I’m searching for the best growth stocks to buy and hold for the next 10 years. Here are three UK penny shares I’ll add to my portfolio if I have spare cash to invest.

Michelmersh Brick Holdings

Britain is in the midst of a chronic property shortage. Think tank Centre for Cities estimates that the UK has a backlog of 4.3m homes missing that were never built. That’s compared to the average European housing market.

The shortage threatens to worsen too due to steady population growth. As a result, housebuilding activity on these shores will have to rise sharply, meaning demand at building material suppliers like Michelmersh Brick Holdings (LSE:MBH) might rise strongly.

Troubles in the housing market may affect sales here in the near term. But the company’s wide customer base — it supplies bricks to residential and commercial builders as well as to the repair, maintenance, and improvement (RMI) market — helps to offset this risk.

Indeed, Michelmersh’s revenues soared 15% in 2022 despite recent weakness in the homes sector.

European Metals Holdings

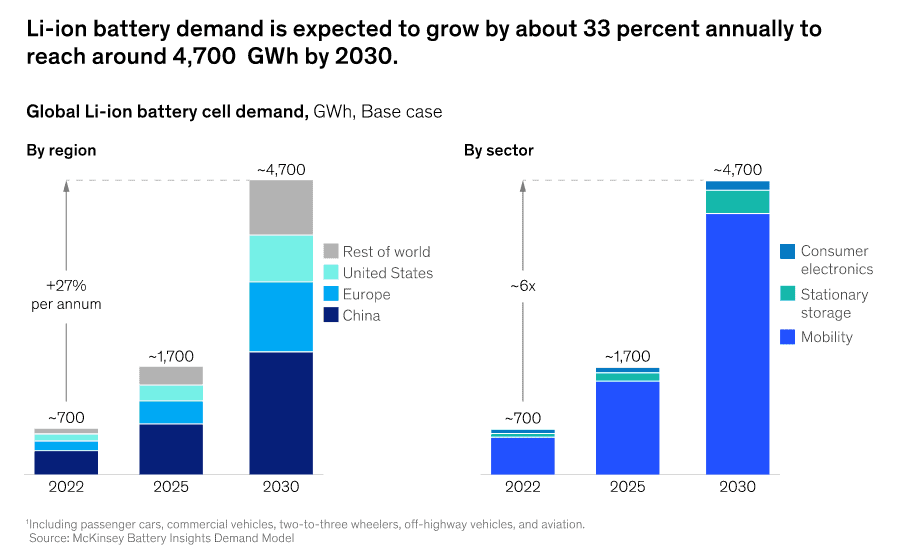

Investing in lithium stocks could be a good idea as electric vehicle sales increase. As research from McKinsey and Company shows, demand for the battery-making component looks set to soar as the decade progresses.

European Metals Holdings (LSE:EMH) is one UK lithium share I’d buy to capitalise on this theme. The business is developing the Cinovec mine in Czechia, a project that has been labelled a strategic asset by the European Union.

Cinovec is the largest lithium resource in Europe, and latest studies suggested it will produce around 29,400 tonnes of the material each year over a 25-year mine life. Critically, the resource is located on the border with Germany, too. This puts it on the doorstep of multiple major auto and energy storage manufacturers.

Investing in early-stage miners can be especially risky. Revenues forecasts can crumble and costs can shoot up if development problems occur.

But on balance I think European Metals Holdings remains a hot growth stock to own today.

Steppe Cement

Kazakhstan-based Steppe Cement (LSE:STCM) is another buildingn product supplier on my watchlist right now. I’d buy it to capitalise on steady urbanisation in the Eurasian country that’s driving cement demand higher.

In fact the penny share has recently stopped exporting its product given how strong conditions are in its home market. Steppe’s revenues jumped 11% year on year in 2022 thanks to a 12% jump in cement prices.

The rise of towns and cities is a critical cog in Kazakhstan’s national development programme. So the government is offering huge subsidies to encourage the building of residential areas and urban infrastructure.

This long-running trend looks set to continue, too. Although Steppe Cement faces the problem of rising costs, I think it could prove a top stock to own for the next decade and beyond.