Scottish Mortgage Investment Trust (LSE:SMT) is a popular investment fund. Baillie Gifford’s flagship FTSE 100 company focuses on global growth stocks in public and private markets, giving investors in Scottish Mortgage shares indirect exposure to both via its portfolio.

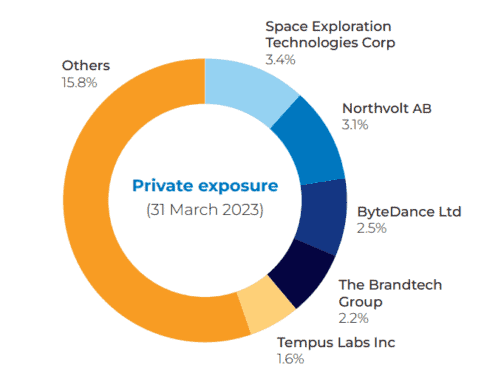

The trust has invested in unlisted stocks since 2012. But it’s not an early-stage venture capital firm. Instead, it prefers larger private companies that often generate billions in annual revenue. Currently, nearly 30% of its holdings are in unquoted shares.

The Scottish Mortgage share price has suffered amid a global growth stock downturn, falling 55% from its November 2021 peak. Let’s explore three of trust’s largest private equity investments that could revive its ailing fortunes.

Space Exploration Technologies

The largest private holding is Elon Musk’s venture SpaceX. At its most recent funding round, it attracted a $137bn valuation. The company’s mission is to reduce space transportation costs and enable the colonisation of Mars. SpaceX has launched 236 rockets and boasts 1.5m subscribers to its Starlink satellite internet service.

That might sound futuristic and the recent explosion of its Starship rocket after launch pours some cold water on the company’s lofty aspirations. Nonetheless, it’s a trailblazer in a rapidly growing sector. McKinsey predicts that the space industry could be worth $1trn by 2030.

Northvolt

Next, there’s Northvolt. This Swedish company aims to make the world’s greenest lithium-ion batteries. It has a core European focus, but it faces tough competition from the US. Northvolt’s major customers include automotive companies like Volkswagen and BMW.

The business last raised funds in 2021 at a valuation of $12bn. It’s mulling an initial public offering (IPO) at over $20bn, which could come as soon as next year.

ByteDance

Finally, Scottish Mortgage also invests in Chinese technology company ByteDance. This may not be a familiar name, but the video hosting service TikTok probably is. ByteDance owns it, alongside its Chinese counterpart Douyin. TikTok’s immense popularity is well-documented, but the company also faces risks as concern grows in Western countries about security and surveillance threats.

There have been several delays to the firm’s mooted IPO, but speculation continues. Its latest employee share buyback programme valued the company at around $220bn, down from a peak of $400bn in 2021.

A Scottish Mortgage recovery?

The considerable unlisted stock exposure makes Scottish Mortgage a high-risk and potentially high-reward investment.

The management team can identify companies with enormous potential at a pre-flotation stage. If these companies ultimately pursue an IPO, they can generate significant amounts of cash for shareholders if their share prices soar after listing. However, this strategy has risks too.

There are strict reporting requirements that public companies must follow regarding their finances. If traders believe the business has been incorrectly valued, the IPOs could disappoint.

I think there are good reasons to be optimistic about these unlisted stocks. However, questions have been raised about the trust’s valuation process and the fact that its exposure is close to its self-imposed 30% limit. Scottish Mortgage has strongly rebutted this criticism.

Overall, I like the unlisted equity exposure and I think these shares could prove critical for Scottish Mortgage’s recovery prospects. I’m happy to assume some additional risk, which is why I invest in the trust.