Let’s see why I’m looking to buy FTSE 100’s largest energy company.

Oil and natural gas prices have come down from the highs seen earlier last year. But with average prices for 2022 still significantly higher than those seen in recent years, Shell (LSE:SHEL) has still been able to post record profits.

Oil prices

Manufacturing activity in China grew last month at the fastest pace in more than a decade, reinforcing expectations of a fuel demand recovery. Seaborne imports of Russian oil are set to hit a record high, data shows, adding to evidence of a rebound in the world’s second-largest economy (China) after removal of strict Covid-19 curbs.

Global oil demand is now pegged to grow more quickly — by 1.9m barrels per day instead of 1.4m barrels per day — on the back of China’s reopening, as well as increased demand from aviation and improved forecasts for GDP growth in 2023.

In the US, comments by Raphael Bostic (president of the Federal Reserve Bank of Atlanta) that the Fed should stick with “steady” quarter-point rate increases eased concerns in the US and helped support oil prices, even after strong unemployment data.

With no sign of the Ukraine invasion ending soon, all it will take is one piece of bullish data to drive these prices higher.

Ben van Beurden, Shell’s chief executive officer, said: “The war in Ukraine is first and foremost a human tragedy, but it has also caused significant disruption to global energy markets and has shown that secure, reliable and affordable energy simply cannot be taken for granted.”

Banks such as Goldman Sachs and Morgan Stanley have forecasted Crude Oil will end up around $100-$110 a barrel by the end of 2023. Though this is in no way a guarantee as we all know banks can be wrong, it put an emphasis on oil prices. It is oil bidding season after all.

Financials

Shell saw 2022 revenues leap 46% to $381bn. Pre-tax profit more than doubled from $29.8bn to $64.8bn, reflecting higher refining margins and strong trading and optimisation results, which more than offset lower volumes.

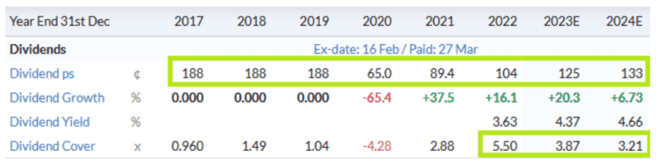

Shell has declared a fourth quarter dividend of $0.2875, up 15% on that declared in the third quarter. $18.4bn was spent on share buybacks over 2022, with a further $4bn announced for the first quarter of 2023.

In 2022 Blackrock added $416.7m to its Shell position, which now totals $522.3m — 7.54% of the company — and so far, hasn’t scaled out from its giant position. BlackRock will sit in these positions for years, so it almost certainly expects Shell to have bull and bear runs. BlackRock sees longevity in Shell, which is the key takeaway from this.

Shell has excellent financials, strong price momentum and is supported by macro-economic events that will continue to drive up revenues and margins over the coming year.

One might argue it’s unethical to buy during a time of geopolitical tension. Well, when I buy Shell shares it will be for the long term, and will look to hold them for half a decade or more.