Over the past six months, Aston Martin (LSE:AML) shares have been among the top performers on the FTSE 350. The stock is up 88% over six months. Some of these gains came on Thursday after Chinese carmaker Geely doubled its holding in the iconic automaker.

Aston Martin shares have been extremely volatile in recent years. In fact, they haven’t been too good to me. So is this the best it’s going to get? Let’s take a closer look.

Heading for success?

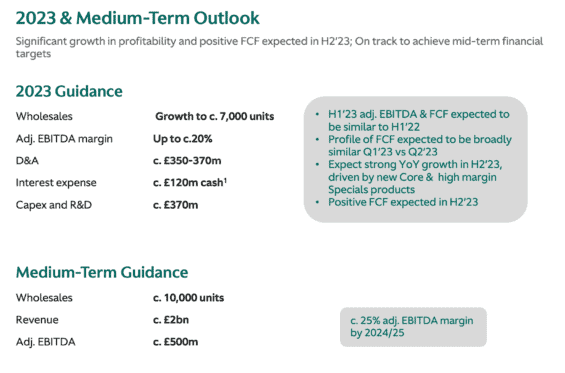

Aston has set out a strategic objective to increase deliveries to 10,000 cars a year by 2024/2025, and achieve £2bn in revenue and £500m in EBITDA. Only 6,412 vehicles were sold in 2022. But the company now says it can hit its revenue target by selling just 8,000 vehicles.

A major reason for this is the focus on higher margin vehicles, including the DBX SUV and the Valkyrie hypercar. Aston Martin will make a total of 150 Valkyries, all of which have been sold — they were valued at $3m each.

However, it’s worth noting that the medium-term guidance still suggests the company will be able to shift 10,000 units, up from around 7,000 in 2023.

What’s achievable?

To access what’s achievable, I’m going to look at Aston’s peers, Ferrari and Porsche. The former is known for having some of the best margins in the industry — the Italian manufacturer earned an astounding $106,078 per unit sold in 2021. In fact, we can assume Lawrence Stroll’s decision to poach former Ferrari boss Amedeo Felisa reflects an attempt to follow in the Italian brand’s footsteps.

| Brand | Deliveries | Market-Cap |

| Aston Martin | 6,412 | £1.8bn |

| Ferrari | 13,221 | €53bn |

| Porsche | 34,801 | €52bn |

Here we can see the discrepancy between the three companies, but we can also observe the opportunity. Aston Martin delivers half as many cars as Ferrari but is valued 20 times less than the Italian carmaker.

I believe it’s entirely possible that Aston can replicate the success of its peers. And I also believe it’s on the right track to do so. The focus on margins appears to be paying off already, with the company registering a small operating profit in Q4 of 2022 — a possible turning point for the brand.

The success of the F1 team in 2023 will only be positive for the firm’s reputation in the US and further afield.

An opportunity to sell?

Debt is a big issue and repayments will continue to impact profitability going forward — interest expenses are likely to reach £120m in 2023. However, despite this and the recent gains, I’m holding my shares.

As demonstrated by Porsche and Ferrari, there is huge potential for Aston Martin in this premium part of the auto market. Under Stroll’s leadership, the brand has been successful in lifting margins and volume. I’m buoyed by what I’ve seen so far.