After underperforming the market last year, Fundsmith has returned to form in 2023. For the four-month period to the end of April, the UK’s most popular investment fund registered a return of 10.4% – well ahead of the 7.1% generated by the FTSE 100.

Here, I’m going to look at why Fundsmith has outperformed the Footsie in 2023. I’ll also explain why I expect the fund to outperform the index in the long run too.

| YTD return | 1-year return | 5-year return | |

| Fundsmith | 10.4% | 8.9% | 80.6% |

| FTSE 100 index | 7.1% | 8.2% | 26.9% |

Big Tech exposure

One of the main drivers of Fundsmith’s outperformance this year has no doubt been Big Tech stocks. These have performed very well as sentiment towards the technology sector has improved.

Take Microsoft, for example, which is one of Fundsmith’s top holdings. Year to date, it’s up about 30%. It’s done well thanks to its exposure to cloud computing and artificial intelligence (AI).

Meta Platforms has also done well. It has had a major rebound this year thanks to Mark Zuckerberg’s move to spend less on the metaverse and more on AI.

Luxury goods holdings

It’s not just tech that has boosted Fundsmith this year however.

Another area that has helped performance is luxury goods. At the end of April, Fundsmith had three luxury goods stocks in its top 10 holdings – LVMH, L’Oréal, and Estée Lauder.

And two of these stocks have hit new all-time highs this year on the back of strong customer demand.

High-quality healthcare stocks

Fundsmith’s choice of stocks in the Healthcare sector will have also been a strong driver of returns.

Among the top 10 holdings of the fund are diabetes specialist Novo Nordisk and medical equipment maker Stryker. Both have outperformed this year.

The former has benefitted from strong demand for its obesity drugs while the latter has benefitted as hospital service has begun to normalise after years of disruption.

Avoiding banking and oil

Finally, avoiding certain areas of the market will have also helped Fundsmith outperform in 2023. It’s well known it doesn’t invest in oil companies or banks. Portfolio manager Terry Smith doesn’t like the unpredictable nature of their revenues and earnings.

Avoiding these areas of the market has helped the fund this year as banks have suffered from the US banking crisis and oil stocks have underperformed as prices have fallen.

Long-term potential

Looking ahead, I expect Fundsmith to outperform the FTSE 100 in the long run. There are few reasons why.

Firstly, Fundsmith is well placed to benefit from a number of powerful long-term trends including:

- Digital transformation

- Rising global wealth

- The global diabetes ‘epidemic’

Now, the FTSE 100 does provide some exposure to these kinds of trends, but not nearly as much as Fundsmith.

For example, Fundsmith has a 9.2% weighting to the Technology sector (plus 6.7% to Communication Services) while the FTSE 100 only has a 1% weighting.

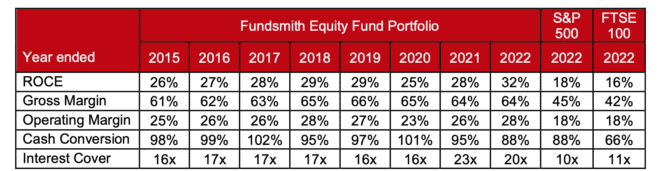

Secondly, the average Fundsmith company is far more profitable than the average FTSE 100 company. This is illustrated in the table below.

Over the long term, companies that are highly profitable tend to produce strong returns for investors.

Of course, Fundsmith is not going to outperform at all time. There will be periods where the Footsie has its glory.

However, taking a five- or 10-year view, I think there’s a good chance the fund will beat the index.