Scottish Mortgage (LSE:SMT) shares have fallen 11.5% in 2023 and remain in the doldrums. This performance is in stark contrast to some of the trust‘s top holdings, particularly Nvidia (NASDAQ:NVDA), whose stock has nearly tripled since the turn of the year.

So this begs the question: when could Scottish Mortgage shares also start rising?

An AI portfolio

First, it’s worth highlighting just how long Scottish Mortgage has held certain companies that are enabling the rise of artificial intelligence (AI) today.

| First Invested | Description | |

| ASML | 1996 | The company’s equipment is at the heart of the semiconductor industry. |

| Amazon | 2003 | Much AI computing is done via Amazon Web Services. |

| Tesla | 2013 | Pioneering real-world autonomous driving software. |

| Nvidia | 2016 | Around 90% of generative AI programmes are trained using Nvidia’s chips. |

The managers recently quoted a Morgan Stanley analyst, who said in 2018 that “all roads lead back to Nvidia the most direct beneficiary” of AI.

They’ve also speculated that we could be at the start of another AI-driven computing revolution, similar in magnitude to the personal computer or smartphone. And while nothing is guaranteed to continue, Nvidia is currently positioned at the centre of it.

Hindsight and foresight

Scottish Mortgage currently owns around 100 stocks, with its top 10 holdings accounting for some 45% of total assets.

In contrast, fund manager Nick Train’s Finsbury Growth and Income Trust has 84% in its top 10 holdings. And Apple represents around 44% of Berkshire Hathaway‘s overall equity portfolio.

Now, the universe of stocks available to Scottish Mortgage is admittedly larger with access to private companies. But still, as a shareholder, I’d like to see the trust have even more conviction in its best ideas.

For instance, if all roads in AI seem to lead to Nvidia, as the managers have said, then why is it only around 4% of assets?

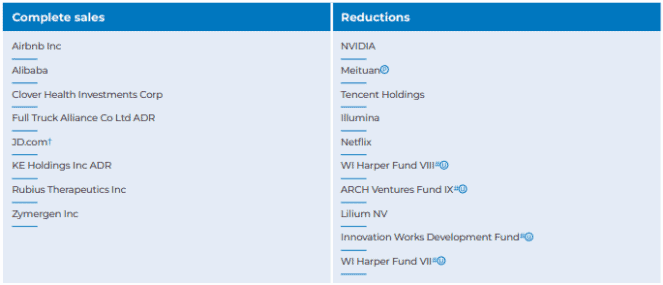

Surprisingly, part of the answer may be that the trust actually significantly reduced its Nvidia holding during FY2023 (year ending 31 March).

I imagine this reduction was done before ChatGPT took the world by storm. Obviously hindsight is a wonderful thing! Still, at least it had the foresight to identify Nvidia in the first place.

When will the discount narrow?

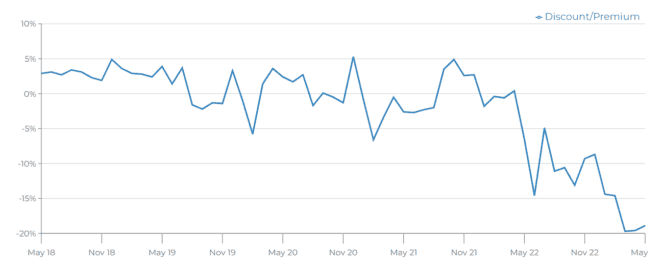

Scottish Mortgage shares are currently trading at a 21% discount to the underlying value of its assets. This discount has been steadily widening for some time now, as can be seen below.

With no discount, the shares would actually be up around 9.5% over the last year. But investors continue to worry about the value of the trust’s private holdings, which is a valid concern.

Nevertheless, I think the discount could narrow in the coming months as the US initial public offering (IPO) market restarts after its 18-month deep freeze.

It’s been reported that lithium-ion battery maker Northvolt, a large unlisted holding, is thinking about going public this year. And it could be valued at over $20bn. Also, SpaceX could list its Starlink operation soon, and maybe other holdings could likewise pursue an IPO.

This could soothe investors fears about unlisted valuations and ultimately begin to narrow the discount. Either way, I’ll be holding on to my shares for the ultra-long term.