I’m heavily invested in Barclays (LSE:BARC) shares. It’s one of the most undervalued stocks on the FTSE 100, offers a decent dividend yield, and has very strong dividend coverage.

All of this is very interesting to me. Because, while it may be a pipe dream, I’m aiming to generate enough passive income to give up work and retire.

So, hypothetically, just how many Barclays shares would I need to retire on? Let’s explore.

Barclays shares

For me, Barclays is one of the most attractive stocks on the FTSE 100. Discounted cash flow metrics suggest the bank could be undervalued by as much as 70% and it offers an above-average 4.6% dividend yield. In 2022, the dividend was covered by income 4.25 times, making it one of the safest dividends on the index.

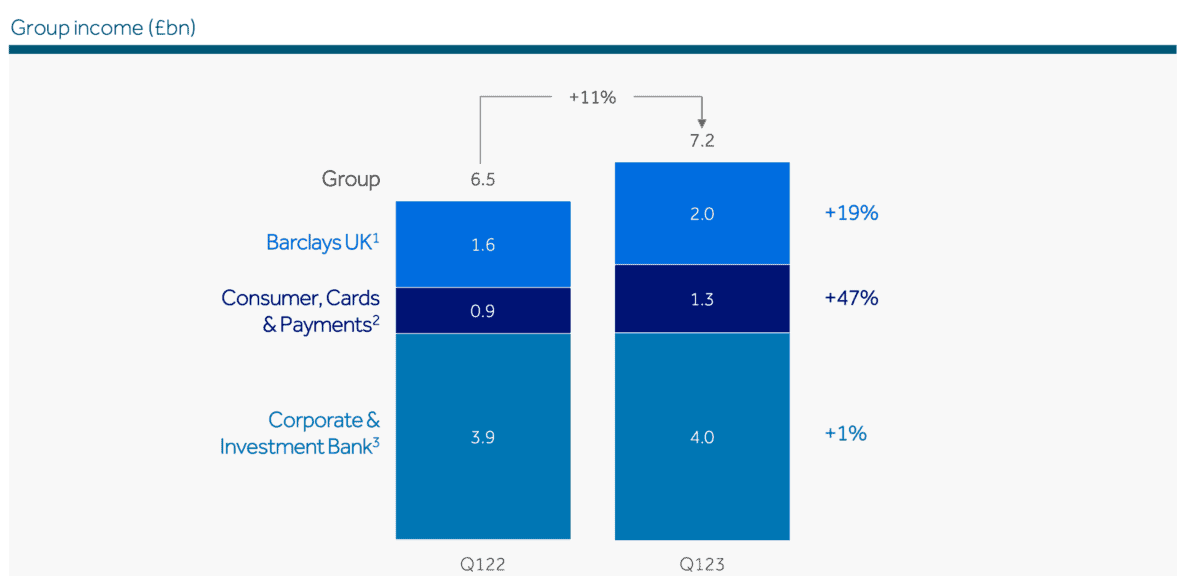

Recent performance has been boosted by rising interest rates. In Q1, its ringfenced UK consumer lender division saw profits leap by a third to £515m. Income across all business segments rose year on year, although investment banking lagged on growth.

The dividend

Barclays’ total dividend rose to 7.25p in 2022, up from 6p in 2021, and just 1p in 2020. In 2018, a 6p dividend was declared. Because of the pandemic, it’s hard to recognise any consistent upward pattern here.

However, I’d expect to see the dividend continue to grow in the coming years. One reason for this is the dividend coverage ratio (DCR). The DCR measures the number of times that a company can pay shareholders its announced dividend using its net income. In 2022, the DCR was 4.25 — this is more than double what would be considered healthy. In 2021, the DCR was 5.93.

Analysts are forecasting the company to pay a dividend of 8.6p per share in 2023, and then 9.7p per share in 2024. This would amount to a forward yield of 5.5% and 6.2%. Using conservative estimates, we could see 10.5p in 2025, and 11p in 2026.

Of course, the dividend yield is always relevant to the buying price. I was lucky to pick up more of the stock when the share price fell in March. It’s all about locking in those higher yields when the opportunity becomes available.

Living off the passive income

Realistically, I’m going to need £30,000 after tax if I’m going to quit work and live off dividends. Right, now, I’d need just over £600,000 invested in Barclays, in an ISA, to achieve that. This means I’d need 379,746 shares at the current price.

However, if we’re working off forward dividend yields, it becomes a little easier to achieve. Assuming a forward yield of 7% in 2026, we’d need £425,000 invested in the banking giant. At the current price, that’s 268,987 shares.

Of course, I’m not going to be buying £425,000 of Barclays stock anytime soon. I just don’t have that kind of money to spend, especially not on a single stock. After all, a portfolio should be varied. Despite this, I’m continuing to top up my position in this FTSE stalwart.