a jaw-dropping 110% this year but has room to sail further.

While the cruise operator remains unprofitable, the business’ most recent results showed encouraging trends that profits are about to flood in. Revenues were above 2019 levels for the first time, and more importantly, forward bookings and customer deposits have hit record highs.

The board now expects to achieve EBITDA profitability by next quarter and even upgraded its outlook for the year. Detractors may point to the stock’s expensive forward P/E of 50.3. Nonetheless, the two-year forward P/E looks extremely lucrative as 19.3 for a growth stock is certainly a bargain.