NIO (NYSE:NIO) stock has shed over half its value in the past year. That’s a catastrophic return for shareholders in the Chinese EV manufacturer, often championed as a major rival to Tesla (NASDAQ:TSLA). But could brighter days be on the horizon?

The company has a strong foothold at home and is rapidly expanding into Europe. It certainly doesn’t lack ambition, but NIO’s no stranger to disappointing financial results itself.

So, let’s explore what Tesla’s recent earnings miss means for NIO and whether this could be a buying opportunity for me.

Tesla earnings

As I write, the Tesla share price has fallen 7% in pre-market trading to $167.47 following Q1 results. Revenue of $23.33bn and adjusted earnings per share of $0.85 were both marginally below Wall Street’s expectations.

But it’s Tesla’s free cash flow that caught my eye. Down 80% year on year, that figure has shrunk to $441m. Coupled with a 24% profit slump over the same time frame, it’s fair to say there are causes for concern in the numbers.

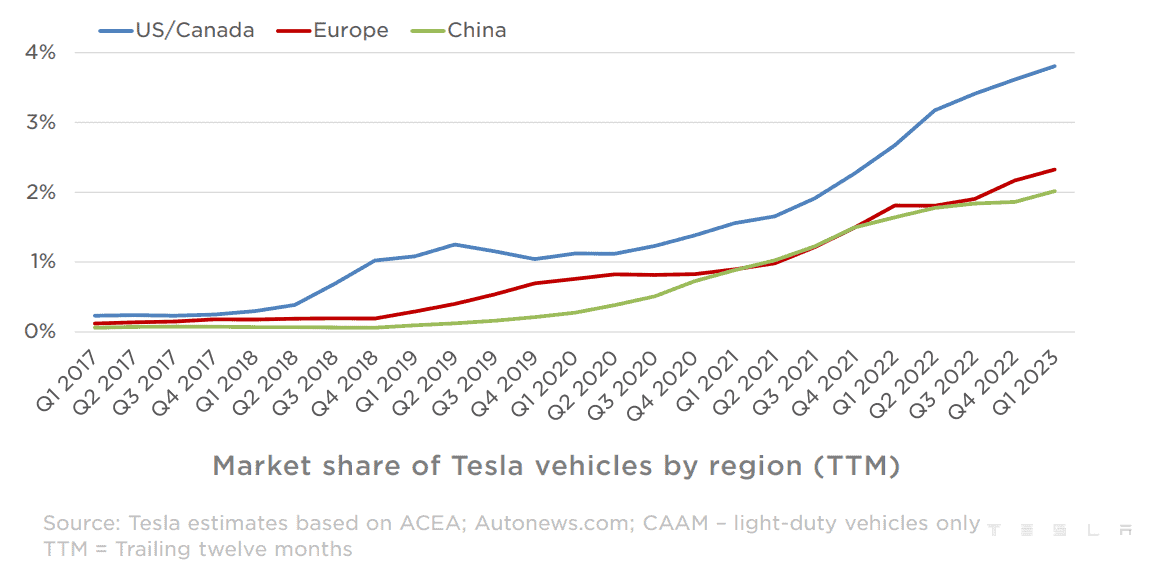

That said, the company delivered a record 422,875 vehicles across the Models 3, S, X, and Y combined. Plus, it continues to claim higher market share in its three key regions.

Despite shrinking margins, Elon Musk has indicated he will remain steadfast in pursuing his strategy of aggressive price cuts to attract more consumers.

What does this mean for NIO?

NIO, which operates at the premium end of the market, was unambiguous in its response to Musk’s raising of the price competition stakes.

We will certainly not join the price war.

NIO CEO, William Li

Only time will tell how wise this is. However, it opens up the possibility of a price gulf emerging between their respective car models. There’s logic to NIO’s move, considering the company’s vehicle margin declined to 6.8% in Q4 FY22, down 14.1% year on year.

Yet in a delivery update for Q1, the business revealed just 31,041 EV deliveries — a reversal from 40,052 in the prior quarter. With increasingly cut-throat competition and a share price below $9, NIO needs to find a way to square the circle of preserving its margins while boosting deliveries.

While Tesla increasingly looks east, perhaps a venture westwards could be the answer to NIO’s dilemma. With a presence in five European countries already, the company plans to release a new model this quarter that caters to the continent’s demand for compact cars.

Should I buy?

Overall, I’m steering clear of NIO stock despite stuttering competition and promising expansion plans. Although the share price is considerably cheaper today than during the pandemic, the company’s recent results aren’t convincing enough for me to invest.

I’m not looking to buy Tesla stock either. I don’t deny the trailblazing nature of Elon Musk’s company and it remains the dominant EV industry player. However, a price-to-earnings ratio just under 50 means the share price still looks too expensive to me today.

That said, I already have indirect exposure to both businesses via my shareholding in Scottish Mortgage Investment Trust. I see this as a nice compromise for the time being. If there are further share price falls, I may reconsider investing in both NIO and Tesla stock directly.