Buying shares of investment trusts can be an excellent way to drive solid returns in an ISA. I gain exposure to a ready-made, diverse portfolio of assets through a single investment.

Here, I’m going to highlight three trusts that I’d buy today.

Mega-trends

First up is BlackRock World Mining Trust (LSE: BRWM), which I’ve recently added to. As the name suggests, it invests in companies in the mining sector.

Top holdings include BHP, Glencore, and Vale, the largest producer of iron ore and nickel in the world. These miners are big dividend payers, underpinning the trust’s juicy 6.7% yield.

This industry is at the centre of some hugely compelling long-term trends. These range from global economic development to digital transformation and the increasing value of precious metals.

But arguably the biggest trend is the transition towards a net-zero global economy. Copper, cobalt, lithium, and many more commodities are essential to a low-carbon future and are in strong demand.

Yet there has been an alarming lack of external investment in new mines, partly caused by the obvious negative environmental impacts of some mining activities. These include deforestation, pollution, and soil erosion.

Such events often discredit the whole industry, which is worth bearing in mind, as is the general cyclicality of mining stocks. Dividends do regularly get reduced.

However, long term, I expect mining companies to capture the benefits of higher prices driven by the supply-demand imbalance. This should improve earnings, boost dividends, and underpin the growth of the trust.

Far Eastern focus

I recently added Henderson Far East Income (LSE: HFEL) to my ISA. I did so because Asia is the fastest-growing region in the world, with a massive population and an expanding middle class.

The trust has an excellent record, having grown its dividend per share from 8.25p in FY2007 to 23.80p in FY2022. And the stock today carries a monster 9.7% dividend yield.

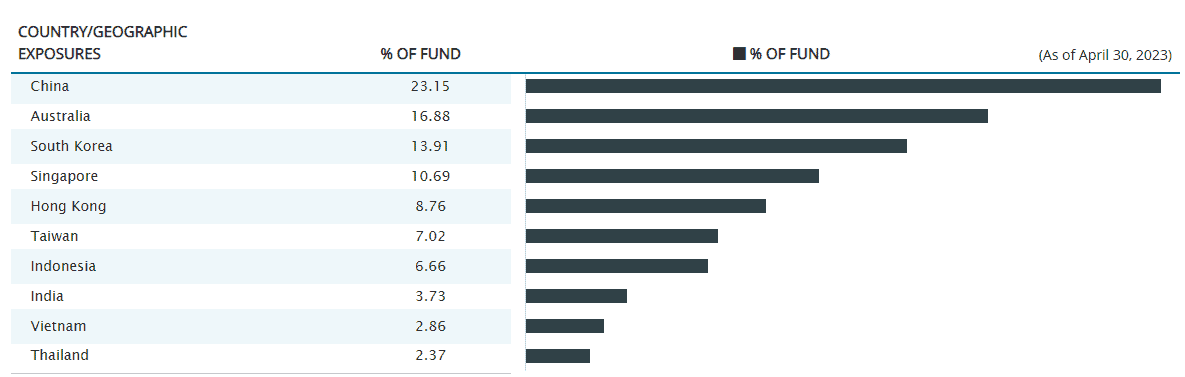

Top holdings in this £396m trust include Samsung Electronics, Ping An Insurance, and Taiwan Semiconductor Manufacturing. All are world-class companies, potentially able to increase dividends for many years, though that isn’t guaranteed.

One ongoing risk is the geopolitical tensions between China and Taiwan. I offer no insight here, but if this situation deteriorates further, I’d imagine all stock markets (not just in Asia) would become very jittery.

I do like the diversity of the portfolio though, with China representing less than a quarter of assets despite its size. This offers investors balanced exposure to numerous dynamic economies.

Global income and growth

My final choice is Scottish American Investment Company (or SAINTS). The 2.6% dividend yield isn’t as high, but the trust invests globally and across sectors, so is arguably less risky.

SAINTS has increased its payout for 49 consecutive years. Incredibly, there have been no dividend reductions since World War II, though I’m sure that cutback can be forgiven.

The managers aim to increase the dividend at a faster rate than inflation. However, that’s become more difficult lately, with inflation still stubbornly high, which is worth considering.

The share price alone is up 105% in 10 years. Yet as a shareholder myself, I’m confident that their investments in “compounding machines” such as pharmaceutical giant Novo Nordisk and Microsoft will continue to bear fruit.