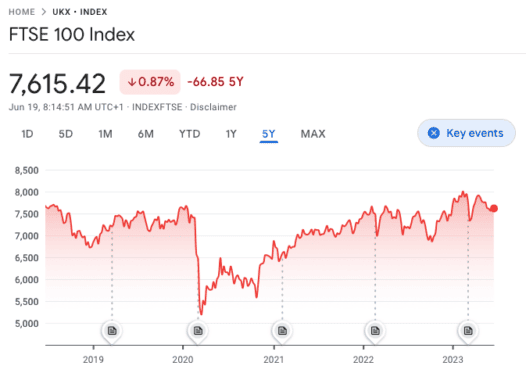

The UK’s main stock market index, the FTSE 100, has stalled recently. I’m not just talking about its flat performance this year. Over the last five years, the index has literally gone nowhere.

The good news is that British investors don’t have to accept low investment returns just because the Footsie is underperforming. Here’s a look at three ways investors can potentially beat the index.

Stock picking can boost returns

One strategy for investors to consider is owning individual FTSE 100 stocks over the index itself.

While the index, as a whole, is going nowhere fast, there are many stocks within it that are performing really well. Take rental equipment group Ashtead, for example.

This stock has been an incredible performer. Over one year, it’s up about 60%. Over five, it has climbed about 140%.

Of course, the stock may not generate these kinds of market-beating returns going forward.

However, I’m quite bullish on it. This company generates a large proportion of its revenues in the US, where the government is spending billions on infrastructure projects.

So I reckon it has the potential for further gains.

The US market is on fire

Speaking of the US, this can be another great source of investment opportunities for UK investors.

Today, the US is home to many of the world’s most dominant businesses including Apple, Microsoft, Amazon, Alphabet (Google), and Nvidia.

But British investors can easily invest in them. Personally, I’ve bought all of these stocks for my portfolio. And they have really helped my performance.

Apple, for example, has risen about nearly 300% over the last five years.

I’ll point out that I don’t expect the stock to deliver the same kind of return over the next five years. However, I think it can continue to beat the FTSE 100 over the long term as it’s a very innovative company.

Smaller UK companies are worth a look

Finally, a third strategy that can help investors beat the FTSE 100 is looking at smaller UK companies.

On the London Stock Exchange’s Alternative Investment Market (AIM), there are some really exciting businesses that are growing rapidly and delivering strong gains for investors in the process.

An example here is Cerillion, a software company that serves the telecoms market. It’s enjoying strong growth right now as telecoms organisations shift their operations to the cloud. And this is reflected in its share price. Over the last five years it’s surged around 800%.

Now, smaller companies can be higher-risk investments. Often their share prices are volatile. However, a little bit of exposure to them can really pay off.

Building a portfolio

It’s worth noting that these three strategies aren’t mutually exclusive. They can be combined to form a winning investment portfolio.

That’s what I’ve done. My portfolio contains top FTSE 100 stocks, some of the best US shares, and a number of UK small-caps for growth. And this approach is working pretty well.