Here are two top penny stocks I think share pickers should check out today.

European Metals Holding

Investing in early-stage miners can be a risky play. Exploring for minerals and developing mining projects can be fraught with expensive setbacks. And smaller operators have less financial headroom than the industry giants to cope with problems.

Yet the potential rewards of owning such shares can still make them attractive investments. European Metals Holding (LSE:EMH) — which owns the gigantic Cínovec lithium asset on the Czech-German border — is one such company on my radar today.

A string of positive project updates has helped lift the AIM-quoted miner’s share price in recent weeks. This includes an “outstanding” lithium extraction report in May that indicated recovery north of 95% using the flotation process. Studies show that Cínovec contains a mammoth 7.4 tonnes of the metal.

Lithium is a commodity for which demand is tipped to explode over the next decade. This is thanks to its essential role in electric vehicle (EV) manufacturing where it’s used to make batteries.

At the same time the development of new lithium projects is weak, suggesting a huge shortfall could be coming that supercharges prices. Industry giant Albemarle forecasts that lithium demand will exceed supply by 500,000 metric tons by 2030.

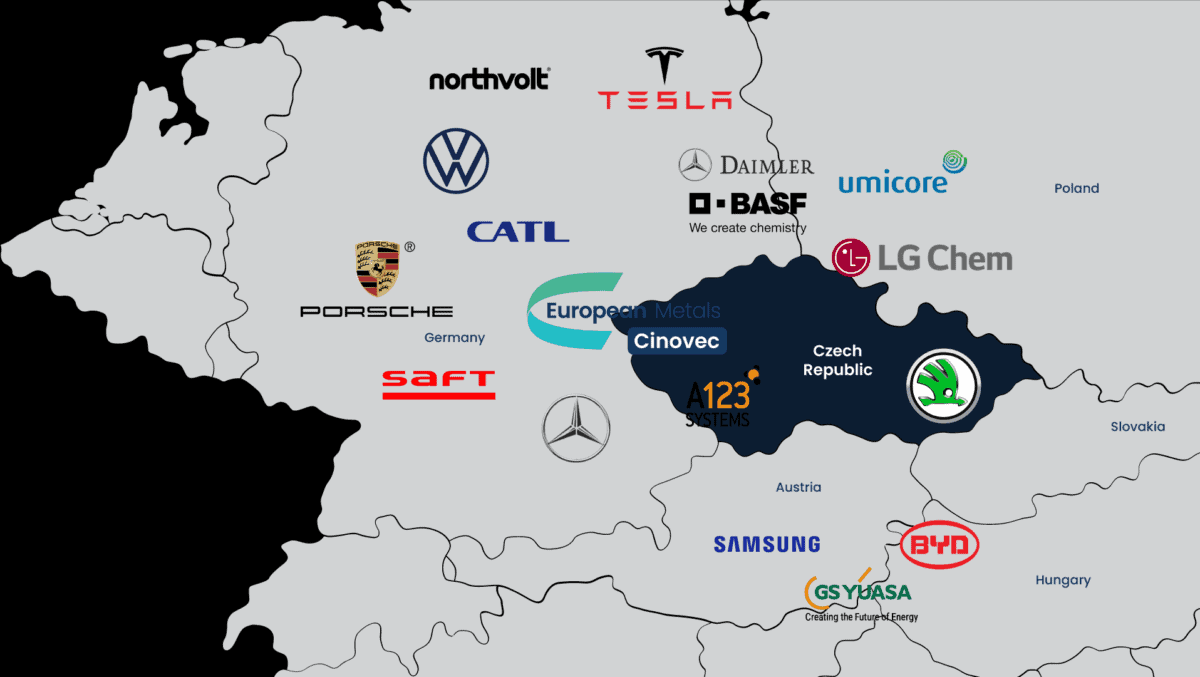

European Metals could be in one of the best seats to exploit this shortage. Not only does it own one of the continent’s most exciting lithium deposits, its strategic position in Central Europe puts it on the doorstep of several automotive, electronics and chemical industry giants.

Ten Lifestyle Group

As the global economy struggles for momentum a dark cloud continues to hang over consumer spending. Yet lifestyle and concierge business Ten Lifestyle Group (LSE:TENG) could be better placed to weather this bump than many other UK shares.

This is because the AIM business provides services to the high-net-worth customers of financial services providers and luxury brands. Spending among this demographic remains largely unaffected during downturns, so blue-chip companies will continue to demand the services Ten Lifestyle provides to keep them happy and loyal.

Indeed, latest trading numbers in May illustrated the robustness of its operations. Net revenues leapt 49% during the six months to February, while the number of active members on its books jumped 43% to a record 275,000.

Ten Lifestyle also advised that member activity had remained “robust” since the end of the period.

I think earnings at this penny stock could grow strongly over the long term. It has a terrific chance to steadily grow its member base as the number of wealthy individuals rises across the globe. The firm is investing heavily in technology and communications to capitalise on this opportunity too.

Spending in these areas rose to £7.1m between September and February, up 9%. It has a strong balance sheet with which to continue investing for growth, too.