Whenever I have spare cash, I invest in dividend stocks to boost my passive income. My go-to index is the FTSE 100. Here, I’m going to outline a few reasons why I generally don’t need to look anywhere else.

Dividend yields

If I want to invest stocks in, say, the fields of artificial intelligence (AI) or cybersecurity, then I’ll generally scour the Nasdaq Composite. This tech-dominated index is full of such high-growth enterprises.

The problem is many of these companies are reinvesting every dollar they generate back into growing their businesses in order to gain market share. Their priority is not distributing profits (if they make any) to shareholders.

Even the established and profitable tech giants, such as Apple and Microsoft, aren’t going to help my passive income needs. They currently have dividend yields of 0.53% and 0.81%, respectively. Indeed, the current yield for the whole index is only 1.4%.

However, the FTSE 100 today is yielding 3.8%, and many stocks pay well above this average figure. Insurer Legal & General, for instance, currently has a dividend yield in excess of 8%. That’s way higher than any savings account is going to pay me.

Increasing dividends

Shareholders will receive an estimated £84.8bn in FTSE 100 cash dividends in 2023, according to investing platform AJ Bell. That’s up from £76.4bn in 2022.

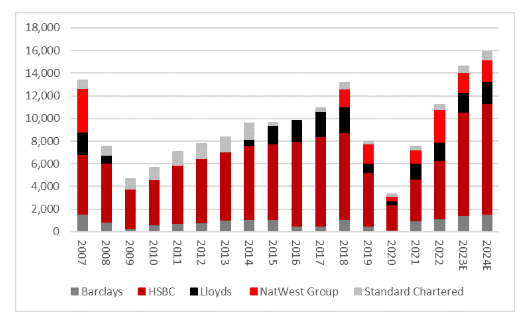

And this year, a big driver of dividend growth is expected to be banks, which are benefiting from higher interest rates. HSBC, Lloyds and Barclays are all expected to hike their payouts.

In fact, banks in the Footsie are currently expected to distribute £14.6bn this year. If that happens, it would be the highest annual distribution since just before the Great Financial Crisis.

Lloyds in particular looks great value to me, with the high street bank’s shares trading cheaply and offering a prospective 6.2% yield this year.

Furthermore, analysts are pencilling in 7% dividend growth for the FTSE 100 in 2024, which would be a record.

While payouts are never guaranteed, these projections do give me confidence that passive income will continue to flow into my brokerage account from UK blue-chip stocks.

Buybacks

As well as paying out cash dividends, companies can also reward shareholders through buying back their own stock.

Doing so reduces the amount of outstanding shares, which usually lifts both earnings per share and dividends per share over time.

Last year, FTSE 100 companies approved £55.2bn of share buybacks, a number that could well be surpassed this year.

Truly international

Another key attraction for me is that the FTSE 100 is an international index. Over 75% of the constituents’ revenue comes from overseas, according to FTSE Russell.

As a result, many companies in the Footsie are exposed to attractive high-growth economies around the world. Plenty of these are in the Asia Pacific region, where the number of middle class consumers is rocketing.

To me, this is important because the earnings of these companies aren’t overly reliant on the health of the UK economy. They’re diversified globally, which should make them more resilient.

These factors — high yields, increasing payouts, buybacks, and international earnings — are why I’d look no further than the FTSE 100 right now for passive income.